SunTrust 2003 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2003 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

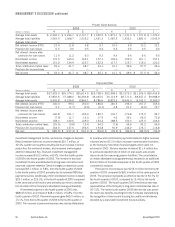

MANAGEMENT’S STATEMENT OF RESPONSIBILITY FOR FINANCIAL INFORMATION

54 SunTrust Banks, Inc. Annual Report 2003

Financial statements and information in this Annual Report

were prepared in conformity with generally accepted accounting

principles. Management is responsible for the integrity and objectiv-

ity of the financial statements and related information. Accordingly,

they maintain an extensive system of internal controls and account-

ing policies and procedures to provide reasonable assurance of the

accountability and safeguarding of Company assets, and of the

accuracy of financial information. These procedures include man-

agement evaluations of asset quality and the impact of economic

events, organizational arrangements that provide an appropriate

division of responsibility and a program of internal audits to evaluate

independently the adequacy and application of financial and operat-

ing controls and compliance with Company policies and procedures.

The Company’s independent auditors,

PricewaterhouseCoopers LLP, express their opinion as to the fair-

ness of the financial statements presented. Their opinion is

based on an audit conducted in accordance with generally

accepted auditing standards as described in their report.

The Board of Directors, through its Audit Committee, is

responsible for ensuring that both management and the inde-

pendent public accountants fulfill their respective responsibilities

with regard to the financial statements. The Audit Committee, com-

posed entirely of directors who are not officers or employees of the

Company, meets periodically with both management and the inde-

pendent public accountants to ensure that each is carrying out its

responsibilities. The independent public accountants have full and

free access to the Audit Committee and meet with it, with and

without management present, to discuss auditing and financial

reporting matters.

The Company assessed its internal control system as of

December 31, 2003, in relation to criteria for effective internal

control over consolidated financial reporting described in “Internal

Control

—

Integrated Framework” issued by the Committee of

Sponsoring Organizations of the Treadway Commission. Based on

this assessment, the Company believes that, as of December 31,

2003, its system of internal controls over consolidated financial

reporting met those criteria.

L. Phillip Humann

Chairman of the Board of Directors,

President and Chief Executive Officer

John W. Spiegel

Vice Chairman

and Chief Financial Officer

Jorge Arrieta

Senior Vice President

and Controller

ABBREVIATIONS

Within the Consolidated Financial Statements and the notes thereto, the following references will be used:

SunTrust Banks, Inc. – Company or SunTrust

SunTrust Bank Holding Company – Bank Parent Company

SunTrust Bank – Bank

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

Page

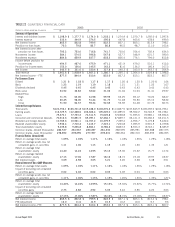

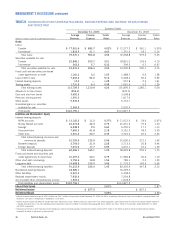

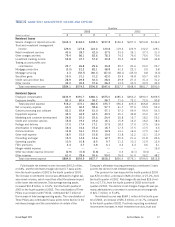

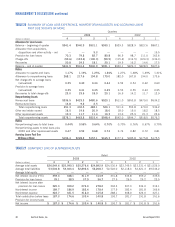

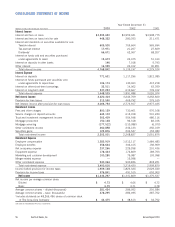

Consolidated Statements of Income 56

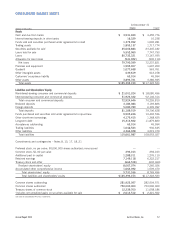

Consolidated Balance Sheets 57

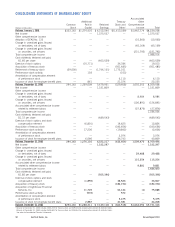

Consolidated Statements of Shareholders’ Equity 58

Consolidated Statements of Cash Flow 59

Notes to Consolidated Financial Statements 60