Rogers 2014 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2014 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

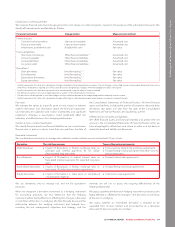

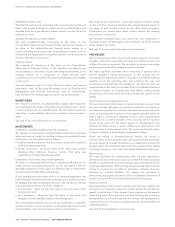

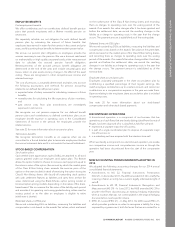

CONSOLIDATED FINANCIAL STATEMENTS

Consolidated Statements of Cash Flows

(In millions of Canadian dollars)

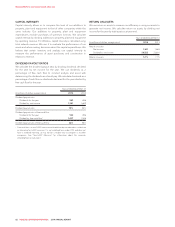

Years ended December 31 Note 2014 2013

Operating activities:

Net income for the year 1,341 1,669

Adjustments to reconcile net income to net cash flows from operating activities:

Depreciation and amortization 7, 8 2,144 1,898

Program rights amortization 866 52

Finance costs 10 817 742

Income taxes 12 506 596

Stock-based compensation 25 37 84

Gain on sale of TVtropolis 11 –(47)

Post-employment benefits contributions, net of expense 23 (34) (32)

Other 48 (14)

Cash provided by operating activities before changes in non-cash working capital,

income taxes paid and interest paid 4,925 4,948

Change in non-cash operating working capital items 30 11 238

Cash provided by operating activities before income taxes paid and interest paid 4,936 5,186

Income taxes paid (460) (496)

Interest paid (778) (700)

Cash provided by operating activities 3,698 3,990

Investing activities:

Additions to property, plant and equipment 7(2,366) (2,240)

Additions to program rights 8(231) (69)

Changes in non-cash working capital related to property, plant and equipment and

intangible assets 153 (114)

Acquisitions and strategic transactions, net of cash acquired 8, 26 (3,456) (1,080)

Proceeds on sale of TVtropolis 11 –59

Other (51) (29)

Cash used in investing activities (5,951) (3,473)

Financing activities:

Proceeds on settlement of cross-currency interest rate exchange agreements and

forward contracts 30 2,150 662

Payments on settlement of cross-currency interest rate exchange agreements and

forward contracts 30 (2,115) (1,029)

Proceeds received on short-term borrowings 19 276 650

Repayment of short-term borrowings 19 (84) –

Issuance of long-term debt 30 3,412 2,578

Repayment of long-term debt 30 (2,551) (356)

Transaction costs incurred (30) (37)

Repurchase of Class B Non-Voting shares 24 –(21)

Dividends paid (930) (876)

Cash provided by financing activities 128 1,571

Change in cash and cash equivalents (2,125) 2,088

Cash and cash equivalents, beginning of year 2,301 213

Cash and cash equivalents, end of year 176 2,301

Cash and cash equivalents is defined as cash and short-term deposits which have an original maturity of less than 90 days, less bank advances. As

at December 31, 2014 and 2013, the balance of cash and cash equivalents was comprised of cash and demand deposits.

The accompanying notes are an integral part of the consolidated financial statements.

92 ROGERS COMMUNICATIONS INC. 2014 ANNUAL REPORT