Rogers 2014 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2014 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

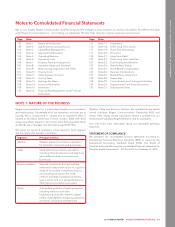

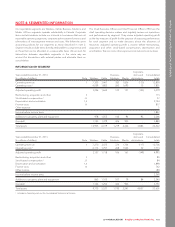

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

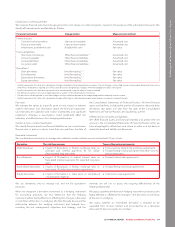

Classification and measurement

We measure financial instruments by grouping them into classes on initial recognition, based on the purpose of the individual instruments. We

classify all financial assets and liabilities as follows:

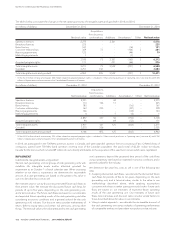

Financial instrument Categorization Measurement method

Financial assets

Cash and cash equivalents Loans and receivable Amortized cost

Accounts receivable Loans and receivable Amortized cost

Investments, available-for-sale Available-for-sale 1Fair value

Financial liabilities

Short-term borrowings Other financial liabilities 2Amortized cost

Accounts payable Other financial liabilities Amortized cost

Accrued liabilities Other financial liabilities Amortized cost

Long-term debt Other financial liabilities 2Amortized cost

Derivatives 3

Debt derivatives Held-for-trading 1, 4 Fair value

Bond forwards Held-for-trading 1, 4 Fair value

Expenditure derivatives Held-for-trading 1, 4 Fair value

Equity derivatives Held-for-trading 5Fair value

1Initially measured at fair value with subsequent changes recorded in other comprehensive income. The net change is reclassified into net income upon disposal of the asset or

when the asset becomes impaired, or in the case of derivatives designated as hedges, when the hedged item affects net income.

2Initially measured at fair value plus transaction costs and amortized using the effective interest method

3The derivatives can be in an asset or liability position at a point in time historically or in the future.

4The derivatives are designated as cash flow hedges with the ineffective portion of the hedge recognized immediately into net income

5Initially measured at fair value with subsequent changes offset against stock-based compensation expense or recovery in operating costs.

Fair value

We estimate fair values at a specific point in time, based on relevant

market information and information about the financial instruments.

Our estimates are subjective and involve uncertainties and significant

judgement. Changes in assumptions could significantly affect the

estimates, and effectiveness of our hedging relationships.

Current and non-current classification

We classify financial assets and financial liabilities as non-current when

they are due, in part or in whole, more than one year from the date of

the Consolidated Statements of Financial Position. All other financial

assets and liabilities, including the portion of long-term debt and debt

derivatives due within one year from the date of the Consolidated

Statements of Financial Position, are classified as current.

Offsetting financial assets and liabilities

We offset financial assets and financial liabilities and present the net

amount in the Consolidated Statements of Financial Position when we

have a legal right to offset them and intend to settle on a net basis or

realize the asset and liability simultaneously.

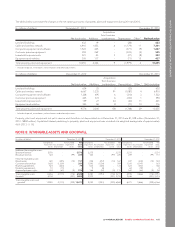

Derivative instruments

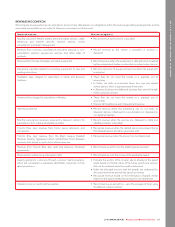

We use derivative instruments to manage risks related to certain activities we are involved with. They include:

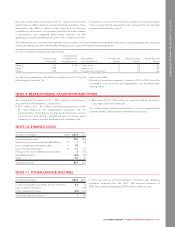

Derivative The risk they manage Types of derivative instruments

Debt derivatives •Impact of fluctuations in foreign exchange rates on

principal and interest payments for US dollar-

denominated long-term debt

•Cross-currency interest rate exchange agreements

•Forward foreign exchange agreements (from time to

time as necessary)

Bond forwards •Impact of fluctuations in market interest rates on

forecasted interest payments for expected long-term

debt

•Forward interest rate agreements

Expenditure derivatives •Impact of fluctuations in foreign exchange rates on

forecasted US dollar-denominated expenditures

•Forward foreign exchange agreements

Equity derivatives •Impact of fluctuations in share price on stock-based

compensation expense

•Total return swap agreements

We use derivatives only to manage risk, and not for speculative

purposes.

When we designate a derivative instrument as a hedging instrument

for accounting purposes, we first determine that the hedging

instrument will be highly effective in offsetting the changes in fair value

or cash flows of the item it is hedging. We then formally document the

relationship between the hedging instrument and hedged item,

including the risk management objectives and strategy, and the

methods we will use to assess the ongoing effectiveness of the

hedging relationship.

We assess quarterly whether each hedging instrument continues to be

highly effective in offsetting the changes in the fair value or cash flows

oftheitemitishedging.

We assess whether an embedded derivative is required to be

separated from its host contract and accounted for as a derivative

when we first become a party to a contract.

2014 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 99