SunTrust 2003 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2003 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2003 SunTrust Banks, Inc. 17

Loans are considered impaired if, based on current informa-

tion and events, it is probable that SunTrust will be unable to

collect the scheduled payments of principal or interest according

to the contractual terms of the loan agreement. When a loan is

deemed impaired, impairment is measured by using the fair

value of the underlying collateral, the present value of the future

cash flows discounted at the effective interest rate stipulated in

the loan agreement, or the estimated market value of the loan.

In measuring the fair value of the collateral, management uses

assumptions (e.g., discount rate) and methodologies (e.g., com-

parison to the recent selling price of similar assets) consistent

with those that would be utilized by unrelated third parties.

Changes in the financial condition of individual borrowers,

economic conditions, historical loss experience, or the condition

of the various markets in which collateral may be sold may affect

the required level of the allowance for loan losses and the associ-

ated provision for loan losses. Should cash flow assumptions or

market conditions change, a different amount may be recorded

for the allowance for loan losses and the associated provision for

loan losses. For additional discussion of the allowance for loan

losses see pages 27 through 30.

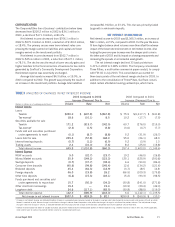

ESTIMATES OF FAIR VALUE

The estimation of fair value is significant to a number of

SunTrust’s assets, including trading assets, loans held for sale,

available-for-sale investment securities, mortgage servicing rights

(MSRs), other real estate owned (OREO), other repossessed

assets, as well as assets and liabilities associated with derivative

financial instruments. These are all recorded at either fair value or

at the lower of cost or fair value. Fair values are volatile and may

be influenced by a number of factors. Circumstances that could

cause estimates of the fair value of certain assets and liabilities

to change include a change in prepayment speeds, discount

rates, or market interest rates.

Fair values for trading assets, most available-for-sale

investment securities and most derivative financial instruments

are based on quoted market prices. If quoted market prices are

not available, fair values are based on the quoted prices of simi-

lar instruments. The fair values of loans held for sale are based

on anticipated liquidation values, while the fair values of mort-

gage servicing rights are based on discounted cash flow analysis

utilizing dealer consensus prepayment speeds and market

discount rates. The fair values of other real estate owned are

typically determined based on appraisals by third parties, less

estimated selling costs.

Estimates of fair value are also required in performing an

impairment analysis of goodwill. The Company reviews goodwill

for impairment at least once annually and whenever events or

circumstances indicate the carrying value may not be recover-

able. An impairment would be indicated if the carrying value

exceeds the fair value of a reporting unit.

RECENT ACCOUNTING DEVELOPMENTS

The Company adopted the provisions of several new accounting

pronouncements in the current year, including Statement of

Financial Accounting Standards (SFAS) Nos. 146, 149, 150

and the recognition and requirements of Financial Accounting

Standards Board Interpretation (FIN) Nos. 45 and 46. The pro-

visions of these pronouncements and the related impact to the

Company are discussed in the Accounting Policies Adopted sec-

tion of Note 1 to the Consolidated Financial Statements

beginning on page 62.

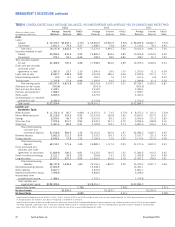

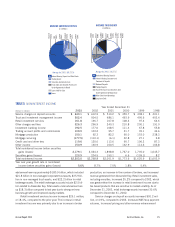

BUSINESS SEGMENTS

Beginning in January 2001, the Company implemented signifi-

cant changes to its internal management reporting system to

begin to measure and manage certain business activities by line

of business. For more financial details on business segment dis-

closures, please see Note 22 – Business Segment Reporting in

the Notes to the Financial Statements. The lines of business

which are the Company’s segments are defined as follows:

RETAIL

The Retail line of business includes loans, deposits, and other

fee-based services for consumer and private banking clients, as

well as business clients with less than $5 million in sales. Retail

serves clients through an extensive network of traditional and in-

store branches, ATMs, the Internet (www.SunTrust.com) and the

telephone (1-800-SUNTRUST). In addition to serving the retail

market, the Retail line of business serves as an entry point for

other lines of business. When client needs change and expand,

Retail refers clients to the Private Client Services, Mortgage and

Commercial lines of business.

COMMERCIAL

The Commercial line of business provides clients with a full array

of financial solutions including traditional commercial lending,

treasury management, financial risk management products and

corporate card services. The primary customer segments served

by this line of business include “Commercial” ($5 million to

$50 million in annual revenue), “Middle Market” ($50 million

to $250 million in annual revenue), “Commercial Real Estate”

(entities that specialize in Commercial Real Estate activities),

and “Government/Not-for-Profit” entities. Also included in this

segment are specialty groups that operate both within and out-

side of the SunTrust footprint such as Affordable Housing (tax

credits related to community development) and Premium

Assignment Corporation (insurance premium financing).