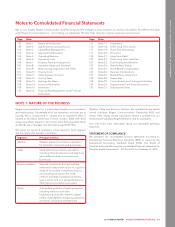

Rogers 2014 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2014 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

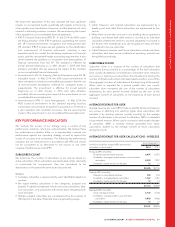

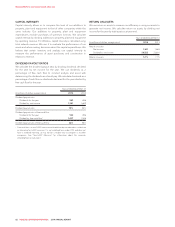

SUMMARY OF FINANCIAL RESULTS OF LONG-TERM DEBT GUARANTOR

Our outstanding public debt, $2.6 billion bank credit and letter of credit facilities and derivatives are unsecured obligations of RCI, as obligor, and

RCP, as either co-obligor or guarantor, as applicable.

The following table sets forth the selected unaudited consolidating summary financial information for RCI for the periods identified below,

presented with a separate column for: (i) RCI, (ii) RCP, (iii) our non-guarantor subsidiaries (Other Subsidiaries) on a combined basis,

(iv) consolidating adjustments, and (v) the total consolidated amounts.

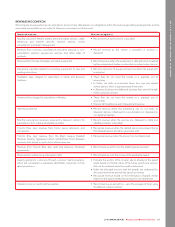

Years ended December 31 RCI RCP

Non-guarantor

subsidiaries 1,2

Consolidated

adjustments 1,2 Total

(In millions of dollars) 2014 2013 2014 2013 2014 2013 2014 2013 2014 2013

Selected Income Statement data measure:

Revenue 19 14 10,983 11,028 1,994 1,822 (146) (158) 12,850 12,706

Net Income (loss) 1,341 1,669 2,674 3,093 (257) 772 (2,417) (3,865) 1,341 1,669

As at December 31 RCI RCP

Non-guarantor

subsidiaries 1,2

Consolidated

adjustments 1,2 Total

(In millions of dollars) 2014 2013 2014 2013 2014 2013 2014 2013 2014 2013

Selected Balance Sheet data measure:

Current assets 18,530 16,592 13,764 11,035 1,775 3,594 (31,724) (26,900) 2,345 4,321

Non-current assets 23,760 19,464 16,347 12,731 24,612 21,678 (40,542) (34,593) 24,177 19,280

Current liabilities 17,701 14,853 6,716 3,014 13,870 15,269 (33,367) (28,530) 4,920 4,606

Non-current liabilities 15,619 13,018 443 293 1,220 1,186 (1,161) (171) 16,121 14,326

1For the purposes of this table, investments in subsidiary companies are accounted for by the equity method.

2Amounts recorded in current liabilities and non-current liabilities for RCP do not include any obligations arising as a result of being a guarantor or co-obligor, as the case may

be, under any of RCI’s long-term debt.

2014 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 85