Rogers 2014 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2014 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

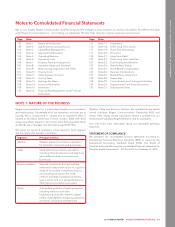

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

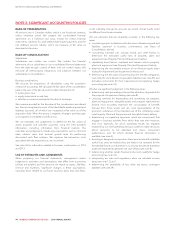

NOTE 2: SIGNIFICANT ACCOUNTING POLICIES

BASIS OF PRESENTATION

All amounts are in Canadian dollars, which is our functional currency,

unless otherwise noted. We prepare the consolidated financial

statements on a historical cost basis, except for certain financial

instruments, liabilities for cash-settled share-based payments and the

net deferred pension liability, which we measure at fair value as

described in the notes.

BASIS OF CONSOLIDATION

Subsidiaries

Subsidiaries are entities we control. We include the financial

statements of our subsidiaries in our consolidated financial statements

from the date we gain control of them until our control ceases. We

eliminate all intercompany transactions and balances between our

subsidiaries on consolidation.

Business combinations

We account for acquisitions of subsidiaries using the acquisition

method of accounting. We calculate the fair value of the consideration

paid as the sum of the fair value at the date of acquisition of:

• assets given; plus

• equity instruments issued; less

• liabilities incurred or assumed at the date of exchange.

We measure goodwill as the fair value of the consideration transferred

less the net recognized amount of the identifiable assets acquired and

liabilities assumed, all of which are measured at fair value as of the

acquisition date. When the excess is negative, a bargain purchase gain

is recognized immediately in profit or loss.

We use estimates and judgements to determine the fair values of

assets acquired and liabilities assumed, using the best available

information, including information from financial markets. The

estimates and judgements include key assumptions such as discount

rates, attrition rates, and terminal growth rates for performing

discounted cash flow analyses. We expense the transaction costs

associated with the acquisitions as we incur them.

Seenote26forinformationrelatedto business combinations in 2014

and 2013.

USE OF ESTIMATES AND JUDGEMENTS

When preparing our financial statements, management makes

judgements, estimates and assumptions that affect how accounting

policies are applied and the amounts we report as assets, liabilities,

revenue and expenses. Significant changes in these assumptions,

including those related to our future business plans and cash flows,

could materially change the amounts we record. Actual results could

be different from these estimates.

We use estimates that are inherently uncertain in the following key

areas:

• considering inputs to determine the fair value of assets acquired and

liabilities assumed in business combinations (see Basis of

Consolidation, above);

• considering intended use, industry trends and other factors to

determine the estimated useful lives of property, plant and

equipment (see Property, Plant and Equipment, below);

• capitalizing direct labour, overhead and interest costs to property,

plant and equipment (see Property, Plant and Equipment, below);

• determining the recoverable amount of non-financial assets when

testing for impairment (see Impairment, below); and

• determining the fair value of post-employment benefits obligations

(see note 23), stock-based compensation liabilities (see note 25) and

derivative instruments for their measurement and applying hedge

accounting (see note 16).

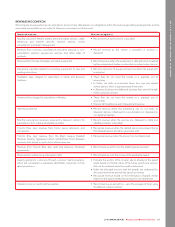

We also use significant judgement in the following areas:

• determining cash generating units and the allocation of goodwill for

the purpose of impairment testing (see note 8);

• choosing methods for depreciating and amortizing our property,

plant and equipment, intangible assets, and program rights that we

believe most accurately represent the consumption of benefits

derived from those assets and are most representative of the

economic substance of the intended use of the underlying assets

(see Property, Plant and Equipment and Intangible Assets, below);

• determining our operating segments, which are components that

engage in business activities from which they may earn revenues

and incur expenses, for which operating results are regularly

reviewed by our chief operating decision makers to make decisions

about resources to be allocated and assess component

performance, and for which discrete financial information is

available (see note 4);

• deciding to designate our spectrum licences as assets with indefinite

useful lives since we believe they are likely to be renewed for the

foreseeable future such that there is no limit to the period that these

assets are expected to generate net cash inflows (see note 8);

• determining whether certain financial instruments qualify for hedge

accounting (see note 16);

• interpreting tax rules and regulations when we calculate income

taxes (see note 12); and

• determining the probability of loss when we assess contingent

liabilities (see note 29).

94 ROGERS COMMUNICATIONS INC. 2014 ANNUAL REPORT