Rogers 2014 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2014 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

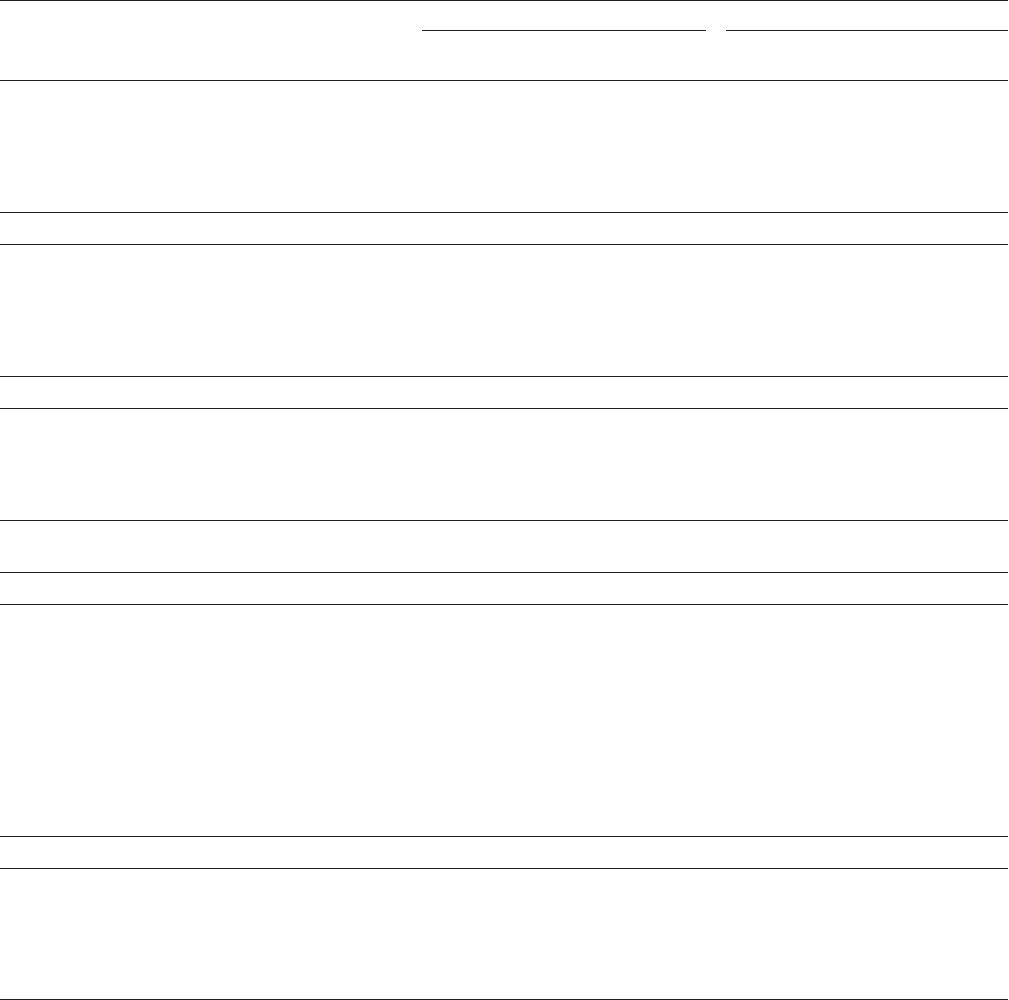

QUARTERLY RESULTS

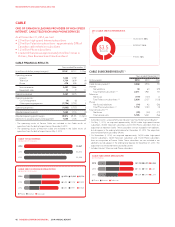

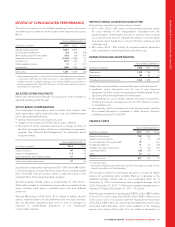

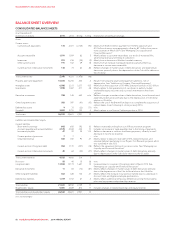

The table below shows our quarterly consolidated financial results and key performance indicators for 2014 and 2013.

