SunTrust 2003 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2003 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2003 SunTrust Banks, Inc. 15

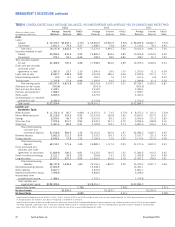

This narrative will assist readers in their analysis of the accompany-

ing Consolidated Financial Statements and supplemental financial

information. It should be read in conjunction with the Consolidated

Financial Statements and Notes on pages 54 through 92. In

Management’s Discussion, net interest income, net interest margin

and the efficiency ratio are presented on a fully taxable-equivalent

(FTE) basis, which is adjusted for the tax-favored status of income

from certain loans and investments. The Company believes this

measure to be the preferred industry measurement of net interest

income and provides relevant comparison between taxable and

non-taxable amounts. Certain reclassifications have been made to

prior year financial statements and related information to conform

them to the 2003 presentation.

SunTrust has made, and may continue to make, various

forward-looking statements with respect to financial and busi-

ness matters. The following discussion contains forward-looking

statements that involve inherent risks and uncertainties. Actual

results may differ materially from those contained in these

forward-looking statements. For additional information regarding

forward-looking statements, see “A Warning About Forward-

Looking Information” on pages 51 through 52 of this Annual

Report. In addition, the preparation of the financial statements,

upon which this Management’s Discussion is based, requires

management to make estimates which impact these financial

statements. Included in the Notes to the Consolidated Financial

Statements, which start on page 60, are the most significant

accounting policies used in the preparation of these statements

as required by generally accepted accounting principles. These

Notes should be read in conjunction with the reader’s review of

SunTrust’s financial statements and results of operations.

INTRODUCTION

Prior to 2003, SunTrust’s geographic footprint extended through-

out Alabama, Florida, Georgia, Maryland, Tennessee, Virginia,

and the District of Columbia. In June 2003, SunTrust expanded

its footprint into South Carolina by acquiring Lighthouse Financial

Services, Inc. (Lighthouse) based on Hilton Head Island.

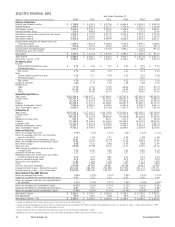

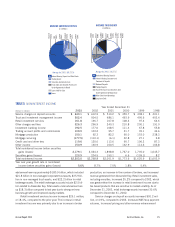

Within the geographic footprint, SunTrust strategically

operates under six business segments. These business segments

are: Retail, Commercial, Corporate and Investment Banking

(CIB), Private Client Services (PCS), Mortgage and Corporate/

Other. For a complete description of each line of business, please

see pages 17 through 18.

From an earnings perspective, 2003 was a challenging year

for SunTrust. On the positive side, credit quality retained “best in

class” distinction and improved throughout the year, mortgage

production reached record levels, the Company’s wealth man-

agement business continued to expand, debt capital markets

produced strong results and middle market commercial loan

growth was solid. On the negative side, the weak economy con-

tinued to negatively impact large corporate commercial loan

demand and continued margin compression into the first half of

2003 constrained revenue growth. The Company ended the year

with earnings per diluted share increasing 1.5% from 2002 to

$4.73 per diluted share.

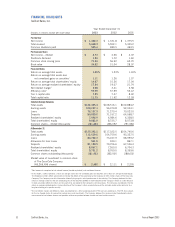

Net interest income for 2003 was $3.4 billion, an increase

of 2.5% compared to 2002. Net interest income began to show

signs of improvement in the latter half of 2003, signaling that the

balance sheet was less vulnerable to low interest rates, while still

positioned favorably for anticipated rate increases. The increased

net interest income was partially attributed to higher volumes in

both the loan and securities portfolios, which were able to offset

the adverse impact of the low rate environment. Positively impact-

ing net interest income, most notably in the latter half of the year,

was the decline in mortgage prepayments along with the steepen-

ing of the yield curve. To combat the negative effects of the low

rate environment, the Company was continually managing its cost

of funding versus the yields on both loans and other earning assets

by funding this growth through more cost effective means, such

as wholesale funding. SunTrust expects net interest income results

in the first half of 2004 to be consistent with the fourth quarter of

2003, with the possibility of slight growth occurring in the latter

part of 2004, when the Federal Reserve may begin to increase

interest rates. Compression of the net interest margin, which the

Company experienced throughout much of 2003, slowed in the

second half of the year and the margin began to expand in the

fourth quarter compared to the third quarter. Also, the first half

of 2003 saw high levels of mortgage prepayments caused by

the low rate environment contributing to the decline in the margin.

However, in the latter part of the year, the margin began to stabi-

lize as prepayments slowed, causing a reduction in securities

premium amortization amounts. Somewhat offsetting these

prepayments was an increase in the Company’s loans held for

sale, which remained at record levels for much of the year. The

Company expects mortgage loans held for sale to return to nor-

mal historical levels in 2004.

Noninterest income was $2.3 billion in 2003, an increase

of 1.5% from 2002. The increase was attributed to strong,

customer-driven fee income in areas such as the Company’s

wealth management and capital market businesses. The wealth

management business performed well in 2003 due to good sales

momentum, strong net asset flows and stable customer retention

rates. Continued improvement of performance for this business is

dependent on cooperation from the stock market and continued

economic recovery. SunTrust’s capital market revenues benefited

from strong growth in debt capital markets. In certain business

areas that appeared to be stagnant, such as corporate lending,

the Company benefited from extensive cross line of business

referrals generated by the teamwork between business special-

ists. This is a good example of how the Company’s approach of

selling, servicing and sustaining client relationships from a team

perspective has produced positive results.

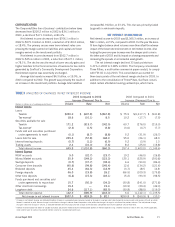

Credit quality improved in 2003, as evidenced by signifi-

cant declines in the provision for loan losses, nonperforming

assets and net charge-offs compared to 2002. Nonperforming

assets, particularly those related to commercial loans, showed

significant improvement from the prior year. The decrease in

nonperforming assets was attributed to a decline in new addi-

tions to large corporate nonaccrual loans, increased loan sales

activity, improvement in credit quality and client repayment. Net

MANAGEMENT’S DISCUSSION