Rogers 2014 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2014 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

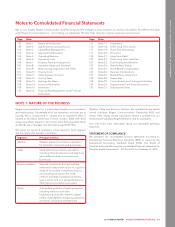

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

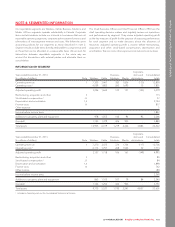

EMPLOYEE BENEFITS

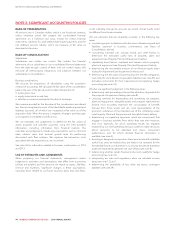

Post-employment benefits

We offer contributory and non-contributory defined benefit pension

plans that provide employees with a lifetime monthly pension on

retirement.

We separately calculate our net obligation for each defined benefit

pension plan by estimating the amount of future benefits that

employees have earned in return for their service in the current and prior

years, and discounting those benefits to determine their present value.

We accrue our pension plan obligations as employees provide the

services necessary to earn the pension. We use a discount rate based

on market yields on high quality corporate bonds at the measurement

date to calculate the accrued pension benefit obligation.

Remeasurements of the accrued pension benefit obligation are

determined at the end of the year, and include actuarial gains and

losses, return on plan assets and any change in the effect of the asset

ceiling. These are recognized in other comprehensive income and

retained earnings.

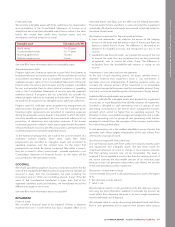

The cost of pensions is actuarially determined and takes into account

the following assumptions and methods for pension accounting

related to our defined benefit pension plans:

• expected rates of salary increases for calculating increases in future

benefits;

• mortality rates for calculating thelifeexpectancyofplanmembers;

and

• past service costs from plan amendments are immediately

expensed in net income.

We recognize our net pension expense for our defined benefit

pension plans and contributions to defined contribution plans as an

employee benefit expense in operating costs in the Consolidated

Statements of Income in the periods the employees provide the

related services.

See note 23 for more information about our pension plans.

Termination benefits

We recognize termination benefits as an expense when we are

committedtoaformaldetailedplanto terminate employment before

the normal retirement date and it is not realistic that we will withdraw it.

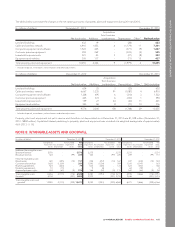

STOCK-BASED COMPENSATION

Stock option plans

Cash-settled share appreciation rights (SARs) are attached to all stock

options granted under our employee stock option plan. This feature

allows the option holder to choose to receive a cash payment equal to

the intrinsic value of the option (the amount by which the market price

of the Class B Non-Voting share exceeds the exercise price of the

option on the exercise date) instead of exercising the option to acquire

Class B Non-Voting shares. We classify all outstanding stock options

with cash settlement features as liabilities and carry them at their fair

value, determined using the Black-Scholes option pricing model or

trinomial option pricing models, depending on the nature of the share-

based award. We re-measure the fair value of the liability each period

andamortizeittooperatingcostsusing graded vesting, either over the

vesting period or to the date an employee is eligible to retire

(whichever is shorter).

Restricted share unit (RSU) plan

We record outstanding RSUs as liabilities, measuring the liabilities and

compensation costs based on the awards’ fair values, which are based

on the market price of the Class B Non-Voting shares, and recording

them as charges to operating costs over the vesting period of the

awards. If an award’s fair value changes after it has been granted and

before the settlement date, we record the resulting changes in the

liability as a charge to operating costs in the year that the change

occurs. The payment amount is established as of the vesting date.

Deferred share unit (DSU) plan

We record outstanding DSUs as liabilities, measuring the liabilities and

compensation costs based on the awards’ fair values at the grant date,

which are based on the market price of the Class B Non-Voting shares,

and recording them as charges to operating costs over the vesting

period of the awards. If an award’s fair value changes after it has been

granted and before the settlement date, we record the resulting

changes in our liability as a charge to operating costs in the year that

the change occurs. The payment amount is established as of the

exercise date.

Employee share accumulation plan

Employees voluntarily participate in the share accumulation plan by

contributing a specified percentage of their regular earnings. We

match employee contributions up to a certain amount, and record our

contributions as a compensation expense in the year we make them.

Expense relating to the employee share accumulation plan is included

in operating costs.

See note 25 for more information about our stock-based

compensation and other stock-based payments.

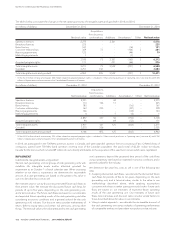

DISCONTINUED OPERATIONS

A discontinued operation is a component of our business that has

operations and cash flows that are clearly distinguished from the rest of

Rogers, has been disposed of or is classified as held-for-sale and:

• represents a separate major line of business;

• is part of a single coordinated plan to dispose of a separate major

line of business; or

• is a subsidiary we have acquired with the intention to re-sell.

When we classify a component as a discontinued operation, we restate

our comparative income and comprehensive income as though the

operation had been discontinued from the start of the comparative

year.

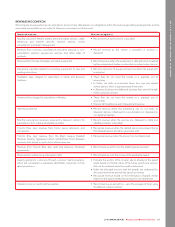

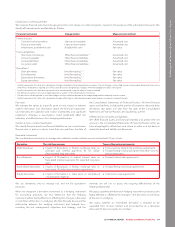

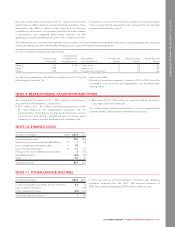

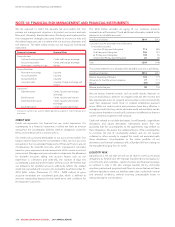

NEW ACCOUNTING PRONOUNCEMENTS ADOPTED IN

2014

We adopted the following accounting changes for our 2014 annual

consolidated financial statements.

• Amendments to IAS 32, Financial Instruments: Presentation

(IAS 32) – In December 2011, the IASB amended IAS 32 to clarify the

meaning of when an entity has a current legally enforceable right of

set-off.

• Amendments to IAS 39, Financial Instruments: Recognition and

Measurement (IAS 39) – In June 2013, the IASB amended IAS 39 to

provide relief from discontinuing an existing hedging relationship

when a novation that was not contemplated in the original hedging

documentation meets specific criteria.

• IFRIC 21, Levies (IFRIC 21) – In May 2013, the IASB issued IFRIC 21,

which provides guidance on when to recognize a liability for a levy

imposed by a government, both for levies that are accounted for in

2014 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 101