SunTrust 2003 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2003 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62 SunTrust Banks, Inc. Annual Report 2003

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

effective, and that has been designated and qualifies as a fair

value hedge, along with the loss or gain on the hedged asset or

liability that is attributable to the hedged risk (including losses or

gains on firm commitments), are recorded in current period

earnings. Changes in the fair value of a derivative that is highly

effective, and that is designated and qualifies as a cash flow

hedge, are recorded in other comprehensive income, with any

ineffective portion recorded in current period earnings. Changes

in the fair value of derivative trading instruments are reported in

current period earnings.

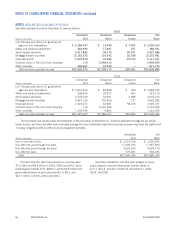

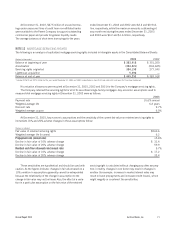

STOCK-BASED COMPENSATION

The Company sponsors a stock-based employee compensation

plan, which is further described in Note 16. Prior to 2002, the

Company accounted for the plan under the recognition and

measurement provisions of Accounting Principles Board (APB)

Opinion No. 25, “Accounting for Stock Issued to Employees,”

and related Interpretations. No stock-based employee compen-

sation cost is reflected in 2001’s net income since all options

granted had an exercise price equal to market value on the date

of grant. Effective January 1, 2002, the Company adopted the

fair-value recognition provisions of SFAS No. 123, “Accounting

for Stock-Based Compensation,” prospectively, to all awards

granted after January 1, 2002. Awards under the Company’s

plan typically vest over three years. The cost related to stock-

based employee compensation included in the determination of

net income for 2003 and 2002 was less than that which would

have been recognized if the fair-value based method had been

applied to all awards since the original effective date of SFAS

No.123. The effect on net income and earnings per share if the

fair-value based method had been applied to all awards in each

period is included in Note 16.

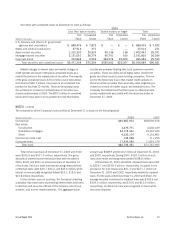

OFF-BALANCE SHEET ENTITIES

The Company has a multi-seller commercial paper conduit relation-

ship with a variable interest entity (VIE), Three Pillars. See Note 17

for further discussion of Three Pillars. As of December 31, 2002,

the Company was not required to consolidate Three Pillars based

on the requirements of SFAS No.140, “Accounting for Transfers and

Servicing of Financial Assets and Extinguishments of Liabilities;”

Accounting Research Bulletin (ARB) 51, “Consolidated Financial

Statements;” SFAS No. 94, “Consolidation of All Majority-Owned

Subsidiaries;” EITF D-14, “Transactions involving Special-Purpose

Entities,” and other accounting principles generally accepted in the

United States.

In January 2003, the FASB issued FIN 46, “Consolidation of

Variable Interest Entities,” which addressed the criteria for the

consolidation of off-balance sheet entities similar to Three Pillars.

FIN 46 nullified the consensus reached in various accounting

pronouncements and interpretations and required consolidation

of Three Pillars. SunTrust adopted the provisions of FIN 46 for

certain of the Company’s VIEs and consolidated Three Pillars as

of July 1, 2003.

In December 2003, the FASB issued a revision to FIN 46

(FIN 46(R)), which replaced the Interpretation issued in January

2003. FIN 46(R) is effective for reporting periods ending after

March 15, 2004. SunTrust will adopt FIN 46(R) for the quarter

ended March 31, 2004 and will continue to apply FIN 46 in the

interim. The adoption of FIN 46(R) is not expected to have a sig-

nificant impact on the financial statements of SunTrust.

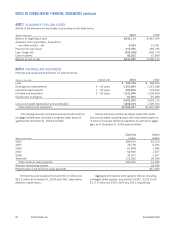

ACCOUNTING POLICIES ADOPTED

In May of 2002, the FASB issued SFAS No. 145, “Rescission

of FASB Statements No. 4, 44, and 64, Amendment of FASB

Statement No. 13, and Technical Corrections as of April 2002.”

This Statement rescinded SFAS No. 4 and 64, “Reporting Gains

and Losses from Extinguishment of Debt” and “Extinguishments of

Debt Made to Satisfy Sinking-Fund Requirements,” respectively,

and restricted the classification of early extinguishment of debt as

an extraordinary item to the provisions of APB Opinion No. 30,

“Reporting the Results of Operations – Reporting the Effects of

Disposal of a Segment of a Business, and Extraordinary, Unusual

and Infrequently Occurring Events and Transactions.” The

Statement also rescinded SFAS No. 44, “Accounting for Intangible

Assets of Motor Carriers,” which was no longer necessary because

the transition to the provisions of the Motor Carrier Act of 1980

was complete. The Statement also amended SFAS No. 13,

“Accounting for Leases,” to eliminate an inconsistency between

the required accounting for sale-leaseback transactions and the

required accounting for certain lease modifications that have

economic effects that are similar to sale-leaseback transactions.

Finally, the Statement made various technical corrections to exist-

ing pronouncements which were not considered substantive.

The provisions of this Statement relating to the rescission of

SFAS No. 4 and 64 were effective for fiscal years beginning after

May 15, 2002. The provisions relating to amendments of SFAS

No. 13 were effective for transactions initiated after May 15, 2002,

and all other provisions were effective for financial statements

issued after May 15, 2002. Additionally, there was retroactive

application for any gain or loss on extinguishment of debt that was

classified as extraordinary in a prior period that does not meet the

criteria in APB Opinion No. 30, requiring reclassification of this gain

or loss. As of January 1, 2003, the Company adopted all provisions

of this Statement, and the adoption did not have a material impact

on the Company’s financial position or results of operations.

In June 2002, the FASB issued SFAS No. 146, “Accounting

for Costs Associated with Exit or Disposal Activities.” SFAS No. 146

provides guidance on the recognition and measurement of liabilities

for costs associated with exit or disposal activities. SFAS No. 146

was effective for exit or disposal activities that are initiated after

December 31, 2002. The Company adopted this Statement as of

January 1, 2003, and it did not have a material impact on the

Company’s financial position or results of operations.