SunTrust 2003 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2003 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2003 SunTrust Banks, Inc. 47

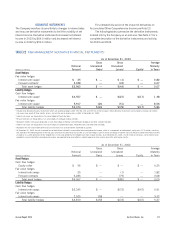

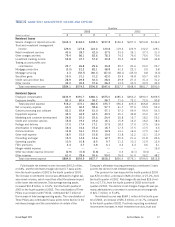

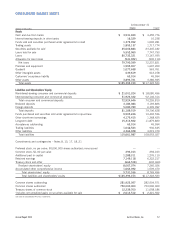

TABLE 25

QUARTERLY NONINTEREST INCOME AND EXPENSE

Quarters

2003 2002

(Dollars in millions) 43214321

Noninterest Income

Service charges on deposit accounts $165.3 $162.0 $158.0 $157.8 $156.2 $157.0 $153.8 $146.0

Trust and investment management

income 129.6 127.8 124.2 120.8 119.4 123.9 132.2 129.1

Retail investment services 43.6 38.7 42.0 37.5 33.0 35.1 37.3 31.3

Other charges and fees 79.4 86.1 82.6 78.3 74.3 76.6 75.6 70.4

Investment banking income 53.8 47.7 57.2 33.8 39.5 39.8 52.8 44.8

Trading account profits and

commissions 22.7 26.8 29.6 30.8 29.7 23.6 24.2 25.7

Mortgage production (3.0) 32.2 82.1 38.8 61.3 22.3 3.0 5.8

Mortgage servicing 2.3 (52.7) (80.1) (47.0) (68.1) (36.5) 0.8 (6.3)

Securities gains 19.5 31.1 31.2 42.0 39.5 45.8 55.7 63.5

Credit card and other fees 28.9 29.6 32.4 28.6 29.9 27.4 31.4 31.2

Other income 42.0 45.2 37.6 26.2 13.0 33.9 34.9 49.0

Total noninterest income $584.1 $574.5 $596.8 $547.6 $527.7 $548.9 $601.7 $590.5

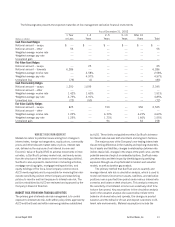

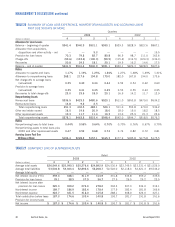

Noninterest Expense

Employee compensation $432.9 $391.7 $386.4 $375.0 $385.2 $363.2 $394.3 $369.5

Employee benefits 83.3 80.4 96.2 98.7 71.0 72.2 72.5 90.8

Total personnel expense 516.2 472.1 482.6 473.7 456.2 435.4 466.8 460.3

Net occupancy expense 60.5 60.5 58.6 57.7 61.7 57.6 55.9 54.0

Outside processing and software 63.2 65.4 61.0 57.1 57.0 59.9 54.0 54.3

Equipment expense 45.5 44.9 44.5 43.5 45.1 42.8 43.2 43.7

Marketing and customer development 24.8 25.0 25.6 24.9 20.8 15.7 18.2 25.2

Credit and collection services 15.8 19.3 19.2 16.1 15.9 14.2 16.2 18.3

Postage and delivery 17.0 17.4 17.1 17.5 18.3 17.0 17.5 16.6

Amortization of intangible assets 16.4 16.2 15.2 16.7 17.5 17.5 17.5 6.5

Communications 14.8 16.1 15.4 14.9 14.1 16.6 17.5 16.7

Other staff expense 18.9 15.0 15.8 10.6 13.8 12.2 12.1 13.9

Consulting and legal 15.9 14.2 14.6 12.7 25.0 21.6 21.8 22.6

Operating supplies 10.9 10.8 8.5 9.7 11.2 10.3 12.9 12.4

FDIC premiums 4.4 4.7 4.8 4.1 4.2 4.4 4.6 4.1

Merger-related expense ———————16.0

Other real estate expense (income) (0.9) (0.3) (0.8) — 0.3 (0.1) (0.4) —

Other expense 61.4 78.6 55.6 59.0 75.3 51.0 36.2 48.2

Total noninterest expense $884.8 $859.9 $837.7 $818.2 $836.4 $776.1 $794.0 $812.8

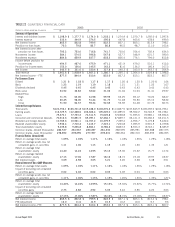

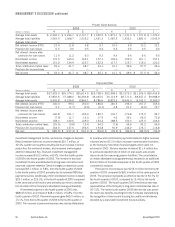

Fully-taxable net interest income increased $40.2 million,

or 4.8%, and the net interest margin declined 17 basis points

from the fourth quarter of 2002 to the fourth quarter of 2003.

The increase in net interest income was attributed to higher bal-

ance sheet volumes, which more than offset the adverse impact

of the lower rate environment. Total average earning assets

increased $10.8 billion, or 10.6%, from the fourth quarter of

2002 to the fourth quarter of 2003. The consolidation of Three

Pillars in accordance with FIN 46, contributed $2.7 billion of

the increase in total average earning assets. The consolidation of

Three Pillars also contributed 6 basis points to the decline in the

net interest margin and the consolidation of certain of the

Company’s affordable housing partnerships contributed 1 basis

point to the decline in net interest margin.

The provision for loan losses for the fourth quarter of 2003

was $70.3 million, a decrease of $26.2 million, or 27.2%, from

the fourth quarter of 2002. Net charge-offs declined $25.9 mil-

lion, or 27.1%, from the fourth quarter of 2002 to the fourth

quarter of 2003. The decline in net charges charge-offs was pri-

marily attributable to a decrease in commercial net charge-offs

of $21.7 million, or 51.8%.

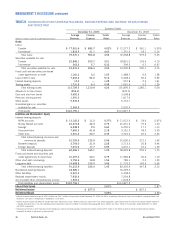

Noninterest income was $584.1 million in the fourth quar-

ter of 2003, an increase of $56.3 million, or 10.7%, compared

to the fourth quarter of 2002. Positively impacting noninterest

income were increases in retail investment services, trust and