SunTrust 2003 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2003 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16 SunTrust Banks, Inc. Annual Report 2003

MANAGEMENT’S DISCUSSION continued

charge-offs decreased primarily due to a reduction in commer-

cial net charge-offs.

Controlling noninterest expense continued to be a focus for

SunTrust in 2003. Although the Company benefited from

numerous cost savings initiatives, increased performance based

incentive payments and bonus payouts more than offset expense

reduction efforts. Total noninterest expense increased 5.6% from

2002. Personnel expense continued to be the largest component

of noninterest expense for SunTrust. Most of the increase in per-

sonnel expense related to incentive payments resulting from

business growth, higher production volumes, and higher revenue

in the PCS, CIB and Mortgage lines of business.

SunTrust experienced moderate loan growth four consecu-

tive quarters in 2003. Residential mortgage loans increased

significantly from 2002 to 2003 partially due to the improve-

ment in adjustable rate mortgage production during 2003.

Commercial middle market produced strong loan growth in

2003, especially given the economic environment. However, the

growth in commercial middle market was masked by shrinkage

in large corporate loans. Average loans within the Commercial

line of business increased 9.9% while average loans in the CIB

line of business decreased 1.7%. The Company anticipates

gradual pick up in the large corporate loan category as the econ-

omy continues to strengthen.

As previously mentioned, the Company took advantage of

wholesale funding sources during 2003 to fund a part of the

earning asset growth. SunTrust also experienced significant

growth in average consumer and commercial deposits which

increased 6.1% over 2002.

The following discussions will provide further insight on the

2003 performance of SunTrust.

CRITICAL ACCOUNTING POLICIES

The Company’s accounting policies are integral to understanding

the results reported. Accounting policies are described in detail in

Note 1 to the Consolidated Financial Statements. The Company’s

most complex accounting policies require management’s judg-

ment to ascertain the valuation of assets, liabilities, commitments

and contingencies. A variety of factors could affect the ultimate

value that is obtained either when earning income, recognizing an

expense, recovering an asset or reducing a liability. In instances

where required by generally accepted accounting principles, the

Company uses a discount factor to determine the present value of

assets and liabilities. A change in the discount factor could

increase or decrease the values of those assets and liabilities.

That change could result in either a beneficial or adverse impact

on the financial results. The Company has established detailed

policies and control procedures that are intended to ensure valua-

tion methods are well controlled and applied consistently from

period to period. In addition, the policies and procedures are

intended to ensure that the process for changing methodologies

occurs in an appropriate manner. The following is a brief descrip-

tion of the Company’s current accounting policies involving

significant management valuation judgments.

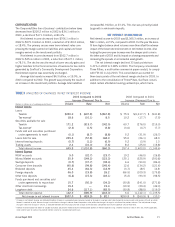

ALLOWANCE FOR LOAN LOSSES

The allowance for loan losses represents management’s esti-

mate of losses inherent in the existing loan portfolio. The

allowance for loan losses is increased by the provision for loan

losses charged to expense and reduced by loans charged off, net

of recoveries. The allowance for loan losses is determined based

on management’s assessment of several factors: reviews and

evaluations of specific loans, changes in the nature and volume

of the loan portfolio, current economic conditions and the related

impact on segments of the loan portfolio, historical loan loss

experience and the level of classified and nonperforming loans.

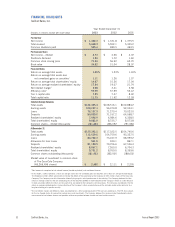

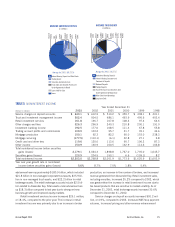

NET INCOME BEFORE

EXTRAORDINARY GAIN

$ in millions

5 Year Compounded Growth Rate 6.5%

98 99 00 01 02 03

971.0

1,124.0

1,294.1

1,375.5

1,331.8

1,332.3

RETURN ON

AVERAGE REALIZED EQUITY

%

See page 14 for reconcilement

to GAAP measure.

98 99 00 01 02 03

17.21

20.83

21.46

21.74

19.07

17.54

RETURN ON

AVERAGE TOTAL EQUITY

%

98 99 00 01 02 03

12.36

16.20

17.25

17.04

15.26

14.67