Rogers 2014 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2014 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

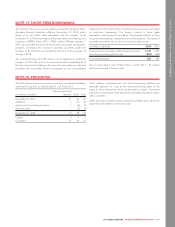

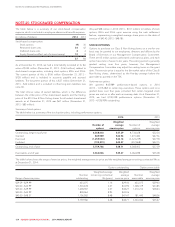

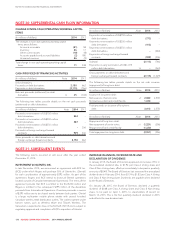

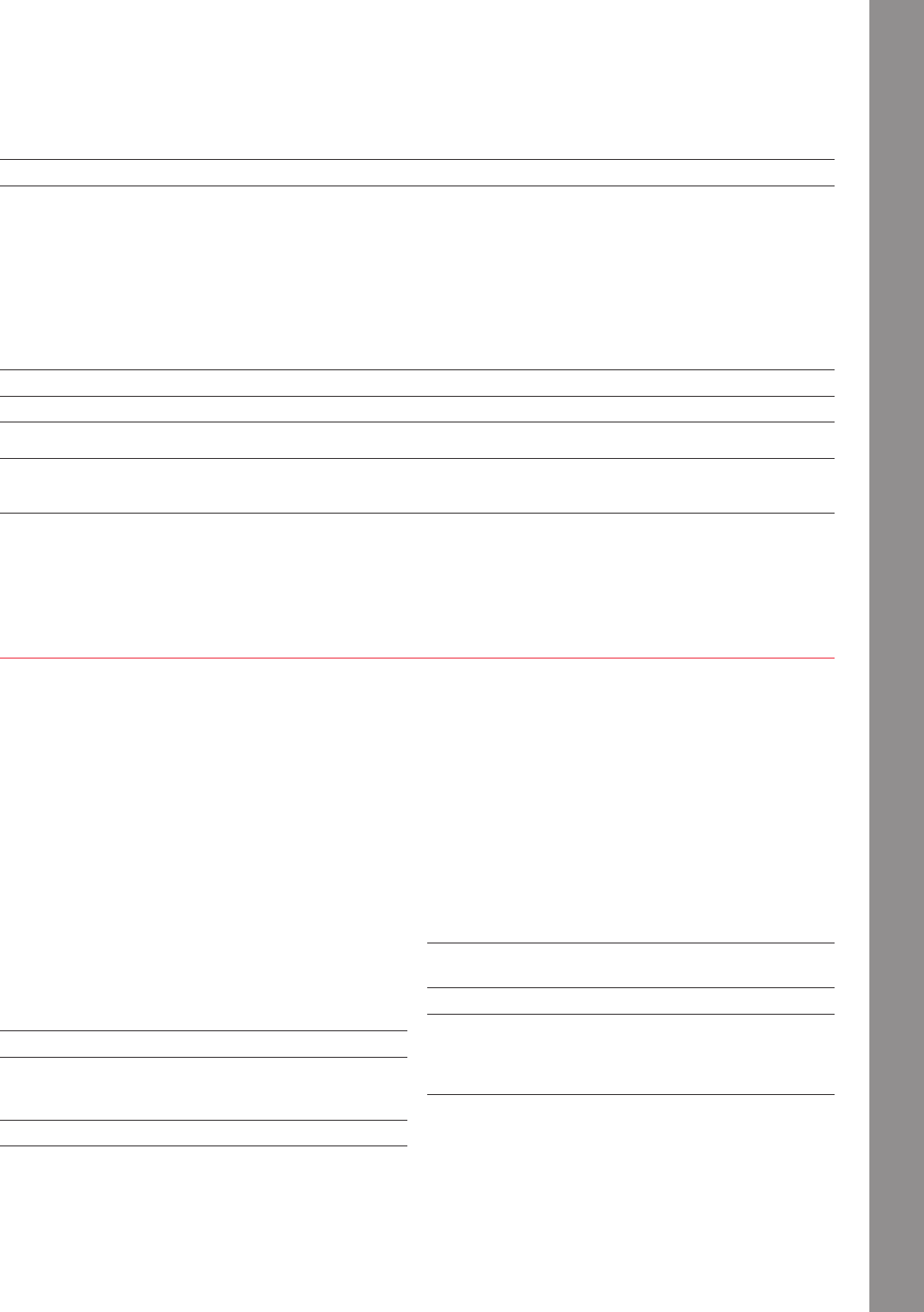

Final fair values of assets acquired and liabilities assumed

The table below summarizes the final fair values of the assets acquired and liabilities assumed for all the acquisitions described above.

