Rogers 2014 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2014 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

March 2016. In March 2014, we issued $1.25 billion of debt securities

under the Canadian Shelf and US$750 million ($832 million) of debt

securities under the US Shelf. See “Senior note issuances” above for

more information.

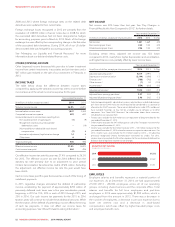

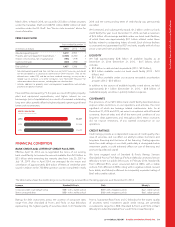

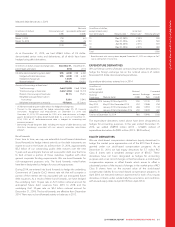

FREE CASH FLOW

Years ended December 31

(In millions of dollars) 2014 2013 % Chg

Adjusted operating profit 15,019 4,993 1

Property, plant and equipment expenditures 2(2,366) (2,240) 6

Interest on borrowings, net of capitalization (756) (709) 7

Cash income taxes (460) (496) (7)

Free cash flow 11,437 1,548 (7)

1Adjusted operating profit and free cash flow are non-GAAP measures and should

not be considered as a substitute or alternative for GAAP measures. They are not

defined terms under IFRS, and do not have standard meanings, so may not be a

reliable way to compare us to other companies. See “Non-GAAP Measures” for

information about these measures, including how we calculate them.

2Includes additions to property, plant and equipment expenditures and excludes

purchases of spectrum licences.

Free cash flow decreased by 7% this year as a result of higher property,

plant and equipment expenditures, and higher interest on our

borrowings (net of capitalization) as a result of increased outstanding

long-term debt, partially offset by higher adjusted operating profit and

lower cash income taxes.

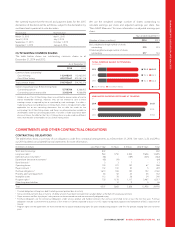

(IN MILLIONS OF DOLLARS)

FREE CASH FLOW

2014

2013

2012

$1,437

$1,548

$1,649

FINANCIAL CONDITION

BANK CREDIT AND LETTER OF CREDIT FACILITIES

Effective April 16, 2014, we re-negotiated the terms of our existing

bank credit facility to increase the amount available from $2.0 billion to

$2.5 billion while extending the maturity date from July 20, 2017 to

July 19, 2019. Also in April 2014, we arranged for the return and

cancellation of approximately $0.4 billion of letters of credit that were

issued in relation to the 700 MHz spectrum auction completed in early

2014 and the corresponding letter of credit facility was permanently

cancelled.

We borrowed, and subsequently repaid, $1.3 billion under our bank

credit facility this year. As at December 31, 2014, we had a maximum

of $2.6 billion of borrowings available under our bank credit facilities,

of which there was approximately $0.1 billion utilized under these

facilities related to outstanding letters of credit. Each of these facilities

is unsecured and guaranteed by RCP and ranks equally with all of our

senior unsecured notes and debentures.

LIQUIDITY

We had approximately $2.8 billion of available liquidity as at

December 31, 2014 (December 31, 2013 – $4.5 billion), which

includes:

• $0.2 billion in cash and cash equivalents (2013 – $2.3 billion);

• $2.5 billion available under our bank credit facility (2013 – $2.0

billion); and

• $0.1 billion available under our accounts receivable securitization

program (2013 – $0.2 billion).

In addition to the sources of available liquidity noted above, we held

approximately $1.1 billion (December 31, 2013 – $0.8 billion) of

marketable equity securities in publicly traded companies.

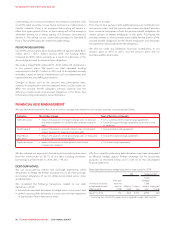

COVENANTS

The provisions of our $2.5 billion bank credit facility described above

impose certain restrictions on our operations and activities, the most

significant of which are leverage related maintenance tests. As at

December 31, 2014 and 2013, we were in compliance with all financial

covenants, financial ratios and all of the terms and conditions of our

long-term debt agreements and, throughout 2014, these covenants

did not impose restrictions of any material consequence on our

operations.

CREDIT RATINGS

Credit ratings provide an independent measure of credit quality of an

issue of securities, and can affect our ability to obtain short-term and

long-term financing and the terms of the financing. If rating agencies

lower the credit ratings on our debt, particularly a downgrade below

investment grade, it could adversely affect our cost of financing and

access to liquidity and capital.

We have engaged each of Standard & Poor’s Ratings Services

(Standard & Poor’s), Fitch Ratings (Fitch) and Moody’s Investors Service

(Moody’s) to rate our public debt issues. In February 2014, Standard &

Poor’s affirmed RCI’s senior unsecured debt at BBB+ with a stable

outlook, Fitch affirmed its BBB+ rating with a negative outlook, revised

from stable, and Moody’s affirmed its comparably equivalent rating of

Baa1 with a stable outlook.

The table below shows the credit ratings on our borrowings received from the rating agencies as at December 31, 2014:

Issuance Standard & Poor’s Fitch Moody’s

Corporate credit issuer default rating BBB+ with a stable outlook BBB+ with a negative outlook Baa1, stable outlook

Senior unsecured debt BBB+ with a stable outlook BBB+ with a negative outlook Baa1, stable outlook

Ratings for debt instruments across the universe of composite rates

range from AAA (Standard & Poor’s and Fitch) or Aaa (Moody’s)

representing the highest quality of securities rated, to D (Standard &

Poor’s), Substantial Risk (Fitch), and C (Moody’s) for the lowest quality

of securities rated. Investment grade credit ratings are generally

considered to range from BBB- (Standard & Poor’s and Fitch) or Baa3

(Moody’s) to AAA (Standard & Poor’s and Fitch) or Aaa (Moody’s).

2014 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 59