SunTrust 2003 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2003 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

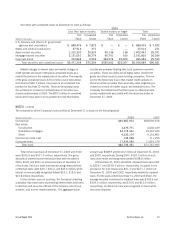

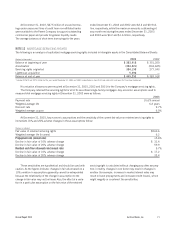

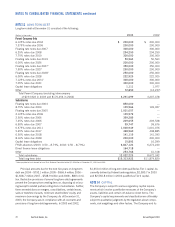

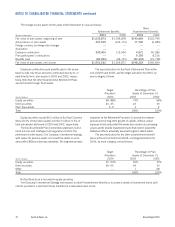

Supplemental Other

(Weighted-average assumptions used to determine Retirement Benefits Retirement Benefits Postretirement Benefits

benefit obligations, end of year) 2003 2002 2003 2002 2003 2002

Discount rate 6.25% 6.75% 6.25% 6.75% 6.25% 6.75%

Rate of compensation increase 3.50 3.50 3.50 3.50 N/A N/A

Annual Report 2003 SunTrust Banks, Inc. 77

Company. The healthcare plans are contributory with participant

contributions adjusted annually; the life insurance plans are

noncontributory. As part of the benefit study performed in 2002,

SunTrust realigned the cost sharing of the postretirement welfare

plans with retirees and eliminated postretirement life insurance

benefits for employees who retire after December 31, 2003.

Additionally, effective January 1, 2004, SunTrust will no longer

subsidize post-65 medical benefits for future retirees. Certain

retiree health benefits are funded in a Retiree Health Trust. In

addition, certain retiree life insurance benefits are funded in a

Voluntary Employees’ Beneficiary Association (VEBA).

SunTrust uses a measurement date of December 31 for its

pension and other postretirement benefit plans.

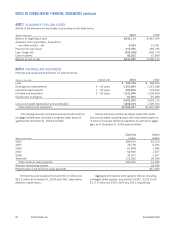

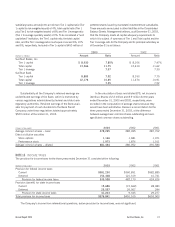

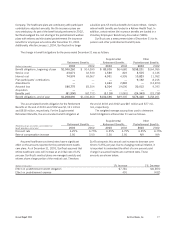

The change in benefit obligations for the years ended December 31 was as follows:

Supplemental Other

Retirement Benefits Retirement Benefits Postretirement Benefits

(Dollars in thousands) 2003 2002 2003 2002 2003 2002

Benefit obligations, beginning of year $1,046,260 $914,090 $89,305 $64,680 $158,201 $164,055

Service cost 43,071 42,530 1,520 823 2,515 4,146

Interest cost 74,574 69,067 4,991 4,995 10,823 11,052

Plan participants’ contributions ————9,192 8,216

Amendments ——1,434 2,882 —(14,873)

Actuarial loss 186,775 83,304 6,304 19,006 20,012 9,343

Acquisition ——————

Benefits paid (81,990) (62,731) (3,118) (3,081) (24,343) (23,738)

Benefit obligations, end of year $1,268,690 $1,046,260 $100,436 $89,305 $176,400 $158,201

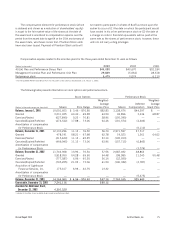

The accumulated benefit obligation for the Retirement

Benefits at the end of 2003 and 2002 was $1,141 million

and $938 million, respectively. For the Supplemental

Retirement Benefits, the accumulated benefit obligation at

the end of 2003 and 2002 was $87 million and $77 mil-

lion, respectively.

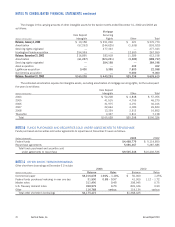

The weighted-average assumptions used to determine

benefit obligations at December 31 were as follows:

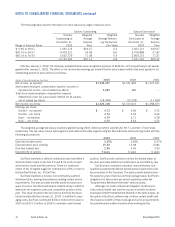

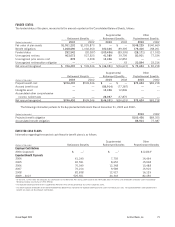

(Dollars in thousands) 1% Increase 1% Decrease

Effect on postretirement benefit obligation $7,781 $(6,853)

Effect on postretirement expense 491 (432)

Assumed healthcare cost trend rates have a significant

effect on the amounts reported for the postretirement health-

care plans. As of December 31, 2003, SunTrust assumed that

retiree healthcare costs will increase at an initial rate of 12%

per year. SunTrust’s medical plans are managed carefully and

retirees share a large portion of the medical cost. Therefore,

SunTrust expects this annual cost increase to decrease over

time to 5.25% per year. Due to changing medical inflation, it

is important to understand the effect of a one percent point

change in assumed healthcare cost trend rates. These

amounts are shown below: