SunTrust 2003 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2003 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2003 SunTrust Banks, Inc. 61

conditions, concentrations and other risk factors are based on

economic indicators, concentrations of credit risk and adminis-

trative factors that are not otherwise addressed and have a

bearing on the collectibility of loans.

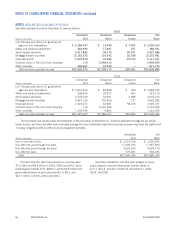

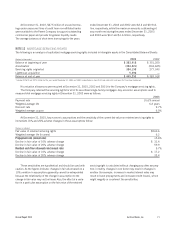

PREMISES AND EQUIPMENT

Premises and equipment are stated at cost less accumulated

depreciation and amortization. Depreciation has been calculated

primarily using the straight-line method over the assets’ esti-

mated useful lives. Certain leases are capitalized as assets for

financial reporting purposes. Such capitalized assets are amor-

tized, using the straight-line method, over the terms of the

leases. Maintenance and repairs are charged to expense and

improvements are capitalized.

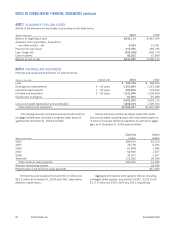

GOODWILL AND OTHER INTANGIBLE ASSETS

Goodwill represents the excess of purchase price over the fair value

of identifiable net assets of acquired companies. On January 1,

2002, SunTrust adopted SFAS No. 142, “Goodwill and Other

Intangible Assets.” Under SFAS No. 142, goodwill, including that

acquired before initial application of the standard, is no longer

amortized but is tested for impairment at least annually.

All other identified finite-lived intangible assets are amortized

over their useful lives and evaluated for impairment whenever

events or changes in circumstances indicate the carrying amount

of the assets may not be recoverable.

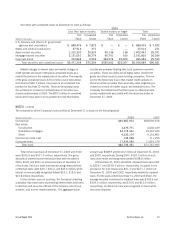

MORTGAGE SERVICING RIGHTS

The Company recognizes as assets the rights to service mort-

gage loans for others whether the servicing rights are acquired

through purchase or loan origination. Purchased MSRs are capi-

talized at cost. The carrying value of MSRs is maintained on the

balance sheet in intangible assets. For loans originated and sold

where the servicing rights have been retained, the Company

allocates the cost of the loan and the servicing rights based on

their relative fair market values. Fair value is determined through

a review of valuation assumptions that are supported by market

and economic data collected from various outside sources. The

Company records amortization of the MSRs based on two com-

ponents. First, the Company amortizes fully the remaining

balance of all MSRs for loans paid-in-full in recognition of the

termination of future cash flow streams, and second, normal

amortization (amortization of the surviving MSRs) is recorded

based on the current market cash flows. The current market

cash flows are calculated and updated monthly by applying mar-

ket-driven assumptions, such as interest rate and prepayment

speed assumptions.

Impairment for MSRs is determined based on the fair value

of the rights, stratified according to interest rate and type of

related loan. Impairment, if any, is recognized through a valua-

tion allowance with a corresponding charge recorded in the

income statement.

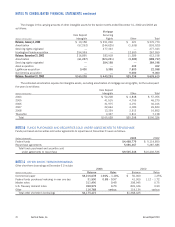

LOAN SALES AND SECURITIZATIONS

The Company sells residential mortgages and other loans and

has securitized mortgage loans. Retained interests in securitized

assets, including debt securities, are initially recorded at their

allocated carrying amounts based on the relative fair value of

assets sold and retained. Retained interests are subsequently

carried at fair value, which is generally estimated based on the

present value of expected cash flows, calculated using manage-

ment’s best estimates of key assumptions, including credit

losses, loan repayment speeds and discount rates commensu-

rate with the risks involved. Gains or losses on sales and

servicing fees are recorded in noninterest income.

INCOME TAXES

Deferred income tax assets and liabilities result from temporary

differences between the tax bases of assets and liabilities and

their reported amounts in the financial statements that will

result in taxable or deductible amounts in future years.

EARNINGS PER SHARE

Basic earnings per share are based on the weighted-average

number of common shares outstanding during each period.

Diluted earnings per share are based on the weighted-average

number of common shares outstanding during each period, plus

common shares calculated for stock options and performance

restricted stock outstanding using the treasury stock method.

CASH FLOWS

For purposes of reporting cash flows, cash and cash equivalents

include cash and due from banks, interest-bearing deposits in

other banks and funds sold and securities purchased under

agreements to resell (only those items with an original maturity

of three months or less).

DERIVATIVE FINANCIAL INSTRUMENTS

It is the policy of the Company to record all derivative financial

instruments at fair value in the financial statements. The Company

uses derivative instruments to hedge interest rate exposure by mod-

ifying the characteristics of the related balance sheet instruments.

Derivatives that do not qualify as hedges are carried at their current

market value on the balance sheet and changes in their fair value

are recorded as trading income in the current period.

Under the provisions of SFAS No. 133, “Accounting for

Derivative Instruments and Hedging Activities” and SFAS No.

149, “Amendment of Statement 133 on Derivative Instruments

and Hedging Activities,” on the date that a derivative contract is

entered into, the Company designates the derivative as (1) a

hedge of the fair value of a recognized asset or liability or of an

unrecognized firm commitment (fair value hedge); (2) a hedge of

a forecasted transaction or of the variability of cash flows to be

received or paid related to a recognized asset or liability (cash

flow hedge); (3) a foreign currency fair value or cash flow hedge

(foreign currency hedge); or (4) held for trading (trading instru-

ments). Changes in the fair value of a derivative that is highly