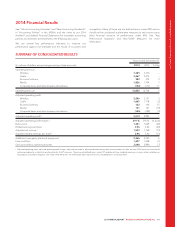

Rogers 2014 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2014 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OPERATING REVENUE

Our operating revenue depends on the size of our subscriber base,

the revenue per user and revenue from wireless devices, and other

equipment sales.

Network revenue

Network revenue includes revenue derived from voice and data

servicesfrompostpaidmonthlyfees,airtime,datausage,longdistance

charges, optional service charges, inbound and outbound roaming

charges and certain fees, as well as prepaid usage for airtime, data and

other ancillary charges such as long distance.

Network revenue was consistent this year as a result of:

• continued adoption of the customer-friendly Rogers Share

Everything Plans, which generate higher ARPU and bundle in certain

calling features and long distance, grant the ability to pool data

usage with other devices on the same account, and entice

customers with access to our other products, such as Roam Like

Home and Rogers NHL GameCentre LIVE; and

• higher usage of wireless data services; offset by

• lower roaming revenue due to the introduction over the past year of

US and international roaming pricing and plans which provide

greater value to our customers.

Blended ARPU decreased this year primarily due to the relatively

unchanged network revenue described above and a slight increase in

average number of wireless subscribers over the course of the year.

Excluding the decline in roaming revenue, network revenue would have

increased by 2% and postpaid ARPU would have increased by 1%.

The increase in churn and volatility in net additions to our postpaid

subscriber base this year were expected in the short-term as we

implement our Rogers 3.0 plan and our strategic focus towards

optimizing subscriber value versus subscriber volumes, as well as

migrating existing customers to current pricing plans. During the latter

portion of the year, we implemented a number of commercial policies

which, amongst other things, adjusted the entry price levels for

customers to be eligible for subsidized premium devices and

eliminated eligibility for device subsidies for a number of previously

discounted offerings. Furthermore, we believe that the industry

transition from three year to two year plans as a result of the adoption

of the CRTC Wireless Code may have also slowed overall wireless

subscriber growth during the year. See “Regulation in Our Industry” for

more information on the Wireless Code.

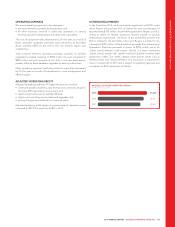

We activated and upgraded approximately 2.6 million smartphones for

new and existing subscribers this year, compared to approximately

2.7 million in 2013. The decrease was due to a 1% decrease in

hardware upgrades and a 12% reduction in gross additions.

The percentage of subscribers with smartphones at the end of the year

was 84% of our total postpaid subscriber base, compared to 75% at

the end of 2013. In our experience, smartphone subscribers typically

generate significantly higher ARPU and are less likely to churn than

customers on less advanced devices. Effective October 1, 2014,

customers with smartphones in our Bring Your Own Device (BYOD)

program are included in our smartphone subscriber measures, which

also contributed to the increase in smartphone penetration.

Data revenue increased by 10% this year primarily because of the

continued penetration and growing use of smartphones, tablet

devices and wireless laptops, which are increasing the use of e-mail,

Internet access, social media, mobile video, text messaging and other

wireless data services. Data revenue exceeded voice revenue for the

first time and represented approximately 52% of total network revenue

this year, compared to approximately 47% last year.

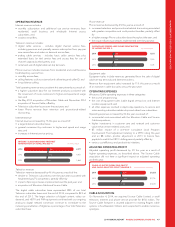

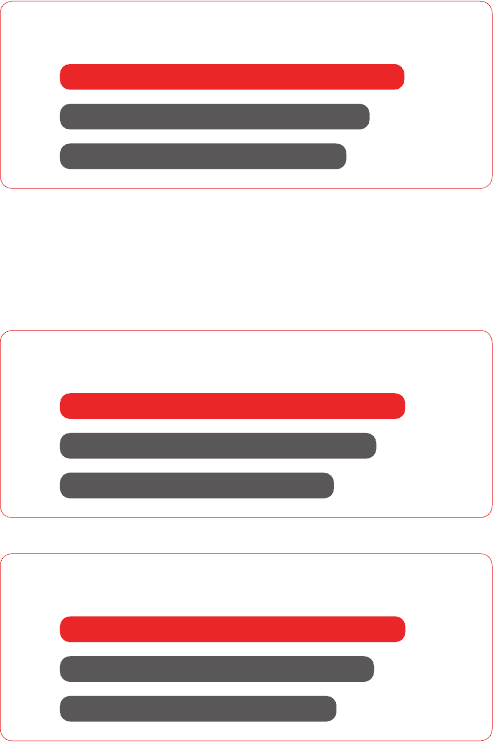

(%)

SMARTPHONES AS A PERCENTAGE OF POSTPAID SUBSCRIBERS

2014

2013

2012

84%

75%

69%

Thedecreaseinprepaidsubscribers was mainly because of increasing

competition at the lower end of the wireless market where prepaid

products are mainly sold as we continue to increase our focus away

from subscriber volume towards the higher lifetime value segment of

the market.

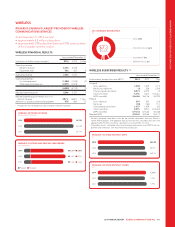

(IN MILLIONS OF DOLLARS)

WIRELESS DATA REVENUE

2014

2013

2012

$3,484

$3,175

$2,722

(%)

DATA REVENUE AS A PERCENTAGE OF NETWORK REVENUE

2014

2013

2012

52%

47%

41%

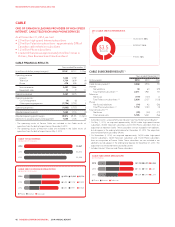

Equipment sales

Equipment sales (net of subsidies) include revenue from sales to:

• independent dealers, agents and retailers; and

• directly to subscribers through fulfillment by Wireless’ customer

service groups, websites, telesales and corporate stores.

The 8% increase in revenue from equipment sales this year primarily

reflects decreased subsidies we provide as a result of the industry

transition from three to two year plans and a shift in the sales mix of

smartphones. During this year, we activated 12% more iPhones in

comparison to the prior year, which corresponded with the launch of

the iPhone 6 in the latter portion of 2014. This was partially offset by

fewer existing subscriber upgrades and the lower number of gross

activations. Overall, the percentage of customers choosing to upgrade

their wireless devices throughout the year represented approximately

23% of our year end postpaid subscriber base, which is consistent with

the prior year.

44 ROGERS COMMUNICATIONS INC. 2014 ANNUAL REPORT