SunTrust 2003 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2003 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

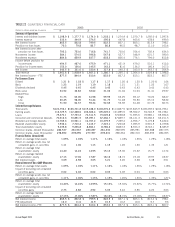

Annual Report 2003 SunTrust Banks, Inc. 41

MARKET RISK MANAGEMENT

Market risk refers to potential losses arising from changes in

interest rates, foreign exchange rates, equity prices, commodity

prices and other relevant market rates or prices. Interest rate

risk, defined as the exposure of net interest income and

Economic Value of Equity (EVE) to adverse movements in inter-

est rates, is SunTrust’s primary market risk, and mainly arises

from the structure of the balance sheet (non-trading activities).

SunTrust is also exposed to market risk in its trading activities,

mortgage servicing rights, mortgage lending activities, and

equity holdings of The Coca-Cola Company common stock.

ALCO meets regularly and is responsible for reviewing the inter-

est-rate sensitivity position of the Company and establishing

policies to monitor and limit exposure to interest rate risk. The

policies established by ALCO are reviewed and approved by the

Company’s Board of Directors.

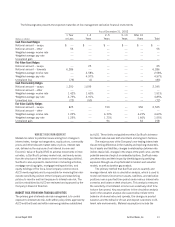

MARKET RISK FROM NON-TRADING ACTIVITIES

The primary goal of interest rate risk management is to control

exposure to interest rate risk, both within policy limits approved by

ALCO and the Board and within narrower guidelines established

by ALCO. These limits and guidelines reflect SunTrust’s tolerance

for interest rate risk over both short-term and long-term horizons.

The major sources of the Company’s non-trading interest rate

risk are timing differences in the maturity and repricing characteris-

tics of assets and liabilities, changes in relationships between rate

indices (basis risk), changes in the shape of the yield curve, and the

potential exercise of explicit or embedded options. SunTrust meas-

ures these risks and their impact by identifying and quantifying

exposures through use of sophisticated simulation and valuation

models, as well as duration gap analysis.

The primary method that SunTrust uses to quantify and

manage interest rate risk is simulation analysis, which is used to

model net interest income from assets, liabilities, and derivative

positions over a specified time period under various interest rate

scenarios and balance sheet structures. This analysis measures

the sensitivity of net interest income over a relatively short time

horizon (two years). Key assumptions in the simulation analysis

(and in the valuation analysis discussed below) relate to the

behavior of interest rates and spreads, the changes in product

balances and the behavior of loan and deposit customers in dif-

ferent rate environments. Material assumptions include the

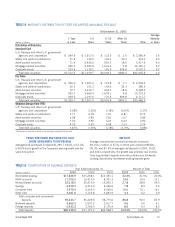

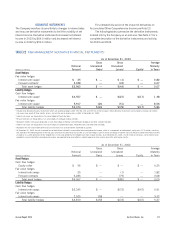

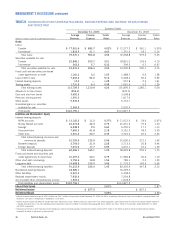

The following table presents the expected maturities of risk management derivative financial instruments:

As of December 31, 2002

1 Year 1–2 2–5 5–10 After 10

(Dollars in millions) or Less Years Years Years Years Total

Cash Flow Asset Hedges

Notional amount – swaps $ — $ — $ — $ — $ — $ —

Notional amount – other 56 — — — — 56

Weighted-average receive rate — — — — — —

Weighted-average pay rate — — — — — —

Unrealized gain — — — — — —

Fair Value Asset Hedges

Notional amount – swaps — 25 — — — 25

Notional amount – forwards 6,286 — — — — 6,286

Weighted-average receive rate — 2.58% — — — 2.58%

Weighted-average pay rate — 4.97% — — — 4.97%

Unrealized loss (79) (1) — — — (80)

Cash Flow Liability Hedges

Notional amount – swaps 1,250 1,095 — — — 2,345

Notional amount – other — — — — — —

Weighted-average receive rate 1.42% 1.60% — — — 1.51%

Weighted-average pay rate 4.79% 4.91% — — — 4.85%

Unrealized loss (22) (50) — — — (72)

Fair Value Liability Hedges

Notional amount – swaps 825 — 750 — 950 2,525

Notional amount – other — — — — — —

Weighted-average receive rate 1.23% — 6.33% — 6.23% 4.63%

Weighted-average pay rate 1.25% — 1.73% — 1.66% 1.55%

Unrealized gain — — 94 — 64 158