Rogers 2014 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2014 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS HAS EXCELLENT POSITIONS IN GROWING MARKETS, POWERFUL BRANDS THAT STAND FOR

INNOVATION, PROVEN MANAGEMENT, A LONG RECORD OF DRIVING GROWTH AND SHAREHOLDER VALUE, AND THE

FINANCIAL STRENGTH TO CONTINUE TO DELIVER LONG-TERM GROWTH.

Why Invest in Rogers

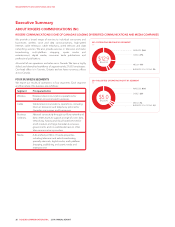

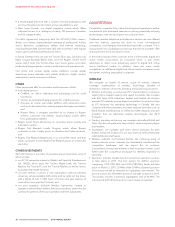

ANNUALIZED DIVIDENDS PER SHARE: 2010–2015

2015

$1.92

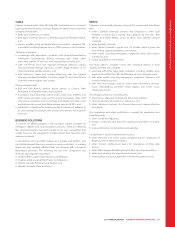

TOTAL SHAREHOLDER RETURN

TEN-YEAR COMPARATIVE TOTAL RETURN: 2005–2014

TSX

TELECOM

INDEX 184%

S&P

TELECOM

INDEX 88%

RCI.B

ON TSX 277%

S&P/TSX

COMPOSITE

INDEX 108%

2012 2013 20142010 2011

$1.74 $1.83

$1.28

$1.42

$1.58

Canada’s largest wireless carrier and a

leading cable television provider, offering

a “quadruple play” of wireless, Internet,

television and telephony services to

consumers and businesses.

LEADER IN CANADIAN

COMMUNICATIONS INDUSTRY

A leading provider of communications

and entertainment products and

services that are increasingly becoming

integrated necessities in today’s world.

MUST-HAVE PRODUCTS

AND SERVICES

Unique and complementary collection

of leading broadcast radio and television,

specialty TV, sports entertainment,

publishing and digital media assets.

CATEGORY-LEADING

MEDIA ASSETS

Majority of revenue and cash flow is

generated from wireless and broadband

services, the fastest growing segments

of the telecommunications industry.

SUPERIOR ASSET MIX

Strong franchises with nationally

recognized and highly respected

brands that are synonymous in Canada

with innovation, choice and value.

STRONG FRANCHISES

AND POWERFUL BRANDS

Leading wireless and broadband

network platforms that deliver the

most innovative communications,

information and entertainment services.

LEADING NETWORKS

AND INNOVATIVE PRODUCTS

Experienced, performance-oriented

management and operating teams

with solid industry expertise, supported

by the spirit of innovation and an

entrepreneurial culture.

PROVEN LEADERSHIP AND

ENGAGED EMPLOYEE BASE

Financially strong with an investment

grade balance sheet, conservative

debt leverage, and significant available

financial liquidity.

FINANCIAL STRENGTH

AND FLEXIBILITY

RCI common stock actively trades on the

TSX and NYSE, with average daily trading

volume of approximately 1.3 million

shares. Each share pays an annualized

dividend of $1.92 per share in 2015.

HEALTHY TRADING VOLUME

AND GROWING DIVIDENDS

22 ROGERS COMMUNICATIONS INC. 2014 ANNUAL REPORT