SunTrust 2003 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2003 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2003 SunTrust Banks, Inc. 83

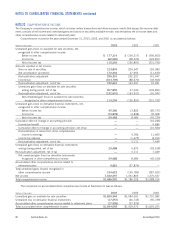

OTHER OFF-BALANCE SHEET ARRANGEMENTS

SunTrust assists in providing liquidity to select corporate cus-

tomers by directing them to SunTrust’s multi-seller commercial

paper conduit, Three Pillars. Three Pillars provides financing for

direct purchases of financial assets originated and serviced by

SunTrust’s corporate customers. Three Pillars finances this activ-

ity by issuing A-1/P-1 rated commercial paper. The result is a

favorable funding arrangement for these SunTrust customers.

As of December 31, 2002, accounting principles generally

accepted in the United States did not require the Company to

consolidate Three Pillars; however, in January 2003, the FASB

issued FIN No. 46, “Consolidation of Variable Interest Entities,”

which addressed the criteria for the consolidation of off-balance

sheet entities similar to Three Pillars. Under the provisions of

FIN 46, SunTrust consolidated Three Pillars as of July 1, 2003.

In December 2003, the FASB issued a revision to FIN 46

(FIN 46(R)) which replaced the Interpretation issued in January

2003. FIN 46(R) is effective for reporting periods ending after

March 15, 2004. The Company will adopt FIN 46(R) for the

quarter ended March 31, 2004, and will continue to apply FIN

46 in the interim.

Three Pillars remains consolidated at December 31, 2003;

however, SunTrust is currently restructuring Three Pillars and

expects consolidation will no longer be required as of March 31,

2004. As of December 31, 2003, Three Pillars had assets and

liabilities included on the Consolidated Balance Sheet of approx-

imately $3.2 billion, consisting of primarily secured loans,

marketable asset-backed securities and short-term commercial

paper liabilities. As of December 31, 2002, Three Pillars had

assets and liabilities of approximately $2.8 billion which were

not included in the Consolidated Balance Sheet.

For the year ended December 31, 2003, activities related to

the Three Pillars relationship generated approximately $21.3 mil-

lion in fee revenue for the Company. These activities include: client

referrals and investment recommendations to Three Pillars; the

issuing of a letter of credit, which provides partial credit protection

to the commercial paper holders; and providing a majority of the

temporary liquidity arrangements that would provide funding to

Three Pillars in the event it can no longer issue commercial paper

or in certain other circumstances.

As part of its community reinvestment initiatives, the

Company invests in multi-family affordable housing properties

throughout its footprint as a limited and/or general partner. The

Company receives affordable housing federal and state tax cred-

its for these limited partner investments. The partnerships are

considered variable interest entities (VIEs) under FIN 46, and

therefore, each partnership has been evaluated to determine the

Company’s level of variable interests. For the partnerships in

which SunTrust is the general partner, the Company consoli-

dated $425.1 million in assets during 2003.

Conversely, partnership assets of approximately $723.8 mil-

lion in partnerships where SunTrust is only a limited partner are

not included in the Consolidated Balance Sheet. The Company’s

maximum exposure to loss for these partnerships is $179.6 mil-

lion, consisting of the limited partnership investments plus unfunded

commitments. The investments in these partnerships represent a

significant variable interest for the Company and will continue to

be accounted for under the equity method of accounting.

In addition, the Company is also a general partner in a num-

ber of limited partnerships, which have been formed to provide

investment opportunities for certain SunTrust customers. Assets

under management, which are not included in the Consolidated

Balance Sheet, totaled $ 3.6 billion as of December 31, 2003.

FIN 46 did not require consolidation of these partnerships.

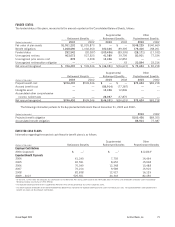

NOTE 18

GUARANTEES

The Company has undertaken certain guarantee obligations in

the ordinary course of business. In following the provisions of

FIN 45, as addressed in Note 1, the Company must consider

guarantees that have any of the following four characteristics (i)

contracts that contingently require the guarantor to make pay-

ments to a guaranteed party based on changes in an underlying

factor that is related to an asset, a liability, or an equity security

of the guaranteed party; (ii) contracts that contingently require

the guarantor to make payments to a guaranteed party based on

another entity’s failure to perform under an obligating agree-

ment; (iii) indemnification agreements that contingently require

the indemnifying party to make payments to an indemnified

party based on changes in an underlying factor that is related to

an asset, a liability, or an equity security of the indemnified

party; and (iv) indirect guarantees of the indebtedness of others.

The issuance of a guarantee imposes an obligation for the

Company to stand ready to perform, and should certain trigger-

ing events occur, it also imposes an obligation to make future

payments. Payments may be in the form of cash, financial

instruments, other assets, shares of stock, or provisions of the

Company’s services. The following is a discussion of the guaran-

tees that the Company has issued as of December 31, 2003,

which have characteristics as specified by FIN 45.

LETTERS OF CREDIT

Letters of credit are conditional commitments issued by the

Company generally to guarantee the performance of a customer

to a third party in borrowing arrangements, such as commercial

paper, bond financing and similar transactions. The credit risk

involved in issuing letters of credit is essentially the same as that

involved in extending loan facilities to customers and may be

reduced by selling participations to third parties. The Company

issues letters of credit that are classified as either financial

standby, performance standby or commercial letters of credit.

Commercial letters of credit are specifically excluded from the

disclosure and recognition requirements of FIN 45.