Rogers 2014 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2014 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

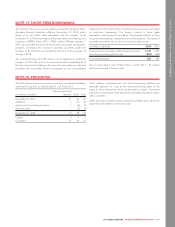

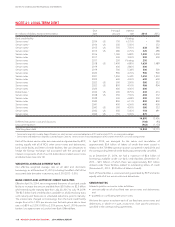

NOTE 19: SHORT-TERM BORROWINGS

We entered into an accounts receivable securitization program with a

Canadian financial institution effective December 31, 2012, which

allows us to sell certain trade receivables into the program. As at

December 31, 2014, the proceeds of the sales were committed up to a

maximum of $900 million (2013 – $900 million). Effective January 1,

2015, we amended the terms of the accounts receivable securitization

program, increasing the maximum potential proceeds under the

program to $1.05 billion and extending the term of the program to

January 1, 2018.

We received funding of $192 million, net of repayments under the

program in 2014. We continue to service and retain substantially all of

the risks and rewards relating to the accounts receivables we sold, and

therefore, the receivables remain recognized on our Consolidated

Statements of Financial Position and the funding received is recorded

as short-term borrowings. The buyer’s interest in these trade

receivables ranks ahead of our interest. The program restricts us from

using the receivables as collateral for any other purpose. The buyer of

our trade receivables has no claim on any of our other assets.

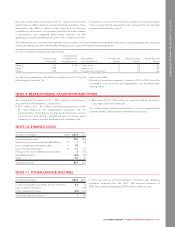

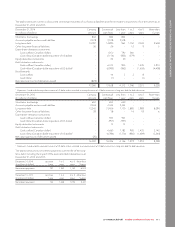

(In millions of dollars) 2014 2013

Trade accounts receivable sold to buyer as security 1,135 1,091

Short-term borrowings from buyer (842) (650)

Overcollateralization 293 441

We incurred interest costs of $14 million in 2014 (2013 — $7 million)

which we recorded in finance costs.

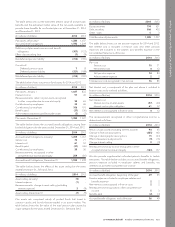

NOTE 20: PROVISIONS

The table below shows our provisions and their classification between

current and long-term as at December 31, 2014 and 2013.

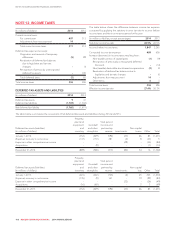

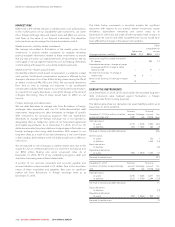

(In millions of dollars)

Decommissioning

liabilities Other Total

December 31, 2013 31 16 47

Additions 1 21 22

Adjustments to existing provisions 1 (6) (5)

Amounts used – (2) (2)

December 31, 2014 33 29 62

Current 2 5 7

Long-term 31 24 55

Cash outflows associated with our decommissioning liabilities are

generally expected to occur at the decommissioning dates of the

assets to which they relate, which are long-term in nature. The timing

and extent of restoration work that will be ultimately required for these

sites is uncertain.

Other provisions include onerous contracts and legal claims, which are

expected to be settled in one to five years.

2014 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 117