(In millions of dollars) Mountain Cable Blackiron theScore 1Pivot Other Total

Fair value of consideration transferred 398 198 167 158 40 961

Cash –– 52 29

Current assets 3 4 12 6 – 25

Property, plant and equipment 53 35 11 58 1 158

Customer relationships 2135 45 – 36 17 233

Broadcast licence 3––104– –104

Current liabilities (5) (8) (6) (7) (2) (28)

Other liabilities – – – (4) (3) (7)

Deferred tax liabilities (44) (7) (7) (11) – (69)

Fair value of net identifiable assets acquired and liabilities assumed 142 69 119 80 15 425

Goodwill 256 129 48 78 25 536

Acquisition transaction costs 2 1 19 41–23

Goodwill allocated to the following segments Cable Business

Solutions

Media Business

Solutions

Multiple

segments 5

1We paid the $167 million related to theScore on October 19, 2012.

2Customer relationships are amortized over a period ranging from 5 to 10 years.

3Broadcast licence is an indefinite life intangible asset.

4Acquisition transaction costs for theScore include $17 million related to the CRTC tangible benefits commitments that were required as a condition of the CRTC’s approval of

the transaction.

5Goodwill related to other acquisitions was allocated to Media and Business Solutions.

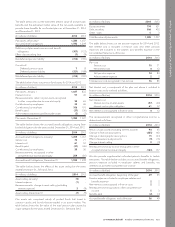

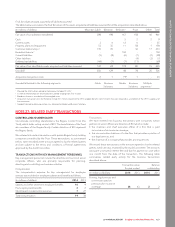

NOTE 27: RELATED PARTY TRANSACTIONS

CONTROLLING SHAREHOLDER

Our ultimate controlling shareholder is the Rogers Control Trust (the

Trust), which holds voting control of RCI. The beneficiaries of the Trust

are members of the Rogers family. Certain directors of RCI represent

the Rogers family.

We entered into certain transactions with private Rogers family holding

companies controlled by the Trust. These transactions, as summarized

below, were recorded at the amount agreed to by the related parties

and are subject to the terms and conditions of formal agreements

approved by the Audit Committee.

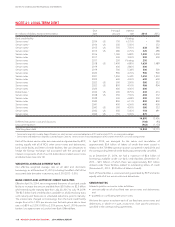

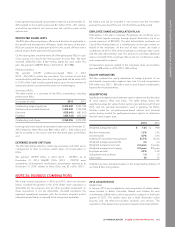

TRANSACTIONS WITH KEY MANAGEMENT PERSONNEL

Key management personnel include the directors and our most senior

corporate officers, who are primarily responsible for planning,

directing and controlling our business activities.

Compensation

The compensation expense for key management for employee

services was included in employee salaries and benefits as follows:

(In millions of dollars) 2014 2013

Salaries and other short-term employee benefits 10 9

Post-employment benefits 22

Stock-based compensation expense 727

Total compensation 19 38

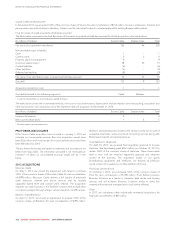

Transactions

We have entered into business transactions with companies whose

partners or senior officers are Directors of RCI which include:

• the chairman and chief executive officer of a firm that is paid

commissions for insurance coverage,

• the non-executive chairman of a lawfirmthatprovidesaportionof

our legal services, and

• the chairman of a company that provides printing services.

We record these transactions at the amount agreed to by the related

parties, which are also reviewed by the Audit Committee. The amounts

owing are unsecured, interest-free and due for payment in cash within

one month from the date of the transaction. The following table

summarizes related party activity for the business transactions

described above:

Transaction value

foryearended

Balance

outstanding

(In millions of dollars) 2014 2013 2014 2013

Printing, legal services and

commission paid on

premiums for insurance

coverage 38 43 22

2014 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 127