Rogers 2014 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2014 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

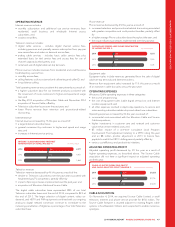

OPERATING EXPENSES

We assess operating expenses in two categories:

• the cost of wireless handsets and equipment; and

• all other expenses involved in day-to-day operations, to service

existing subscriber relationships and attract new subscribers.

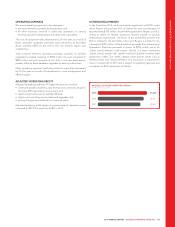

The cost of equipment sales decreased by 3% this year as a result of

fewer subscriber upgrades and fewer gross activations as described

above, partially offset by the shift in the mix towards higher cost

smartphones.

Total customer retention spending (including subsidies on handset

upgrades) increased modestly to $946 million this year compared to

$939 million last year because of the shift in mix described above,

partially offset by fewer hardware upgrades by existing subscribers.

Other operating expenses (excluding retention spending) decreased

by 2% this year as a result of improvements in cost management and

efficiency gains.

OTHER DEVELOPMENTS

In late December 2014, we announced an agreement with BCE under

which Rogers will purchase 50% of Glentel for cash consideration of

approximately $392 million. As part of the agreement, Rogers and BCE

intend to divest all Glentel operations located outside of Canada

(International Operations). The terms of the agreement provide that

BCE is entitled to the first $100 million and Rogers is entitled to the

subsequent $195 million of the divestiture proceeds from International

Operations. Divesture proceeds in excess of $295 million are to be

shared evenly between both parties. Glentel is a large multicarrier

mobile phone retailer with several hundred Canadian wireless retail

distribution outlets. The outlets operate under banner names such as

Wireless Wave and TBooth Wireless. The transaction is expected to

close in the first half of 2015 and is subject to regulatory approval and

completion of BCE’s acquisition of Glentel.

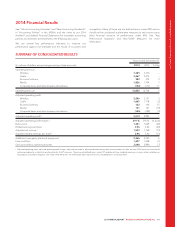

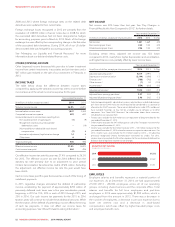

ADJUSTED OPERATING PROFIT

Adjusted operating profit was 3% higher this year as a result of:

• continued growth of wireless data revenue and continued adoption

of higher ARPU-generating service plans; and

• higher equipment revenue; partially offset by

• higher unit costs of equipment sales and upgrades; and

• pricing changes associated with our roaming plans.

Adjusted operating profit margin as a percentage of network revenue

increased to 48.1% this year from 46.8% in 2013.

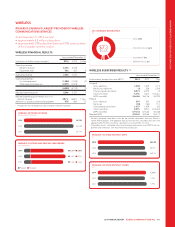

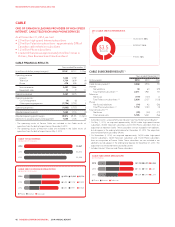

(IN MILLIONS OF DOLLARS)

WIRELESS ADJUSTED OPERATING PROFIT

2014

2013

2012

$3,246

$3,157

$3,063

2014 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 45