SunTrust 2003 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2003 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

86 SunTrust Banks, Inc. Annual Report 2003

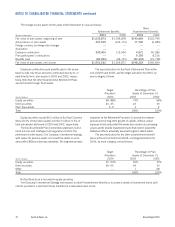

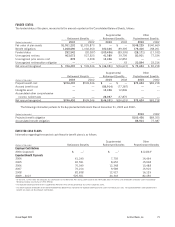

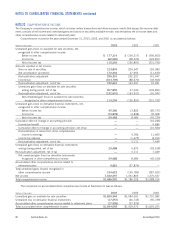

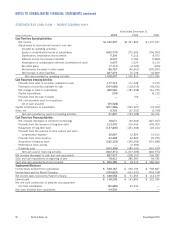

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

NOTE 22

BUSINESS SEGMENT REPORTING

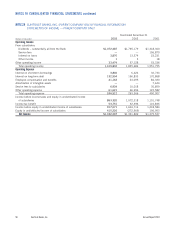

Unlike financial accounting, there is no comprehensive authori-

tative body of guidance for management accounting practices

equivalent to generally accepted accounting principles.

Therefore, the disclosure of business segment performance is

not necessarily comparable with similar information presented

by any other financial institution.

The Company utilizes a matched maturity funds transfer

pricing methodology to transfer interest rate risk of all assets and

liabilities to the Corporate Treasury area which manages the

interest rate risk of the Company. Differences in the aggregate

amounts of transfer priced funds charges and credits are reflected

in the Corporate/Other line of business segment. A system of

internal credit transfers is utilized to recognize supportive busi-

ness services across lines of business. The net results of these

credits are reflected in each line of business segment. The cost of

operating office premises is charged to the lines of business by

use of an internal cost transfer process. Allocations of certain

administrative support expenses and customer transaction process-

ing expenses are also reflected in each line of business segment.

The offset to these expense allocations, as well as the amount of

any unallocated expenses, is reported in the Corporate/Other line

of business segment.

The Company also utilizes an internal credit risk transfer

methodology (the credit risk premium) which creates a current

period financial charge against interest income to each line of

business based on the estimated credit risk-adjusted return on

loans. The offset to the aggregate credit risk premium charges is

matched against the Company’s current provision for loan losses

with any difference reported in the Corporate/Other line of busi-

ness segment. The provision for income taxes is also reported in

the Corporate/Other line of business segment.

The Company continues to enhance and refine its internal

management reporting system. Future enhancements of items

reported for each line of business segment are expected to

include: assets, liabilities and attributed economic capital;

matched maturity funds transfer priced net interest revenue, net

of credit risk premiums; direct noninterest income; internal

credit transfers between lines of business for supportive business

services; and fully absorbed expenses. The internal management

reporting system and the business segment disclosures for each

line of business do not currently include attributed economic

capital, nor fully absorbed expenses. Any amounts not currently

reported in each line of business segment are reported in the

Corporate/Other line of business segment. The implementation

of these enhancements to the internal management reporting

system is expected to materially affect the net income disclosed

for each segment. Whenever significant changes to management

reporting methodologies take place, the impact of these

changes is quantified and prior period information is restated

when possible.

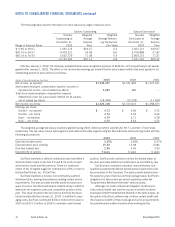

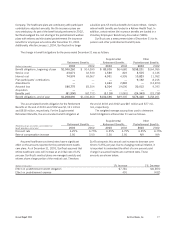

The tables on pages 86 and 87 disclose selected financial

information for SunTrust’s reportable business segments for the

twelve months ended December 31, 2003, 2002, and 2001.

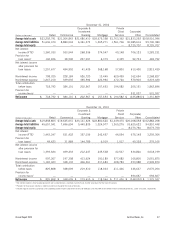

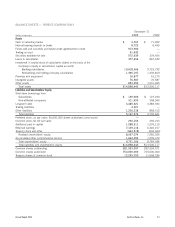

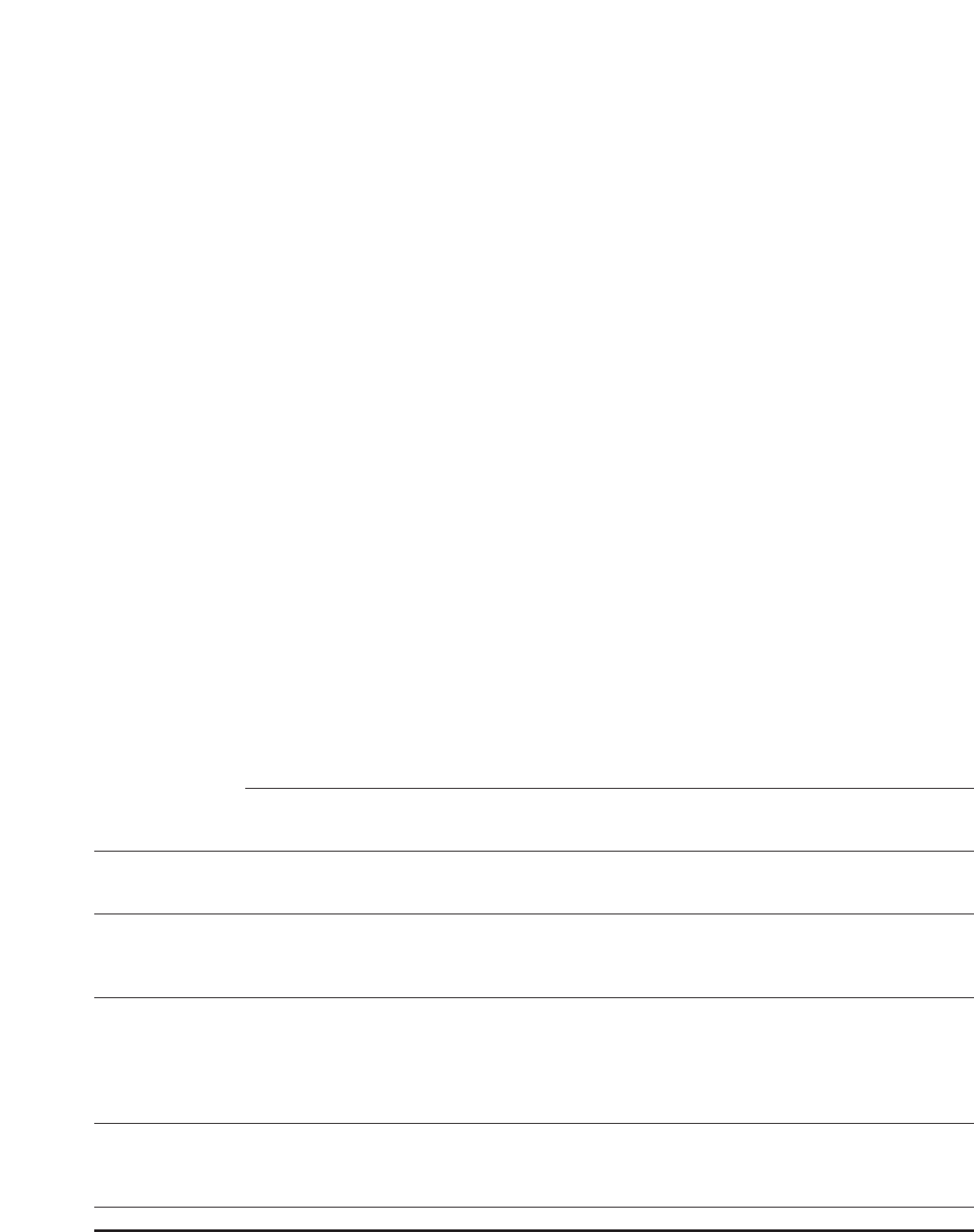

December 31, 2003

Corporate & Private

Investment Client Corporate/

(Dollars in thousands) Retail Commercial Banking Mortgage Services Other Consolidated

Average total assets $25,682,775 $23,395,794 $22,386,327 $22,494,200 $2,183,274 $26,182,991 $122,325,361

Average total liabilities 52,981,839 10,827,735 9,081,569 1,800,908 1,530,188 37,020,096 113,242,335

Average total equity —————9,083,026 9,083,026

Net interest

income (FTE)11,334,281 585,574 279,911 545,847 43,755 575,949 3,365,317

Provision for

loan losses2152,570 41,828 107,303 6,855 1,977 3,017 313,550

Net interest income

after provision for

loan losses 1,181,711 543,746 172,608 538,992 41,778 572,932 3,051,767

Noninterest income 738,354 306,638 547,590 14,702 660,118 35,599 2,303,001

Noninterest expense 1,277,990 358,618 368,441 307,415 513,762 574,390 3,400,616

Total contribution

before taxes 642,075 491,766 351,757 246,279 188,134 34,141 1,954,152

Provision for

income taxes3—————621,855 621,855

Net income $642,075 $ 491,766 $ 351,757 $ 246,279 $ 188,134 $ (587,714) $ 1,332,297

1Net interest income is fully taxable equivalent and is presented on a matched maturity funds transfer price basis for the lines of business.

2Provision for loan losses includes a credit risk premium charge for the lines of business.

3Includes regular income tax provision and taxable-equivalent income adjustment reversal of $45,014 for the twelve months ended December 31, 2003.