SunTrust 2003 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2003 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82 SunTrust Banks, Inc. Annual Report 2003

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

Market risk is the adverse effect that a change in interest

rates, currency or implied volatility rates has on the value of a

financial instrument. The Company manages the market risk

associated with interest rate, credit, and equity derivatives and

foreign exchange contracts by establishing and monitoring limits

on the types and degree of risk that may be undertaken. The

Company continually measures this risk by using a value-at-risk

methodology.

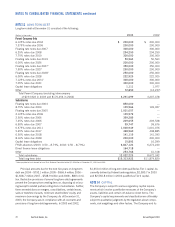

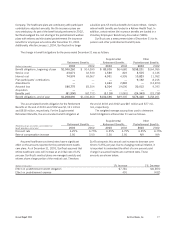

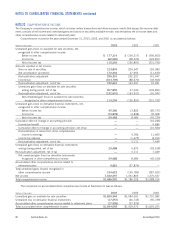

FAIR VALUE HEDGES

The Company enters into interest rate swaps to convert its

fixed rate funding exposure to a floating rate. For the years ended

December 31, 2003 and 2002, the Company recognized additional

income in the net interest margin of $130.7 and $49.9 million,

respectively, related to cash payments from net settlements and

income accrued for interest rate swaps accounted for as fair value

hedges. This hedging strategy resulted in ineffectiveness that

reduced earnings by $0.3 million and $1.4 million for the periods

ended December 31, 2003 and 2002, respectively.

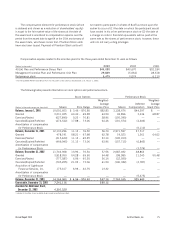

The Company maintains a risk management program to

protect and manage interest rate risk and pricing risk associated

with its mortgage lending activities. The following derivative

instruments are recorded in the financial statements at fair value

and are used to offset changes in value of the mortgage inven-

tory due to changes in market interest rates: forward contracts,

interest rate lock commitments and option contracts. A portion

of the forward contracts have been documented as fair value

hedges of specific pools of loans that meet the similar assets test

as described in SFAS No. 133. The pools of hedged loans are

recorded in the financial statements at their fair value, resulting

in a partial offset of the market value adjustments on the forward

contracts. The pools of loans are matched with a certain portion

of a forward contract so that the expected changes in market

value will inversely offset within a range of 80% to 125%. This

hedging strategy resulted in ineffectiveness that reduced earn-

ings by $149.7 million and $72.7 million for the periods ended

December 31, 2003 and 2002, respectively.

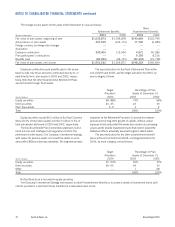

CASH FLOW HEDGES

The Company uses various interest rate swaps to convert float-

ing rate funding to fixed rates. Specific types of funding and

principal amounts hedged were determined based on prevailing

market conditions and the current shape of the yield curve. The

terms and notional amounts of the swaps are determined based

on management’s assessment of future interest rates, as well as

on other factors.

For the years ended December 31, 2003 and 2002, the

Company recognized expense in the net interest margin of

$66.7 million and $100.3 million, respectively, related to

cash payments and expense accrued for interest rate swaps

accounted for as cash flow hedges.

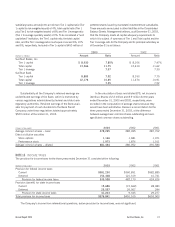

Gains and losses on derivative contracts that are reclassi-

fied from accumulated other comprehensive income to current

period earnings are included as an adjustment to the cost of

funding in the net interest margin. As of December 31, 2003,

$12.6 million, net of taxes, of the deferred net losses on deriva-

tive instruments that are recorded in accumulated other

comprehensive income are expected to be reclassified to interest

expense in the next twelve months as derivatives mature or as

payments are made.

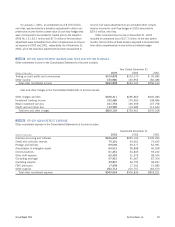

TRADING ACTIVITIES

The Company enters into various derivative contracts on behalf of

its clients and for its own trading account. These trading positions

primarily include interest rate swaps, equity derivatives, credit

default swaps, futures, options and foreign currency contracts.

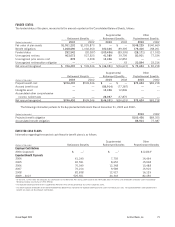

CREDIT-RELATED ARRANGEMENTS

In meeting the financing needs of its customers, the Company

issues commitments to extend credit, standby and other letters

of credit and guarantees. For additional information regarding

guarantees, which includes standby and other letters of credit

see Note 19. The Company also provides securities lending serv-

ices. For these instruments, the contractual amount of the

financial instrument represents the maximum potential credit

risk if the counterparty does not perform according to the terms

of the contract. A large majority of these contracts expire without

being drawn upon. As a result, total contractual amounts do not

represent actual future credit exposure or liquidity requirements.

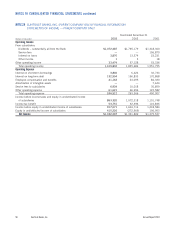

Commitments to extend credit are agreements to lend to a

customer who has complied with predetermined contractual

conditions. Commitments generally have fixed expiration dates

and are subjected to the Company’s credit policy standards. As

of December 31, 2003, the Company had outstanding commit-

ments to extend credit to its customers totaling $56.6 billion.

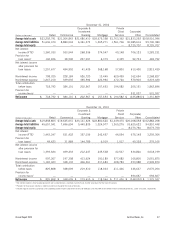

The Company services mortgage loans other than those

included in the accompanying Consolidated Financial Statements

and, in some cases, accepts a recourse liability on the serviced

loans. The Company’s exposure to credit loss in the event of

nonperformance by the other party to these recourse loans is

approximately $5.6 billion. In addition to the value of the prop-

erty serving as collateral, approximately $4.2 billion of the

balance of these loans serviced with recourse as of December 31,

2003, is insured by governmental agencies and private mortgage

insurance firms.

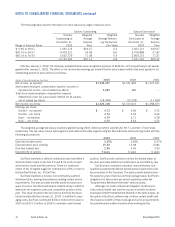

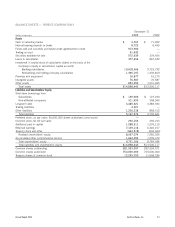

WHEN-ISSUED SECURITIES

The Company enters into transactions involving “when-issued

securities.” When-issued securities are commitments to purchase

or sell securities authorized for issuance but not yet actually

issued. Accordingly, they are not recorded on the balance sheet

until issued. Risks arise from the possible inability of counterpar-

ties to meet the terms of their contracts and from movements in

securities values and interest rates. As of December 31, 2003,

the Company did not have any commitments to purchase or sell

when-issued securities.