SunTrust 2003 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2003 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2003 SunTrust Banks, Inc. 75

The compensation element for performance stock (which

is deferred and shown as a reduction of shareholders’ equity)

is equal to the fair market value of the shares at the date of

the award and is amortized to compensation expense over the

period from the award date to age 64 or the 15th anniversary of

the award date, whichever comes first. Phantom Stock units

have also been issued. Payment of Phantom Stock units will

be made to participants in shares of SunTrust stock upon the

earlier to occur of (1) the date on which the participant would

have vested in his or her performance stock or (2) the date of

a change in control. Dividend equivalents will be paid at the

same rate as the shares of performance stock; however, these

units do not carry voting privileges.

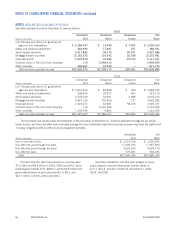

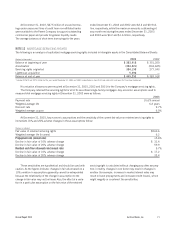

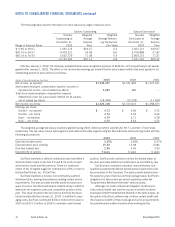

Compensation expense related to the incentive plans for the three years ended December 31 were as follows:

(Dollars in thousands) 2003 2002 2001

401(k) Plan and Performance Bonus Plan1$44,090 $43,670 $52,184

Management Incentive Plan and Performance Unit Plan 29,849 (5,664) 28,618

Performance stock 5,475 3,074 6,110

1The non-qualified Performance Bonus Plan was not paid in 2002 and was discontinued as of January 1, 2003.

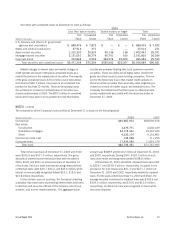

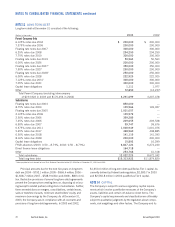

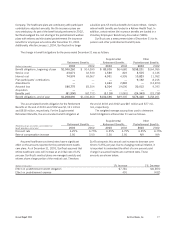

The following table presents information on stock options and performance stock:

Stock Options Performance Stock

Weighted- Weighted-

Average Deferred Average

(Dollars in thousands except per share data) Shares Price Range Exercise Price Shares Compensation Grant Price

Balance, January 1, 2001 10,001,653 $ 3.46 – $76.50 $52.83 3,128,474 $44,397 $ —

Granted 3,231,025 64.40 – 69.38 64.59 49,896 3,436 68.87

Exercised/Vested (627,840) 9.23 – 70.81 28.96 (105,399) — —

Canceled/Expired/Forfeited (474,542) 17.88 – 73.06 64.46 (101,374) (4,206) —

Amortization of compensation

for Performance Stock — — — — (6,110) —

Balance, December 31, 2001 12,130,296 11.13 – 76.50 56.70 2,971,597 37,517 —

Granted 478,191 58.21 – 67.98 62.78 19,523 1,261 64.62

Exercised/Vested (415,634) 11.13 – 65.25 33.14 (145,913) — —

Canceled/Expired/Forfeited (449,945) 11.13 – 73.06 63.96 (157,715) (6,842) —

Amortization of compensation

for Performance Stock — — — — (3,074) —

Balance, December 31, 2002 11,742,908 13.96 – 76.50 57.56 2,687,492 28,862 —

Granted 3,818,050 54.28 – 69.90 54.48 198,985 11,040 55.48

Exercised/Vested (777,087) 6.96 – 65.25 36.14 (22,930) — —

Canceled/Expired/Forfeited (795,225) 21.03 – 73.06 61.50 (100,382) (4,787) —

Acquisition of Lighthouse

Financial Services, Inc. 175,417 6.96 – 22.75 13.32 — — —

Amortization of compensation

for Performance Stock — — — — (5,475) —

Balance, December 31, 2003 14,164,063 $ 6.96 – $76.50 $57.14 2,763,165 $29,640

Exercisable, December 31, 2003 7,241,116 $55.12

Available for Additional Grant,

December 31, 2003 4,310,3201

1Includes 3.8 million shares available to be issued as performance stock.