Rogers 2014 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2014 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

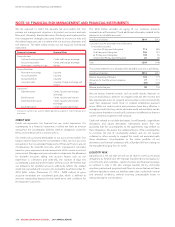

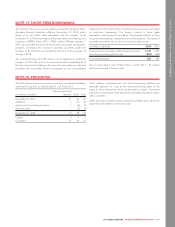

NOTE 17: INVESTMENTS

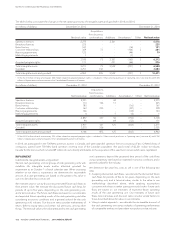

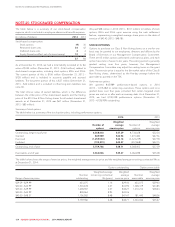

(In millions of dollars) 2014 2013

Investments in:

Publicly traded companies 1,130 809

Private companies 161 103

Investments, available-for-sale 1,291 912

Investments, associates and joint ventures 607 575

Total investments 1,898 1,487

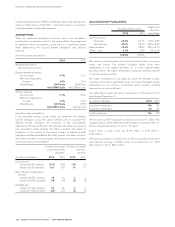

INVESTMENTS, AVAILABLE-FOR-SALE

Publicly Traded Companies

We hold interests in a number of publicly traded companies. This year

we recorded realized gains of $3 million and unrealized gains of $325

million (2013 – $13 million of realized gains and $186 million of

unrealized gains) with a corresponding increase in net income and

other comprehensive income, respectively.

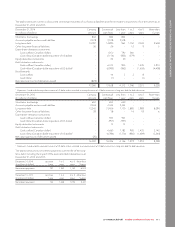

INVESTMENTS, ASSOCIATES AND JOINT VENTURES

We have interests in a number of associates and joint ventures, some

of which include:

Maple Leaf Sports and Entertainment Limited (MLSE)

MLSE, a sports and entertainment company, owns and operates the

Air Canada Centre, the NHL’s TorontoMapleLeafs,theNBA’sToronto

Raptors, the MLS’ Toronto FC, the AHL’s Toronto Marlies and other

assets. We, along with BCE Inc., jointly own an indirect net 75% equity

interest in MLSE with our portion representing a 37.5% equity interest

in MLSE. Our investment in MLSE is a joint venture and is accounted for

using the equity method.

shomi

In 2014, we entered into a joint venture equally owned by Rogers and

Shaw Communications Inc. to develop,launchandoperateapremium

subscription video-on-demand service offering movies and television

series for viewing on-line and through cable set-top boxes. Our

investment in shomi is a joint venture and is accounted for using the

equity method.

Inukshuk

Inukshuk is a joint operation owned 50% by each Rogers and BCE Inc.

that was created to operate a national fixed wireless

telecommunications network to be used by the partners and their

subsidiaries.

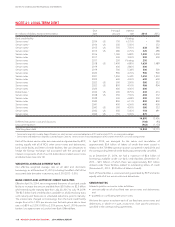

The following tables provide summary financial information on all our

material associates and joint ventures and our portions thereof. We

record our investments in joint ventures and associates using the

equity method.

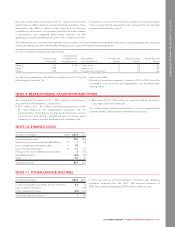

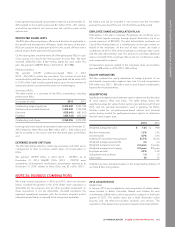

(In millions of dollars) 2014 2013

Current assets 261 153

Long-term assets 2,577 2,434

Current liabilities 432 334

Long-term liabilities 1,247 1,146

Total net assets 1,159 1,108

Our share of net assets 580 554

Revenues 714 648

Expenses 736 644

Total net (loss) income (22) 4

Our share of net (loss) income (11) 2

Some of our joint ventures have non-controlling shareholders that have

a right to require our joint venture to purchase the non-controlling

interest at a future date.

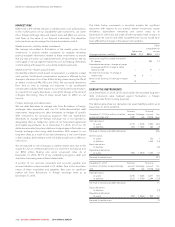

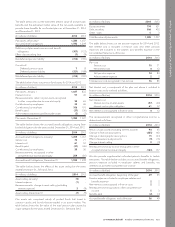

NOTE 18: OTHER LONG-TERM ASSETS

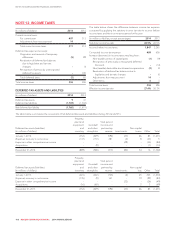

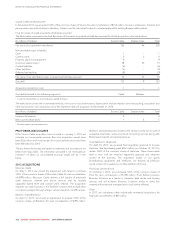

(In millions of dollars) 2014 2013

Spectrum licence deposits 250 250

Other 106 147

Total other long-term assets 356 397

In 2013, we paid total deposits of $250 million for the option to

purchase Shaw’s Advanced Wireless Services (AWS) spectrum

holdings pending regulatory approval. Under the agreement,

$200 million of this balance is refundable if the transaction does not

close.

116 ROGERS COMMUNICATIONS INC. 2014 ANNUAL REPORT