Rogers 2014 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2014 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

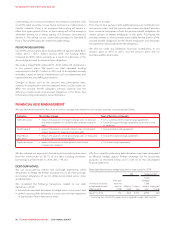

MANAGEMENT’S DISCUSSION AND ANALYSIS

We currently expect that the record and payment dates for the 2015

declaration of dividends will be as follows, subject to the declaration by

our Board each quarter at its sole discretion:

Record date Payment date

March 13, 2015 April 1, 2015

June 12, 2015 July 2, 2015

September 11, 2015 October 1, 2015

December 11, 2015 January 4, 2016

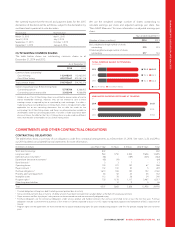

OUTSTANDING COMMON SHARES

The table below shows our outstanding common shares as at

December 31, 2014 and 2013.

As at December 31

2014 2013

Common shares outstanding 1

Class A Voting 112,448,000 112,462,000

Class B Non-Voting 402,297,667 402,281,178

Total common shares 514,745,667 514,743,178

Options to purchase Class B Non-Voting shares

Outstanding options 5,759,786 6,368,403

Outstanding options exercisable 3,363,046 4,066,698

1Holders of our Class B Non-Voting shares are entitled to receive notice of and to

attend shareholder meetings; however, they are not entitled to vote at these

meetings except as required by law or stipulated by stock exchanges. If an offer is

made to purchase outstanding Class A Voting shares, there is no requirement under

applicable law or our constating documentsthatanofferbemadeforthe

outstanding Class B Non-Voting shares, and there is no other protection available to

shareholders under our constating documents. If an offer is made to purchase both

classes of shares, the offer for the Class A Voting shares may be made on different

terms than the offer to the holders of Class B Non-Voting shares.

We use the weighted average number of shares outstanding to

calculate earnings per share and adjusted earnings per share. See

“Non-GAAP Measures” for more information on adjusted earnings per

share.

Years ended December 31

(Number of shares in millions) 2014 2013

Basic weighted average number of shares

outstanding 515 515

Diluted weighted average number of shares

outstanding 517 518

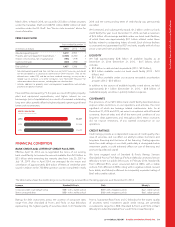

(IN MILLIONS)

TOTAL COMMON SHARES OUTSTANDING

2014

2013

2012

112.5 402.3

112.5 402.3

112.5 402.8

Class B Non-VotingClass A Voting

ANNUALIZED DIVIDENDS PER SHARE AT YEAR END

2014

2013

2012

$1.83

$1.74

$1.58

($)

COMMITMENTS AND OTHER CONTRACTUAL OBLIGATIONS

CONTRACTUAL OBLIGATIONS

The table below shows a summary of our obligations under firm contractual arrangements as at December 31, 2014. See notes 3, 22 and 29 to

our 2014 audited consolidated financial statements for more information.

(In millions of dollars) Less Than 1 Year 1-3 Years 4-5 Years After 5 Years Total

Short-term borrowings 842 – – – 842

Long-term debt 1963 1,750 2,524 9,658 14,895

Debt derivative instruments 2(58) – (189) (435) (682)

Expenditure derivative instruments 2(45) (19) – – (64)

Bond forwards 2337 –13

Operating leases 150 221 120 67 558

Player contracts 3132 100 52 5 289

Purchase obligations 41,610 308 140 102 2,160

Property, plant and equipment 63 52 22 45 182

Intangible assets 112 78 26 24 240

Program rights 5735 1,178 1,117 3,487 6,517

Other long-term liabilities –12 9 526

Total 4,507 3,683 3,828 12,958 24,976

1Principal obligations of long-term debt (including current portion) due at maturity.

2Net (asset) disbursements due at maturity. US dollar amounts have been translated into Canadian dollars at the Bank of Canada year-end rate.

3Player contracts are Blue Jays players’ salary contract we have entered into and are contractually obligated to pay.

4Purchase obligations are the contractual obligations under service, product and handset contracts that we have committed to for at least the next fiveyears.Purchase

obligations include a commitment to purchase a 50% interest in Glentel, expected to occur in 2015, subject to regulatory approval and completion of BCE’s acquisition of

Glentel.

5Program rights are the agreements we have entered into to acquire broadcasting rights for sports broadcasting programs and films for periods ranging from one to twelve

years.

2014 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 63