SunTrust 2003 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2003 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

As one example of S3+E2in action, we adopted a structured

approach to improve sales effectiveness in our more than

1,200 branches. This new approach, which has been rolled

out system-wide, calls for individual sales plans for all

employees, enhanced training, a lobby management

program and customer access to investment profes-

sionals in every office.

S3+E2is an evolving effort, but it is already contributing to results. Some highlights:

➣

In Retail Banking, 2003 sales per day by each employee exceeded the 2002 average

by 38%, and more than 63,000 new clients were introduced to our SunTrust

Securities brokers. Sales of home equity lines and loans exceeded the prior year

by $7.3 billion, or 18%.

➣

In Commercial Banking, a newly installed sales process and supporting systems con-

tributed to a 21% deposit balance increase and a 10% increase in loan balances.

➣

In Private Client Services, retail investment sales, heavily driven

by branch introductions, were up 25% for the year.

➣

In our Mortgage business, closing volumes were up 42% over last year

resulting in more than $43 billion in production. And a restructured

and enhanced cross-sell program resulted in

more than 95,000 other targeted products

and services sold last year.

➣

In Corporate & Investment Banking, an intensified

focus on developing mutually beneficial rela-

tionships with clients and a handful of new

products contributed to a 19% increase in debt

capital markets fees.

As we see it, providing customers the products

and services they need is central to fostering the

mutually rewarding customer relationships upon

which SunTrust’s long-term success is based.

S3+E2is how we’re making that happen.

8 SunTrust Banks, Inc. Annual Report 2003

SunTrust’s formula for success, “Selling,

Serving and Sustaining client relationships,

with Excellence in Execution,” highlights

SunTrust’s commitment to retaining and

building client relationships.

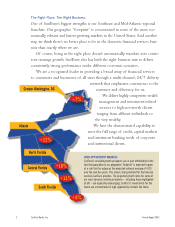

Mortgage lending has evolved into a key national

business with SunTrust Mortgage originating loans

through 135 locations in SunTrust markets and

adjacent states, maintaining correspondent and

broker relationships in 48 states, and servicing

loans in all 50 states and the District of Columbia.