SunTrust 2003 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2003 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2003 SunTrust Banks, Inc. 25

advisement were approximately $180.9 billion, which included

$21.8 billion in non-managed corporate trust assets, $35.9 bil-

lion in non-managed trust assets, and $22.2 billion in retail

brokerage assets. The retail brokerage accounts include $2.5 bil-

lion related to Alexander Key. Total assets under advisement are

up $18.3 billion compared to last year due to strong net new

business growth and improved equity markets.

Retail investment services income increased $25.1 million,

or 18.4%, compared to the prior year. The increase in retail

investment income was primarily due to an increase in broker

production, an increase in the number of brokers, and increased

revenue generated from Alexander Key. Retail investment sales,

including annuities, increased 25.2% compared to 2002, which

was greater than the increase in retail investment income due to

fee based products that are sensitive to market volatility. As of

December 31, 2003, retail brokerage assets increased 30.6%

compared to December 31, 2002.

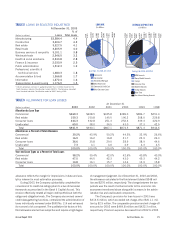

Service charges on deposit accounts increased $30.2 mil-

lion, or 4.9%, compared to 2002. Increased NSF/stop payment

volumes, increased pricing and other revenue enhancement

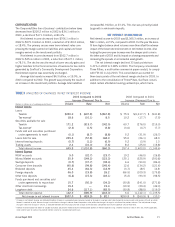

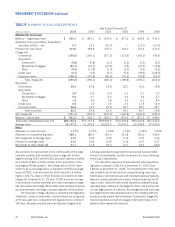

TABLE 5

NONINTEREST INCOME

Year Ended December 31

(Dollars in millions) 2003 2002 2001 2000 1999 1998

Service charges on deposit accounts $643.1 $612.9 $ 510.2 $ 459.7 $ 438.1 $ 401.1

Trust and investment management income 502.4 504.5 486.1 493.9 495.6 453.4

Retail investment services 161.8 136.7 107.8 108.2 97.4 64.6

Other charges and fees 326.3 296.9 240.3 210.8 200.1 191.0

Investment banking income 192.5 177.0 108.5 111.3 67.8 55.8

Trading account profits and commissions 109.9 103.2 95.7 31.7 35.1 44.6

Mortgage production 150.1 92.3 82.2 90.0 153.0 238.3

Mortgage servicing (177.5) (110.1) (6.1) 32.8 27.1 2.8

Credit card and other fees 119.6 120.0 113.6 95.7 106.2 87.3

Other income 150.9 130.9 160.5 132.9 114.6 106.8

Total noninterest income before securities

gains (losses) 2,179.1 2,064.3 1,898.8 1,767.0 1,735.0 1,645.7

Securities gains (losses) 123.9 204.5 153.1 6.6 (109.1) 8.2

Total noninterest income $2,303.0 $2,268.8 $2,051.9 $1,773.6 $1,625.9 $1,653.9

Year over year growth rate in noninterest

income before securities gains (losses) 5.6% 8.7% 7.5% 1.8% 5.4%

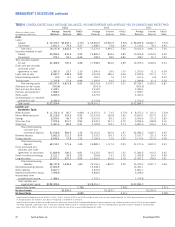

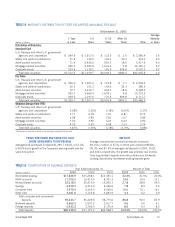

AVERAGE EARNING ASSET MIX

$ in Millions

Average for 2003: 109,257.4

76,137.9

69.68%

10.5

0.01%

1,765.8

1.62%

21,368.5

19.56%

1,387.0

1.27%

8,587.7

7.86%

Interest Bearing Deposits in Other Banks

Trading Assets

Securities Available for Sale

Funds Sold and Securities Purchased

Under Agreements to Resell

Loans Held For Sale

Loans

AVERAGE FUNDING MIX

$ in Millions

Average for 2003: 106,574.7

6,933.3

6.50%

3,662.0

3.44%

11,666.9

10.95%

2,211.7

2.07%

12,657.1

11.88%

17,826.9

16.73%

51,616.8

48.43%

Noninterest Bearing Deposits

Interest-Bearing Consumer and

Commercial Deposits

Brokered Deposits

Foreign Deposits

Funds Purchased and Securities Sold

Under Agreement to Repurchase

Other Short-term Borrowings

Long-term Debt