Rogers 2014 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2014 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

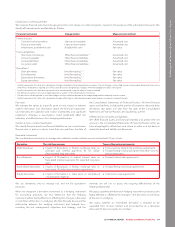

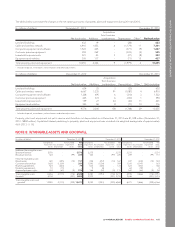

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

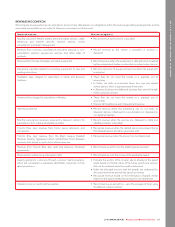

REVENUE RECOGNITION

We recognize revenue when we can estimate its amount, have delivered on our obligations within the revenue generating arrangements, and are

reasonably assured that we can collect it. Revenue is recorded net of discounts.

Source of revenue How we recognize it

Monthly subscriber fees for wireless airtime and data services, cable,

telephony and Internet services, network services, media

subscriptions and rental of equipment

• Record revenue as the service is provided

Revenue from roaming, long-distance and other optional or non-

subscription services, pay-per-use services and other sales of

products

• Record revenue as the service is provided or product is

delivered

Revenue from the sale of wireless and cable equipment • Record revenue when the equipment is delivered and accepted

by the independent dealer or subscriber in a direct sales channel

Equipment subsidies related to providing equipment to new and

existing subscribers

• Record a reduction of equipment revenues when the equipment

is activated

Installation fees charged to subscribers in Cable and Business

Solutions

• These fees do not meet the criteria as a separate unit of

accounting

• In Cable, we defer and amortize these fees over the related

service period, which is approximately three years

• In Business Solutions we defer and amortize fees over the length

of the customer contract

Activation fees charged to subscribers in Wireless • These fees do not meet the criteria as a separate unit of

accounting

• We record these fees as part of equipment revenue

Advertising revenue • Record revenue when the advertising airs on our radio or

television stations, is featured in our publications or displayed on

our digital properties

Monthly subscription revenues received by television stations for

subscriptions from cable and satellite providers

• Record revenue when the services are delivered to cable and

satellite providers’ subscribers

Toronto Blue Jays’ revenue from home game admission and

concessions

• Recognize revenue when the related games are played during

the baseball season and when goods are sold

Toronto Blue Jays’ revenue from the Major League Baseball

Revenue Sharing Agreement which redistributes funds between

member clubs based on each club’s relative revenues

• Recognize revenue when the amount can be determined

Revenue from Toronto Blue Jays, radio and television broadcast

agreements

• Record revenue at the time the related games are aired

Revenue from sublicensing of program rights • Record revenue over the course of the applicable season

Awards granted to customers through customer loyalty programs,

which are considered a separately identifiable component of the

sales transactions

• Estimate the portion of the original sale to allocate to the award

credit based on the fair value of the future goods and services

that can be obtained when the credit is redeemed

• Defer the allocated amount until the awards are redeemed by

the customer and we provide the goods or services

• Recognize revenue based on the redemption of award credits

relative to the award credits that we expect to be redeemed

Interest income on credit card receivables • Record revenue as earned (i.e.- upon the passage of time) using

the effective interest method

2014 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 95