SunTrust 2003 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2003 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2003 SunTrust Banks, Inc. 11

Financial Results

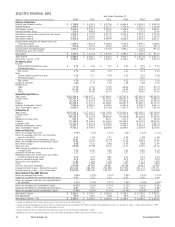

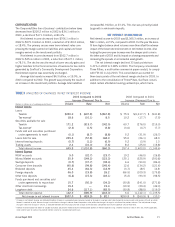

The year’s financial results are reviewed in great detail in the “Management

Discussion & Analysis” that begins on page 15. In the spirit of openness in

financial reporting, I invite you to review it carefully. For purposes of this letter,

though, a quick overview of 2003 financial highlights is in order.

In general, our earnings improvement was based on solid, revenue-driven

gains in our major lines of business, with particularly strong growth in sales-

related revenues.

We saw year-over-year improvement in net interest income and, in par-

ticular, in fee income where there was noticeable pick-up in fees related to

improving equity markets. Because of investments we made in market-driven

businesses, such as wealth management and capital markets services, SunTrust

is particularly well positioned to benefit from a stronger stock market.

Improved Credit Quality

The credit quality picture got progressively better during the year. SunTrust

continued to be well-served by our traditionally conservative risk posture and

careful credit management. We are proud that during an economic cycle when

other large U.S. banks were hit by serious credit problems, SunTrust’s credit

quality remained “best in class” compared with both peer institutions and

industry averages.

On a less positive note, loan demand in one important market segment, the

large corporate market, was weak in 2003. This overshadowed quite healthy loan

growth in other areas such as consumer, mortgage and commercial lending.

With our balance sheet positioned for rising interest rates, historically low

rates had a dampening effect on our net interest margin, and thus on net inter-

est income and earnings overall, especially during the first half of 2003. The

good news is that this negative impact began to diminish – and in fact turned

around – in the second half of the year. Signs were pointing to continued

improvement as 2004 began.

Focus on Efficiency

Although we did a respectable job of keeping core operating expenses in check

in 2003, further improving efficiency remains a critical corporate priority. To