SunTrust 2003 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2003 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64 SunTrust Banks, Inc. Annual Report 2003

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

RECENTLY ISSUED ACCOUNTING PRONOUNCEMENTS

In December 2003, the American Institute of Certified Public

Accountants (AICPA) issued Statement of Position (SOP) 03-3,

“Accounting for Loans or Certain Debt Securities Acquired in a

Transfer.” The SOP addresses accounting for differences between

contractual cash flows and cash flows expected to be collected

from an investor’s initial investment in loans or debt securities

acquired in a transfer if those differences relate to a deterioration of

credit quality. The SOP also prohibits companies from “carrying

over” or creating a valuation allowance in the initial accounting

for loans acquired that meet the scope criteria of the SOP. The

SOP is effective for loans acquired in fiscal years beginning after

December 15, 2004.

In December 2003, the Securities Exchange Commission

(SEC) Staff announced that it will issue a Staff Accounting

Bulletin (SAB) addressing the accounting treatment for mortgage

loan interest rate lock commitments. The SAB will require inter-

est rate lock commitments that relate to mortgage loans held for

sale to be accounted for, by the issuer of the interest rate lock

commitment, under SFAS No. 133, “Accounting for Derivative

Instruments and Hedging Activities,” as written options that

would be reported as liabilities until either they are exercised or

they expire unexercised. SunTrust hedges its interest rate lock

commitments with fair value hedging instruments and the SAB,

if issued, would restrict the Company’s ability to apply fair value

accounting to the interest rate lock commitments that could be

reported as an asset on the Company’s balance sheet, while the

hedges in place would be subject to unrestricted fair value

accounting. The SAB is expected to be effective for interest rate

lock commitments entered into in the period beginning after

March 15, 2004. The Company is in the process of assessing

the impact this SAB will have on its results of operations.

In December 2003, the Medicare Prescription Drugs,

Improvement and Modernization Act of 2003 (the Medicare Act)

was signed into law. The Medicare Act calls for sponsors of retiree

health care benefit plans to be reimbursed for a certain percentage

of the prescription cost for retirees. SFAS No. 106, “Employers’

Accounting for Postretirement Benefits Other Than Pensions,”

requires enacted changes in relevant laws to be considered in cur-

rent period measurements of postretirement benefit costs and

Accumulated Postretirement Benefit Obligations (APBO).

Therefore, under SFAS No. 106, measures of APBO and net peri-

odic post retirement benefit costs on or after the date of enactment

should reflect the effects of the Medicare Act. However, certain

accounting issues raised in the Medicare Act have resulted in the

FASB allowing plan sponsors to elect to defer accounting for the

effects of the Medicare Act until further guidance is issued.

SunTrust elected to defer until the FASB issues additional guid-

ance, which is expected to be later in 2004. Nonetheless, certain

disclosures are required as of December 31, 2003, and are

included in Note 16 to the Consolidated Financial Statements.

SunTrust is in the process of analyzing the impact the Medicare

Act will have on the Company’s financial position and results of

operations when adopted.

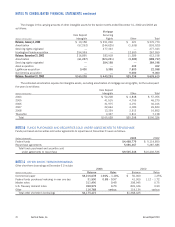

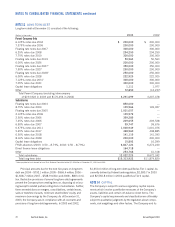

NOTE 2

ACQUISITIONS

SunTrust completed the acquisition of the Florida banking franchise

of Huntington Bancshares, Inc. (Huntington-Florida) on February 15,

2002. The Company acquired approximately $4.7 billion in assets

and liabilities. The transaction resulted in $528 million of goodwill,

$255 million of core deposit intangibles and $13 million of other

intangibles, all of which were deductible for tax purposes.

On June 2, 2003, SunTrust completed the acquisition of

Lighthouse Financial Services, Inc. (Lighthouse) based in Hilton

Head Island, South Carolina. The Company acquired approximately

$637 million in assets, $567 million in loans, and $421 million in

deposits. In addition, SunTrust paid $131 million in a combi-

nation of cash and SunTrust stock. The transaction resulted in

$99 million of goodwill and $23 million of other intangible

assets, which were not deductible for tax purposes. The acqui-

sition did not have a material impact on SunTrust’s financial

position or results of operations.

SunTrust completed the acquisition of Sun America

Mortgage (Sun America), one of the top mortgage lenders in

Metro Atlanta, on July 31, 2003. The transaction resulted in

$10 million of goodwill and $9 million of other intangibles, all

of which were deductible for tax purposes. The acquisition did

not have a material impact on SunTrust’s financial position or

results of operations.