SunTrust 2003 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2003 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36 SunTrust Banks, Inc. Annual Report 2003

MANAGEMENT’S DISCUSSION continued

another entity’s failure to perform under an obligating agree-

ment; (iii) indemnification agreements that contingently require

the indemnifying party to make payments to an indemnified

party based on changes in an underlying factor that is related to

an asset, a liability, or an equity security of the indemnified

party; and (iv) indirect guarantees of the indebtedness of others.

The issuance of these guarantees imposes an obligation to

stand ready to perform, and should certain triggering events

occur, it also imposes an obligation for the Company to make

future payments. Note 18 to the Consolidated Financial

Statements includes the annual required disclosures under

FIN 45.

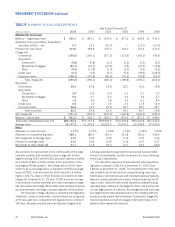

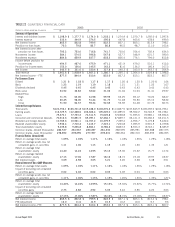

In the normal course of business, the Company utilizes vari-

ous derivative and credit-related financial instruments to meet the

needs of customers and to manage the Company’s exposure to

interest rate and other market risks. These financial instruments

involve, to varying degrees, elements of credit and market risk in

excess of the amount recorded on the balance sheet in accordance

with accounting principles generally accepted in the United

States. SunTrust manages the credit risk of its derivatives by (i)

limiting the total amount of arrangements outstanding by an indi-

vidual counterparty; (ii) monitoring the size and maturity structure

of the portfolio; (iii) obtaining collateral based on management’s

credit assessment of the counterparty; (iv) applying uniform credit

standards maintained for all activities with credit risk; and (v)

entering into transactions with high quality counterparties that are

periodically reviewed by the Company’s Credit Committee. The

Company manages the market risk of its derivatives by establish-

ing and monitoring limits on the types and degree of risk that may

be undertaken. The Company continually measures market risk by

using a value-at-risk methodology. Note 17 to the Consolidated

Financial Statements includes additional information regarding

derivative financial instruments and Table 22 provides further

details with respect to SunTrust’s derivative positions.

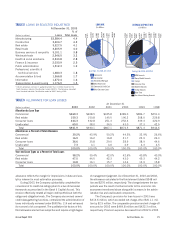

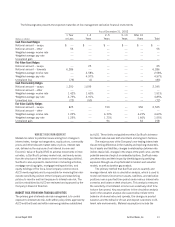

As detailed in Table 18, the Company had $59.4 billion in

total commitments to extend credit at December 31, 2003 that

were not recorded on the Company’s balance sheet which included

$2.8 billion in interest rate lock commitments. Commitments to

extend credit are arrangements to lend to a customer who has com-

plied with predetermined contractual conditions. The Company

also had $9.8 billion at December 31, 2003 in letters of credit,

which primarily consisted of financial and performance standby

letters of credit that provide guarantees to a third party beneficiary

that the Company will fund or perform, respectively, if certain future

events occur. Of this, approximately $4.8 billion supports Variable

Rate Demand Obligations (VRDO) remarketed by SunTrust and

other agents. VRDOs are municipal securities that are typically

remarketed by the agent on a weekly basis. In the event that the

securities are unable to be remarketed, the Company would fund

under the letters of credit.

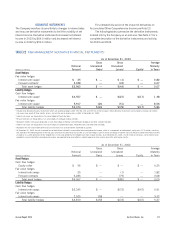

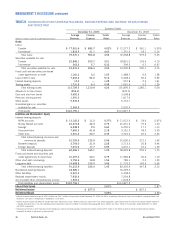

SunTrust also assists in providing liquidity to select corpo-

rate customers by directing them to SunTrust’s multi-seller

commercial paper conduit, Three Pillars. Three Pillars provides

financing for or direct purchases of financial assets originated and

serviced by SunTrust’s corporate customers. Three Pillars finances

this activity by issuing A-1/P-1 rated commercial paper. The result

is a favorable funding arrangement for these SunTrust customers.

As of December 31, 2002, accounting principles generally

accepted in the United States did not require the Company to

consolidate Three Pillars; however, in January 2003, the FASB

issued FIN 46, “Consolidation of Variable Interest Entities,”

which addressed the criteria for the consolidation of off-balance

sheet entities similar to Three Pillars. Under the provisions of FIN

46, SunTrust consolidated Three Pillars as of July 1, 2003; how-

ever, SunTrust is currently restructuring Three Pillars and expects

consolidation will no longer be required as of March 31, 2004.

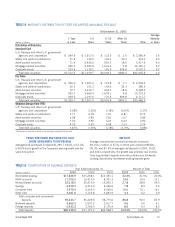

As of December 31, 2003, Three Pillars had assets and

liabilities included on the Consolidated Balance Sheet of approx-

imately $3.2 billion, primarily consisting of secured loans,

marketable asset-backed securities and short-term commercial

paper liabilities. As of December 31, 2002, Three Pillars had

assets and liabilities of approximately $2.8 billion which were

not included in the Consolidated Balance Sheet.

For the year ended December 31, 2003, activities related to

the Three Pillars relationship generated approximately $21.3 million

in fee revenue for the Company. These activities include: client

referrals and investment recommendations to Three Pillars; the

issuing of a letter of credit, which provides partial credit protec-

tion to the commercial paper holders; and providing a majority of

the temporary liquidity arrangements that would provide funding

to Three Pillars in the event it can no longer issue commercial

paper or in certain other circumstances.

As part of its community reinvestment initiatives, the

Company invests in multi-family affordable housing properties

throughout its footprint as a limited and/or general partner. Assets

of approximately $723.8 million in partnerships where SunTrust

is only a limited partner are not included in the Consolidated

Balance Sheet. The Company’s maximum exposure to loss for

these partnerships is $179.6 million, consisting of the limited

partnership investments plus unfunded commitments.

In addition, the Company is also a general partner in a num-

ber of limited partnerships, which have been formed to provide

investment opportunities for certain SunTrust customers. Assets

under management, which are not included in the Consolidated

Balance Sheet, totaled $3.6 billion as of December 31, 2003.

In connection with certain acquisitions made by the

Company, the terms of the acquisition agreement provide for

deferred payments or additional consideration to minority interest

holders and others, based on certain post-acquisition performance

targets. Disclosure of the amount of contingent consideration

expected to be paid is included in Note 18 to the Consolidated

Financial Statements.