Rogers 2014 Annual Report Download - page 102

Download and view the complete annual report

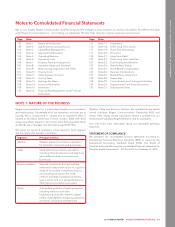

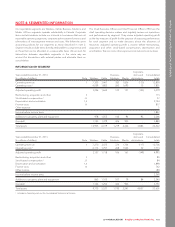

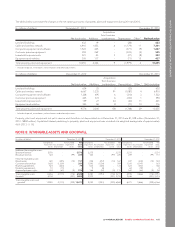

Please find page 102 of the 2014 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

pre-tax rate that reflects current market assessments of the time value

of money and the risks specific to the asset. Estimated cash flows are

based on management’s assumptions and are supported by external

information.

The above concepts used to determine the recoverable amount

require significant estimates, such as:

• future cash flows;

• terminal growth rate; and

• discount rates applied.

If our estimate of the asset’s or cash generating unit’s recoverable

amount is less than its carrying amount, we reduce its carrying amount

to the recoverable amount and recognize the loss in net income

immediately.

We reverse a previously recorded impairment loss if our estimate of a

previously impaired asset’s or cash generating unit’s recoverable

amount has increased such that the impairment recorded in a previous

year has reversed. The reversal is recognized by increasing the asset’s

or cash generating unit’s carrying amount to our new estimate of its

recoverable amount. The new carrying amount cannot be higher than

the carrying amount we would have recorded if we had not recognized

an impairment loss in previous years. We do not reverse impairment

losses recognized for goodwill.

INCOME TAXES

Income tax expense includes both current and deferred taxes. We use

judgement to interpret tax rules and regulations to calculate the

expense recorded each period. We recognizeincometaxexpensein

net income unless it relates to an item recognized directly in equity or

other comprehensive income.

Current tax expense is tax we expect to pay or receive based on our

taxable income or loss during the year. We calculate the current tax

expense using tax rates enacted or substantively enacted as at the

reporting date, and including any adjustment to taxes payable or

receivable related to previous years.

Deferred tax assets and liabilities arise from temporary differences

between the carrying amounts of the assets and liabilities we record in

our Consolidated Statements of Financial Position and their respective

tax bases. We calculate deferred tax assets and liabilities using enacted

or substantively enacted tax rates that will apply in the years the

temporary differences are expected to reverse.

Deferred tax assets and liabilities are offset if there is a legally

enforceable right to offset current tax liabilities and assets and they

relate to income taxes levied by the same authority on:

• the same taxable entity; or

• different taxable entities where these entities intend to settle current

tax liabilities and assets on a net basis or the tax assets and liabilities

will be realized and settled simultaneously.

We recognize a deferred tax asset for unused losses, tax credits and

deductible temporary differences to the extent that it is probable that

future taxable income will be available to use the asset. We use

judgement to evaluate whether we can recover a deferred tax asset

based on our assessment of existing tax laws, estimates of future

profitability and tax planning strategies.

We rely on estimates and assumptions when determining the amount

of current and deferred tax, and take into account the impact of

uncertain tax positions and whether additional taxes and interest may

be due. If new information becomes available and changes our

judgement on the adequacy of existing tax liabilities, these changes

would affect the income tax expense in the period that we make this

determination.

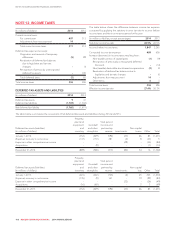

See note 12 for more information about our income taxes.

EARNINGS PER SHARE

We calculate basic earnings per share by dividing the net income or

loss attributable to our Class A and B shareholders by the weighted

average number of Class A and B shares outstanding during the year.

We calculate diluted earnings per share by adjusting the net income or

loss attributable to Class A and B shareholders and the weighted

average number of Class A and B shares outstanding for the effect of

all dilutive potential common shares. We use the treasury stock

method for calculating diluted earnings per share, which considers the

impact of employee stock options and other potentially dilutive

instruments.

See note 13 for our calculations of basic and diluted earnings per

share.

FOREIGN CURRENCY TRANSLATION

We translate amounts denominated in foreign currencies into

Canadian dollars as follows:

• monetary assets and monetary liabilities – at the exchange rate in

effect as at the date of the Consolidated Statements of Financial

Position

• non-monetary assets, non-monetary liabilities and related

depreciation and amortization expenses – at the historical exchange

rates

• revenue and expenses other than depreciation and amortization – at

the average rate for the month in which the transaction was

recorded.

FINANCIAL INSTRUMENTS

Recognition

We initially recognize cash and cash equivalents, accounts receivable,

debt securities and accounts payable and accrued liabilities on the

date they originate. All other financial assets and financial liabilities are

initially recognized on the trade date when we become a party to the

contractual provision of the instrument.

98 ROGERS COMMUNICATIONS INC. 2014 ANNUAL REPORT