SunTrust 2003 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2003 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2003 SunTrust Banks, Inc. 67

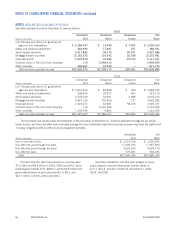

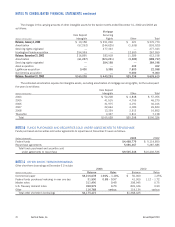

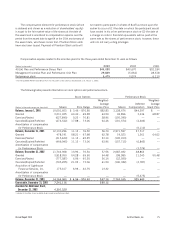

Total nonaccrual loans at December 31, 2003 and 2002

were $336.5 and $511.0 million, respectively. The gross

amounts of interest income that would have been recorded in

2003, 2002, and 2001 on nonaccrual loans at December 31

of each year, if all such loans had been accruing interest at their

contractual rates, were $33.7, $45.2, and $45.6 million, while

interest income actually recognized totaled $14.1, $15.6, and

$15.8 million, respectively.

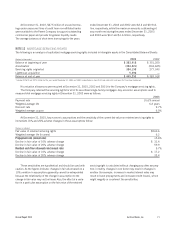

In the normal course of business, the Company’s banking

subsidiary has made loans at prevailing interest rates and terms

to directors and executive officers of the Company and its sub-

sidiaries, and to their related interests. The aggregate dollar

amount was $408.9 and $410.2 million at December 31, 2003

and 2002, respectively. During 2003, $197.5 million of such

loans were made and repayments totaled $198.8 million.

At December 31, 2003 and 2002, impaired loans amounted

to $229.7 and $399.3 million, respectively. Included in the

allowance for loan losses was $41.3 and $121.7 million at

December 31, 2003 and 2002, respectively related to impaired

loans. For the years ended December 31, 2003 and 2002, the

average recorded investment in impaired loans was $359.6 and

$424.6 million, respectively; and $10.0 and $10.6 million,

respectively, of interest income was recognized on loans while

they were impaired.

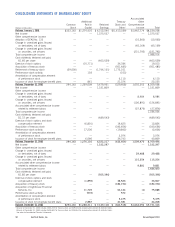

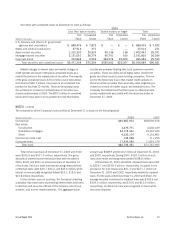

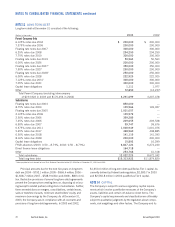

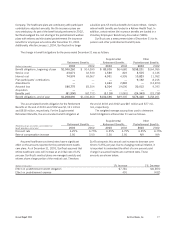

Securities with unrealized losses at December 31 were as follows:

2003

Less than twelve months Twelve months or longer Total

Fair Unrealized Fair Unrealized Fair Unrealized

(Dollars in thousands) Value Losses Value Losses Value Losses

U.S. Treasury and other U.S. government

agencies and corporations $689,476 $ 7,872 $ — $ — $ 689,476 $ 7,872

States and political subdivisions 27,512 271 — — 27,512 271

Asset-backed securities 1,312,307 25,933 90,136 138 1,402,443 26,071

Mortgage-backed securities 3,131,051 26,774 60,751 160 3,191,802 26,934

Corporate bonds 310,863 9,504 384,573 20,009 695,436 29,513

Total securities with unrealized losses $5,471,209 $70,354 $535,460 $20,307 $6,006,669 $90,661

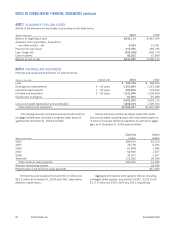

NOTE 6

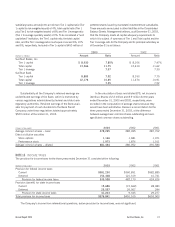

LOANS

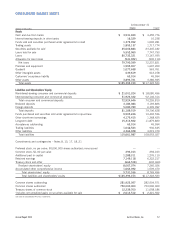

The composition of the Company’s loan portfolio at December 31 is shown in the following table:

(Dollars in thousands) 2003 2002

Commercial $30,681,914 $28,693,616

Real estate

Construction 4,479,771 4,002,439

Residential mortgages 24,173,441 19,443,445

Other 9,330,114 9,101,801

Commercial credit card 132,998 111,255

Consumer loans 11,934,083 11,815,379

Total loans $80,732,321 $73,167,935

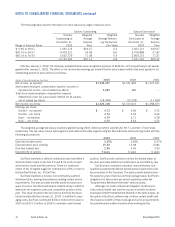

Market changes in interest rates and market changes in

credit spreads will result in temporary unrealized losses as a

normal fluctuation in the market price of securities. The majority

of the gross unrealized losses, $70.4 million out of total unreal-

ized losses of $90.7 million, have been in an unrealized loss

position for less than 12 months. These are temporary losses

due primarily to increases in interest rates on securities pur-

chased predominately in 2003. The $20.3 million in unrealized

losses which have been in a loss position for more than twelve

months are primarily floating-rate, trust preferred corporate

securities. These securities are all highly-rated, investment

grade securities issued by bank holding companies. The rea-

son for the temporary loss is that market credit spreads on

these securities are wider than when they were originally pur-

chased as a result of market supply and demand factors. The

Company has determined that there were no other than tem-

porary impairments associated with the above securities at

December 31, 2003.