SunTrust 2003 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2003 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2003 SunTrust Banks, Inc. 19

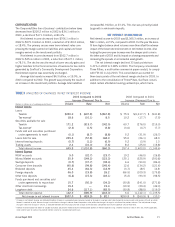

The following analysis details the operating results for each

line of business for the twelve months ended December 31,

2003 and 2002.

RETAIL

Retail’s contribution before taxes was $642.1 million for 2003, a

decline of $76.7 million, or 10.7%, compared to 2002. Net inter-

est income declined $26.1 million, or 1.9%, primarily the result of

the lower interest rate environment and deposit margin compres-

sion. Net interest income on loans increased $67.2 million, or

11.5%, overcoming lower interest rates through an increase in

average loans. Net interest income for deposits declined $93.3 mil-

lion, or 12.0%, due to margin compression, or the inability to

reduce interest rates paid on deposits as much as the drop in the

funds transfer pricing credit. Provision for loan losses increased

$49.9 million, or 48.6%, as a result of growth in the loan portfo-

lio and changes in risk factors.

Noninterest income increased $30.0 million, or 4.2%,

compared to 2002. Of the increase, $26.8 million was attribut-

able to higher deposit service charges. Noninterest expense

grew by $30.8 million, or 2.5%. While personnel expense

declined $6.7 million, investment in the Retail distribution

network and improved technology drove the 2.5% increase in

noninterest expense.

Average loan balances grew $1.8 billion, an 8.3% increase

over 2002. Growth in consumer equity lines and indirect installment

lending drove the overall loan portfolio growth. Average deposit bal-

ances increased $1.4 billion, or 2.7%, compared to 2002. Demand

deposits, NOW accounts and money market accounts were the pri-

mary drivers of the deposit growth. The Lighthouse acquisition did

not have a significant impact on the balance sheet growth.

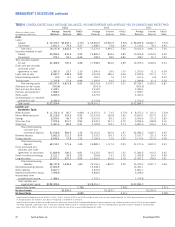

COMMERCIAL

Commercial’s contribution before taxes increased $107.7 mil-

lion, or 28.0%, from 2002 to 2003. The growth was driven by a

combination of increased net interest income on loans and

higher noninterest revenue. During 2003, the Commercial line

of business consolidated certain affordable housing limited part-

nerships. Income and expenses related to these partnerships

were not included in the 2002 results. The growth in contribu-

tion before taxes included $52.3 million related to the affordable

housing unit.

Net interest income increased $52.0 million, or 9.8%. The

change was driven by a $1.9 billion, or 9.9%, increase in aver-

age loans. Increased loan volumes were largely the result of

robust sales. Loan quality remained good as the net charge-off

ratio was 0.10% in 2003 compared to 0.06% in 2002.

SunTrust’s acquisition of Lighthouse Financial Services con-

tributed $234.1 million to the loan growth in 2003. Average

deposit balances rose $1.8 billion, or 20.9%, which also con-

tributed to the rise in net interest income. This increase was a

result of improved sales efforts and market liquidity.

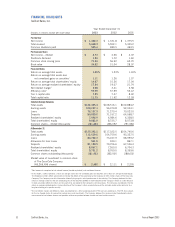

The following table for SunTrust’s reportable business segments compares total income before taxes for the twelve months ended

December 31, 2003 to the same period last year:

TABLE 1

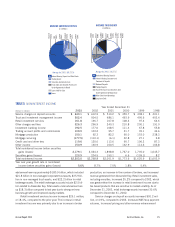

TOTAL CONTRIBUTION BEFORE TAXES

(Dollars in millions) 2003 2002

Retail $642.1 $718.8

Commercial 491.8 384.1

Corporate and Investment Banking 351.8 202.6

Mortgage 246.3 157.7

Private Client Services 188.1 194.6

Corporate/Other 34.1 205.2

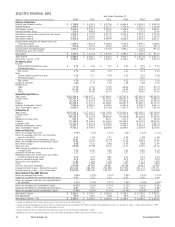

The following table for SunTrust’s reportable business segments compares average loans and average deposits for the twelve

months ended December 31, 2003 to the same period last year:

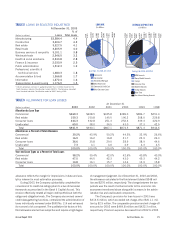

TABLE 2

AVERAGE LOANS AND DEPOSITS

(Dollars in millions) 2003 2002

Average Average Average Average

loans deposits loans deposits

Retail $23,476.2 $52,828.5 $21,669.0 $51,425.4

Commercial 21,525.2 10,611.2 19,592.1 8,780.2

Corporate and Investment Banking 15,906.4 2,909.7 16,185.3 2,480.7

Mortgage 13,221.4 1,634.4 12,082.9 1,011.0

Private Client Services 2,001.2 1,486.9 1,590.6 1,531.1