SunTrust 2003 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2003 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

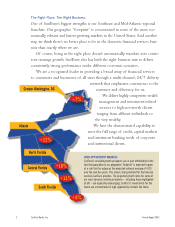

The Right Place. The Right Business.

One of SunTrust’s biggest strengths is our Southeast and Mid-Atlantic regional

franchise. Our geographic “footprint” is concentrated in some of the most eco-

nomically vibrant and fastest-growing markets in the United States. Said another

way, we think there’s no better place to be in the domestic financial services busi-

ness than exactly where we are.

Of course, being in the right place doesn’t automatically translate into consis-

tent earnings growth. SunTrust also has built the right business mix to deliver

consistently strong performance under different economic scenarios.

We are a recognized leader in providing a broad array of financial services

to consumers and businesses of all sizes through a multi-channel, 24/7 delivery

network that emphasizes convenience to the

customer and efficiency for us.

We deliver highly competitive wealth

management and investment-related

services to high-net-worth clients

ranging from affluent individuals to

the very wealthy.

We have the demonstrated capability to

meet the full range of credit, capital markets

and investment banking needs of corporate

and institutional clients.

2 SunTrust Banks, Inc. Annual Report 2003

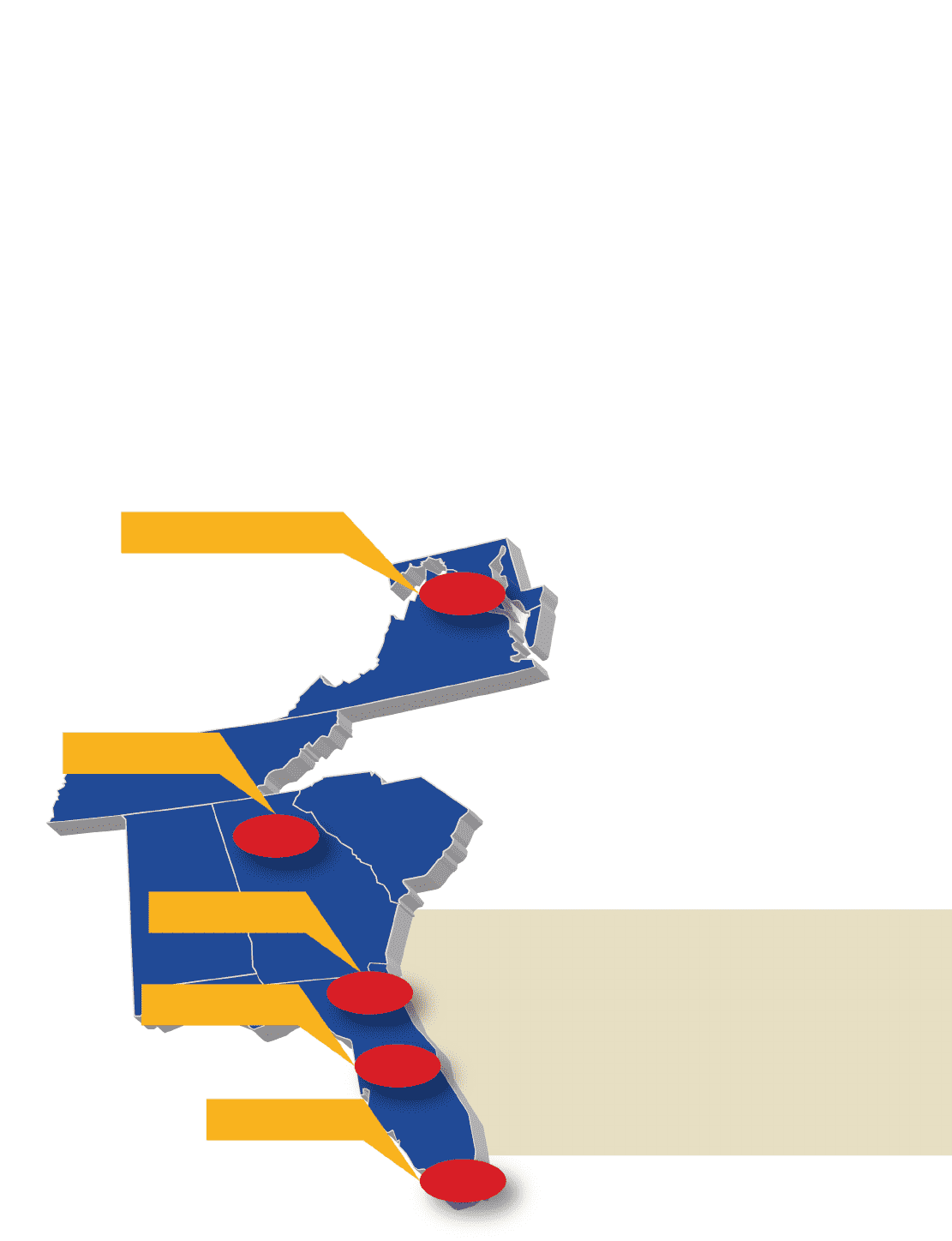

HIGH-OPPORTUNITY MARKETS

SunTrust’s enviable growth prospects are in part attributable to the

fact that population in our geographic “footprint” is expected to grow

at a rate that far outpaces the projected national average of 4.8%

over the next five years. This means strong demand for the financial

services SunTrust provides. The projected growth rates for some of

our most dynamic individual markets – including those highlighted

at left – are especially encouraging. SunTrust’s investments for the

future are concentrated in high-opportunity markets like these.

+8%

+11%

+10%

+12%

+7%

Atlanta

North Florida

Central Florida

South Florida

Greater Washington, DC