SunTrust 2003 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2003 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48 SunTrust Banks, Inc. Annual Report 2003

MANAGEMENT’S DISCUSSION continued

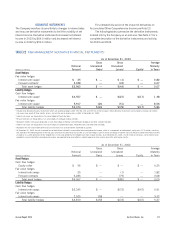

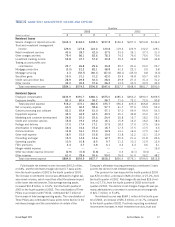

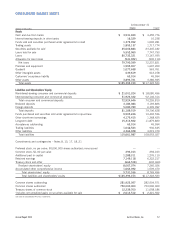

TABLE 26

SUMMARY OF LOAN LOSS EXPERIENCE, NONPERFORMING ASSETS AND ACCRUING LOANS

PAST DUE 90 DAYS OR MORE

Quarters

2003 2002

(Dollars in millions) 43214321

Allowance for Loan Losses

Balance – beginning of quarter $941.4 $940.9 $931.1 $930.1 $929.3 $928.9 $927.6 $867.1

Allowance from acquisitions,

dispositions and other activity – net ——9.3 — ———15.5

Provision for loan losses 70.3 79.8 82.7 80.8 96.5 98.7 111.0 163.6

Charge-offs (90.6) (103.6) (100.3) (99.9) (115.2) (114.5) (124.3) (136.1)

Recoveries 20.8 24.3 18.1 20.1 19.5 16.2 14.6 17.5

Balance – end of quarter $941.9 $941.4 $940.9 $931.1 $930.1 $929.3 $928.9 $927.6

Ratios

Allowance to quarter-end loans 1.17% 1.19% 1.25% 1.26% 1.27% 1.28% 1.29% 1.31%

Allowance to nonperforming loans 268.1 217.6 194.8 179.0 182.0 167.8 194.0 173.6

Net charge-offs to average loans

(annualized) 0.35 0.40 0.44 0.44 0.52 0.54 0.62 0.69

Provision to average loans

(annualized) 0.35 0.41 0.45 0.45 0.53 0.55 0.63 0.95

Recoveries to total charge-offs 23.0 23.5 18.0 20.1 16.9 14.2 11.7 12.9

Nonperforming Assets

Nonaccrual loans $336.5 $423.3 $480.6 $520.1 $511.0 $553.8 $479.0 $534.2

Restructured loans 14.8 9.2 2.5 — ————

Total nonperforming loans 351.3 432.5 483.1 520.1 511.0 553.8 479.0 534.2

Other real estate owned 16.5 19.6 20.9 18.0 18.0 15.0 18.2 18.5

Other repossessed assets 10.3 11.7 11.4 10.3 13.0 25.9 21.3 23.6

Total nonperforming assets $378.1 $463.8 $515.4 $548.4 $542.0 $594.7 $518.5 $576.3

Ratios

Nonperforming loans to total loans 0.44% 0.55% 0.64% 0.70% 0.70% 0.76% 0.67% 0.75%

Nonperforming assets to total loans plus

OREO and other repossessed assets 0.47 0.59 0.68 0.74 0.74 0.82 0.72 0.81

Accruing Loans Past Due

90 Days or More $196.4 $228.2 $157.1 $165.3 $177.9 $185.8 $175.8 $175.5

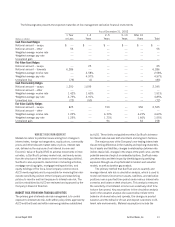

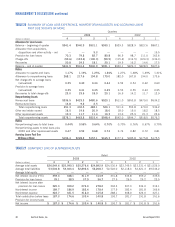

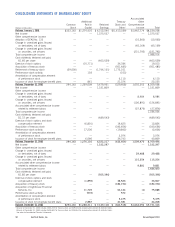

TABLE 27

QUARTERLY LINE OF BUSINESS RESULTS

Retail

2003 2002

(Dollars in millions) 432143 21

Average total assets $26,549.6 $25,990.3 $25,276.6 $24,892.9 $24,530.4 $23,745.5 $23,331.4 $21,526.0

Average total liabilities 53,504.8 53,303.4 52,892.6 52,208.7 52,522.0 52,118.4 52,321.3 49,546.2

Average total equity ————————

Net interest income (FTE) 359.4 348.1 311.9 314.9 331.8 333.8 359.2 335.6

Provision for loan losses 39.1 38.9 37.9 36.7 27.5 26.5 25.2 23.5

Net interest income after

provision for loan losses 320.3 309.2 274.0 278.2 304.3 307.3 334.0 312.1

Noninterest income 189.7 186.9 183.4 178.4 177.5 182.4 181.8 166.6

Noninterest expense 322.7 321.5 318.0 315.8 288.1 308.0 324.0 327.1

Total contribution before taxes 187.3 174.6 139.4 140.8 193.7 181.7 191.8 151.6

Provision for income taxes ————————

Net income $187.3 $ 174.6 $ 139.4 $ 140.8 $193.7 $ 181.7 $ 191.8 $ 151.6