Rogers 2014 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2014 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

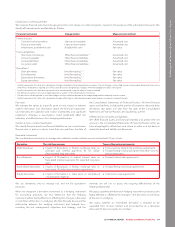

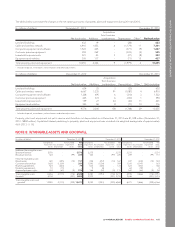

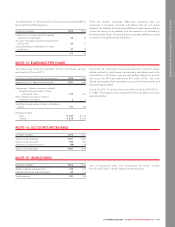

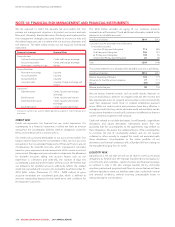

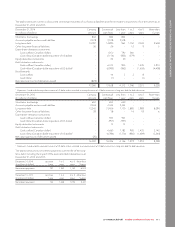

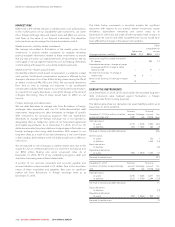

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

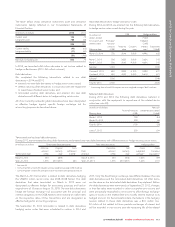

As at December 31, 2014 and 2013, we had not recognized deferred

tax assets for the following items.

(In millions of dollars) 2014 2013

Capital losses in Canada that can be applied

against future capital gains 56 43

Tax losses in foreign jurisdictions that expire from

2023 to 2033 20 17

Deductible temporary differences in foreign

jurisdictions 37 32

113 92

There are taxable temporary differences associated with our

investment in Canadian domestic subsidiaries. We do not record

deferred tax liabilities for temporary differences when we are able to

control the timing of the reversal, and the reversal is not probable in

the foreseeable future. Reversing these temporary differences would

not result in any significant tax implications.

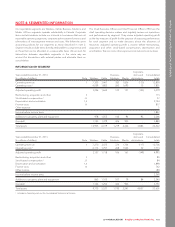

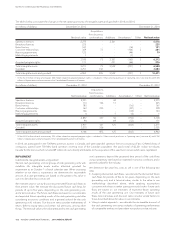

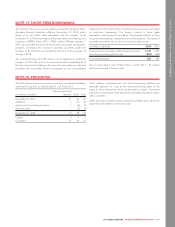

NOTE 13: EARNINGS PER SHARE

The table below shows the calculation of basic and diluted earnings

per share for 2014 and 2013.

(In millions of dollars, except per share amounts) 2014 2013

Numerator (basic) – Net income for the year 1,341 1,669

Denominator – Number of shares (in millions):

Weighted average number of shares

outstanding – basic 515 515

Effect of dilutive securities (in millions):

Employee stock options 23

Weighted average number of shares outstanding –

diluted 517 518

Earnings per share

Basic $ 2.60 $3.24

Diluted $ 2.56 $3.22

Accounting for outstanding share-based payments using the equity-

settled method for stock-based compensation was determined to be

more dilutive in 2014 than using the cash-settled method. As a result,

net income for 2014 was reduced by $15 million (2013 – nil) in the

diluted earnings per share calculation to account for these awards as if

they were equity-settled.

A total of 1,257,117 options were out of the money for 2014 (2013 –

577,584). These options were excluded from the calculation since they

were anti-dilutive.

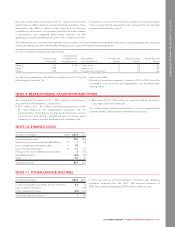

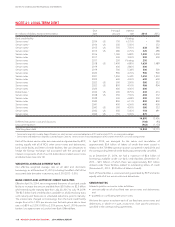

NOTE 14: ACCOUNTS RECEIVABLE

(In millions of dollars) 2014 2013

Trade accounts receivable 1,307 1,252

Other accounts receivable 382 361

Allowance for doubtful accounts (98) (104)

Total accounts receivable 1,591 1,509

NOTE 15: INVENTORIES

(In millions of dollars) 2014 2013

Wireless handsets and accessories 189 213

Other finished goods and merchandise 62 63

Total inventories 251 276

Cost of equipment sales and merchandise for resale includes

$1,615 million (2013 – $1,667 million) of inventory costs.

2014 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 109