SunTrust 2003 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2003 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2003 SunTrust Banks, Inc. 31

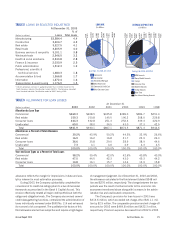

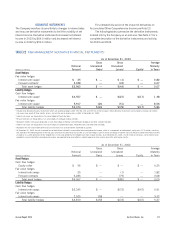

NONPERFORMING ASSETS

Nonperforming assets, which consists of nonaccrual loans, restruc-

tured loans, other real estate owned (OREO), and other repossessed

assets, totaled $378.1 million at December 31, 2003, a decrease

of $163.9 million, or 30.2%, from December 31, 2002. The

decrease was primarily due to a $159.6 million, or 31.2%, decline

in nonperforming loans and resulted in a decline in the ratio of

nonperforming assets to total loans plus OREO and other repos-

sessed assets to 0.47% at December 31, 2003 from 0.74% at

December 31, 2002. Nonperforming loans at December 31, 2003

included $336.5 million of nonaccrual loans and $14.8 million

of restructured loans, the latter of which represents a select group

of consumer workout loans.

Nonaccrual loans decreased $174.4 million, or 34.1%,

from 2002 to 2003 as nonaccrual commercial loans dropped

$185.3 million, or 52.8%. The decrease in nonaccrual commer-

cial loans resulted from a decline in new additions to large

corporate nonaccrual loans, increased loan sales activity,

charge-offs, improvement in credit quality and client repayment.

Interest income on nonperforming loans, if recognized, is

recorded using the cash basis method of accounting. When a

loan is placed on nonaccrual, unpaid interest is reversed against

interest income. When a nonaccrual loan is returned to accruing

status, any unpaid interest is recorded as interest income only

after all principal has been collected.

As of December 31, 2003 and 2002, the gross amount of

interest income that would have been recorded on nonaccrual loans

if all such loans had been accruing interest at the original con-

tractual rate was $33.7 million and $45.2 million, respectively.

Interest payments recorded in 2003 and 2002 as interest income

for all such nonperforming loans at December 31, 2003 and

2002, were $14.1 million and $15.6 million, respectively.

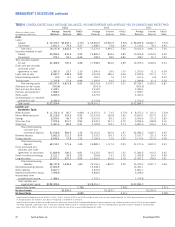

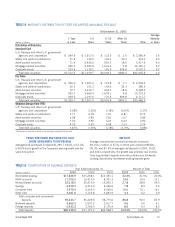

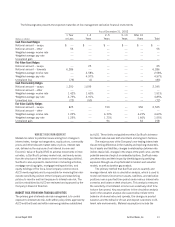

SECURITIES AVAILABLE FOR SALE

The securities portfolio is managed as part of the overall asset and

liability management process to optimize income and market per-

formance over an entire interest rate cycle. During 2003, the

portfolio was repositioned in conjunction with asset and liability

management strategies to mitigate SunTrust’s risk to lower interest

rates and a flatter yield curve while maintaining a slightly asset-

sensitive interest rate risk position. The portfolio’s size increased

by $2.0 billion on an amortized cost basis to $23.0 billion from

$21.0 billion at December 31, 2003 and 2002, respectively.

Most of the increase occurred in the second half of 2003 and was

comprised of mortgage-backed securities issued by federal agen-

cies and investment grade asset-backed securities. During the

first half of 2003, the portfolio size decreased $1.3 billion primarily

from rapid prepayments in a historically low interest rate envi-

ronment. During the second half of 2003, the Company took

advantage of an increase in market rates and a steeper yield curve

to increase the size by $3.3 billion and to improve the yield. The

average yield for the year was 3.28%, but the yield improved to

3.55% in the fourth quarter of 2003 and ended the year at 3.66%.

The average life increased from 2.8 years to 4.0 years, and the

average duration of the portfolio, a measure of price sensitivity

described on page 24, also increased from 1.3 to 2.7, at

December 31, 2002 and 2003, respectively.

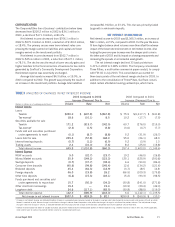

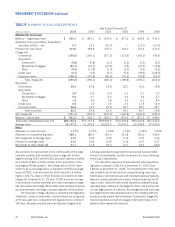

TABLE 11

NONPERFORMING ASSETS AND ACCRUING LOANS PAST DUE 90 DAYS OR MORE

At December 31

(Dollars in millions) 2003 2002 2001 2000 1999 1998

Nonperforming Assets

Nonaccrual loans

Commercial $165.9 $351.3 $377.6 $273.6 $105.0 $ 50.7

Real estate

Construction 4.4 10.0 4.0 2.2 9.0 13.5

Residential mortgages 85.4 82.5 79.9 81.8 82.6 83.9

Other 48.6 38.0 62.8 29.0 34.9 46.6

Consumer loans 32.2 29.2 33.8 18.7 17.4 12.5

Total nonaccrual loans 336.5 511.0 558.1 405.3 248.9 207.2

Restructured loans 14.8 —————

Total nonperforming loans 351.3 511.0 558.1 405.3 248.9 207.2

Other real estate owned (OREO) 16.5 18.0 20.7 23.0 26.8 34.9

Other repossessed assets 10.3 13.0 21.0 10.3 8.3 7.0

Total nonperforming assets $378.1 $542.0 $599.8 $438.6 $284.0 $249.1

Ratios

Nonperforming loans to total loans 0.44% 0.70% 0.81% 0.56% 0.38% 0.34%

Nonperforming assets to total loans

plus OREO and other repossessed assets 0.47 0.74 0.87 0.61 0.43 0.40

Accruing Loans Past Due 90 Days or More $196.4 $177.9 $185.5 $181.2 $117.4 $108.2