SunTrust 2003 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2003 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44 SunTrust Banks, Inc. Annual Report 2003

MANAGEMENT’S DISCUSSION continued

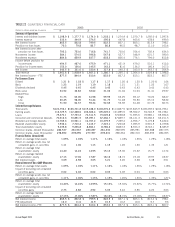

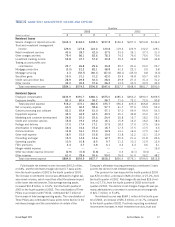

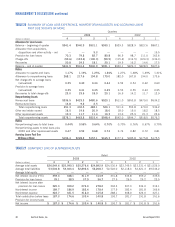

EARNINGS AND BALANCE SHEET ANALYSIS 2002 VS. 2001

Net income was $1,331.8 million in 2002 compared to

$1,375.5 million in 2001, a decrease of 3.2%. Diluted earnings

per share were $4.66 in 2002 and $4.72 in 2001. After-tax

merger-related expenses associated with the Huntington-Florida

acquisition totaled $39.8 million, or $0.14 per diluted share, in

2002. After-tax expenses totaling $20.2 million, or $0.07 per

diluted share, were incurred in 2001 related to the Company’s

proposal to acquire the former Wachovia Corporation. Additionally,

the Company recorded One Bank initiative charges of $36.5 mil-

lion, net of tax, or $0.13 per diluted share, and $35.5 million,

net of tax, or $0.12 per diluted share, in 2002 and 2001, respec-

tively. The One Bank initiative was completed in the fourth quarter

of 2002.

The continued decline of interest rates impacted operating

results in 2002 and 2001. Net interest income decreased $10.1 mil-

lion to $3,283.2 million in 2002, compared to $3,293.4 million

in 2001. The net interest margin decreased 17 basis points from

3.58% in 2001 to 3.41% in 2002. The decrease in net interest

income and margin was due to multiple factors, including a

decline in loan demand resulting from a sluggish economy, the

shift in the Company’s balance sheet position to slightly asset-

sensitive in anticipation of rising interest rates that did not come

to fruition and the flattening of the yield curve in 2002, which

created an acceleration of prepayments in the mortgage industry.

Net interest income was positively impacted by the high volume

of mortgage refinancing experienced during 2002, which led to

an increase in average loans to be sold into the secondary market

from $2.9 billion in 2001 to $4.4 billion in 2002.

Net charge-offs were $422.3 million, or 0.59%, of average

loans for 2002, compared to $272.4 million, or 0.39%, of aver-

age loans for 2001. The provision for loan losses increased

$194.6 million, or 70.7%, from 2001 to 2002. The increases

were primarily due to an increase in large corporate charge-offs

resulting from the weakened economy. Also, $45.3 million of

additional provision expense was recorded in 2002 to conform

the Huntington-Florida portfolio to SunTrust’s credit standards.

Noninterest income was $2,268.8 million in 2002, com-

pared to $2,051.9 million in 2001. The increase was driven by a

$159.2 million, or 21.2%, increase in service charges on deposit

accounts and other charges and fees as the Company benefited

from increased usage of products and services, a more consistent

pricing strategy throughout the Company’s markets, and a lower

earnings credit rate. Also positively impacting noninterest income

was a $68.5 million, or 63.1%, increase in investment banking

income due to improvements in the performance of the Company’s

capital markets business and the addition of the institutional busi-

ness of Robinson Humphrey during the third quarter of 2001.

Additionally, the Company benefited from increases of $28.9 mil-

lion, or 26.8%, in retail investment services and $18.4 million, or

3.8%, in trust and investment management income. Combined

mortgage production and servicing income decreased $93.9 mil-

lion from 2001 to 2002 due to accelerated amortization of

mortgage servicing rights resulting from increased prepayments

in the low rate environment.

Noninterest expense was $3,219.4 million in 2002, com-

pared to $2,999.9 million in 2001. Personnel expenses

increased $141.1 million, or 8.4%, primarily attributable to

increased benefits costs and the acquisitions of Huntington-

Florida, the institutional business of The Robinson Humphrey

and AMA Holdings, Inc., as well as expenses related to the One

Bank initiative. Also negatively impacting personnel expenses

were increased incentive payments resulting from the high level

of mortgage production in 2002. Other noninterest expense

increased $42.2 million, or 25.0%, from 2001 to 2002 prima-

rily due to $25.0 million related to the standardization of the

financial performance of the Company’s affordable housing busi-

ness. Also impacting noninterest expense was an increase in net

occupancy expense of $18.8 million, or 8.9%, due to the acquisi-

tions of Huntington-Florida and the institutional business of

Robinson Humphrey. Amortization of intangible assets increased

$12.6 million, or 27.3%, due to amortization of intangibles

related to the Huntington-Florida acquisition. In 2001, the

Company recorded $41.7 million of goodwill amortization that

is no longer being amortized in conjunction with the provisions

of SFAS No. 142.

Average earning assets increased $4.3 billion, or 4.7%,

from 2001 to 2002. The acquisition of Huntington-Florida con-

tributed $3.2 billion of the growth in average earning assets.

Average loans increased $1.2 billion, or 1.8%, from 2001 to

2002. Included in the increase was $2.3 billion in average loans

from the acquisition of Huntington-Florida. Average loans held

for sale increased $1.5 billion, or 49.5%, from 2001 to 2002

due to an increase in refinancing activity and mortgage origina-

tions resulting from the low rate environment.

Average interest-bearing liabilities increased $2.7 billion, or

3.5%, from 2001 to 2002. Included in the increase was $3.7 bil-

lion in interest-bearing liabilities related to the acquisition of

Huntington-Florida. Average consumer and commercial deposits

increased $8.7 billion compared to 2001. The acquisition of

Huntington-Florida contributed $3.8 billion of the growth in con-

sumer and commercial deposits. The remaining growth was due

primarily to an increase of 29.3% in money market accounts result-

ing from initiatives taken by the Company to grow retail deposits.

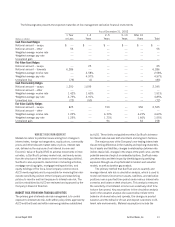

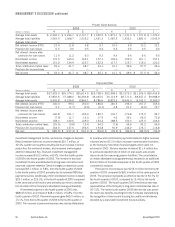

FOURTH QUARTER RESULTS

SunTrust reported $342.5 million, or $1.21 per diluted share,

of net income for the fourth quarter of 2003 compared with

$340.3 million, or $1.20 per diluted share, for the fourth quar-

ter of 2002.