QUARTERLY CONSOLIDATED FINANCIAL SUMMARY

2014 2013

(In millions of dollars, except per share amounts)

Full

Year Q4 Q3 Q2 Q1

Full

Year Q4 Q3 Q2 Q1

Operating revenue

Wireless 7,305 1,898 1,880 1,800 1,727 7,270 1,851 1,846 1,813 1,760

Cable 3,467 871 864 872 860 3,475 871 873 870 861

Business Solutions 382 97 96 95 94 374 98 93 90 93

Media 1,826 544 440 475 367 1,704 453 440 470 341

Corporate items and intercompany eliminations (130) (44) (28) (30) (28) (117) (30) (28) (31) (28)

Total operating revenue 12,850 3,366 3,252 3,212 3,020 12,706 3,243 3,224 3,212 3,027

Adjusted operating profit (loss)

Wireless 3,246 725 888 843 790 3,157 696 875 821 765

Cable 1,665 424 409 423 409 1,718 433 425 431 429

Business Solutions 122 34 32 28 28 106 29 29 25 23

Media 131 78 23 54 (24) 161 49 55 64 (7)

Corporate items and intercompany eliminations (145) (28) (40) (35) (42) (149) (40) (43) (35) (31)

Adjusted operating profit 15,019 1,233 1,312 1,313 1,161 4,993 1,167 1,341 1,306 1,179

Stock-based compensation (37) (12) (9) (11) (5) (84) (18) (7) (1) (58)

Restructuring, acquisition and other (173) (43) (91) (30) (9) (85) (24) (38) (14) (9)

Depreciation and amortization (2,144) (560) (533) (532) (519) (1,898) (508) (477) (463) (450)

Finance costs (817) (202) (202) (188) (225) (742) (196) (180) (185) (181)

Other (expense) income (1) 10 (12) (9) 10 81 14 (3) 60 10

Net income before income taxes 1,847 426 465 543 413 2,265 435 636 703 491

Income taxes (506) (129) (133) (138) (106) (596) (115) (172) (171) (138)

Net income 1,341 297 332 405 307 1,669 320 464 532 353

Earnings per share:

Basic 2.60 0.58 0.64 0.79 0.60 3.24 0.62 0.90 1.03 0.69

Diluted 2.56 0.57 0.64 0.76 0.57 3.22 0.62 0.90 0.93 0.68

Net income 1,341 297 332 405 307 1,669 320 464 532 353

Add (deduct):

Stock-based compensation 37 12 9 11 5 84 18 7 1 58

Restructuring, acquisition and other 173 43 91 30 9 85 24 38 14 9

Loss on repayment of long-term debt 29 –––29 –––––

Gain on sale of TVtropolis ––––– (47)––(47)–

Income tax impact of above items (62) (11) (27) (14) (10) (30) (5) (8) (11) (6)

Income tax adjustment, legislative tax change 14 14––– 8––8–

Adjusted net income 11,532 355 405 432 340 1,769 357 501 497 414

Adjusted earnings per share 1:

Basic 2.97 0.69 0.79 0.84 0.66 3.43 0.69 0.97 0.97 0.80

Diluted 2.96 0.69 0.78 0.84 0.66 3.42 0.69 0.97 0.96 0.80

Additions to property, plant, and equipment 2,366 664 638 576 488 2,240 703 548 525 464

Free cash flow 11,437 275 370 436 356 1,548 109 506 505 428

Cash provided by operating activities 3,698 1,031 1,057 1,202 408 3,990 1,072 1,052 1,061 805

1Adjusted operating profit, adjusted net income, adjusted basic and diluted earnings per share and free cash flow are non-GAAP measures and should not be considered as a

substitute or alternative for GAAP measures. They are not defined terms under IFRS, and do not have standard meanings, so may not be a reliable way to compare us to other

companies. See “Non-GAAP Measures” for information about these measures, including how we calculate them.

54 ROGERS COMMUNICATIONS INC. 2014 ANNUAL REPORT