Rogers 2014 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2014 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

tax, our business is complex and significant judgement is required in

interpreting how tax legislation and regulations apply to us. Our tax

filings are subject to audit by the relevant government revenue

authorities and the results of the government audit could materially

change the amount of our actual income tax expense, income taxes

payable or receivable, other taxes payable or receivable and deferred

income tax assets and liabilities and could, in certain circumstances,

result in the assessment of interest and penalties.

CONTINGENCIES

Considerable judgement is involved in the determination of

contingent liabilities. Our judgement is based on information currently

known to us, and the probability of the ultimate resolution of the

contingencies. If it becomes probable that a contingent liability will

result in an outflow of economic resources, we will record a provision in

the period the change in probability occurs. The amount of the loss

involves judgement based on information available at that time. Any

provision recognized for a contingent liability could be material to our

consolidated financial position and results of operations.

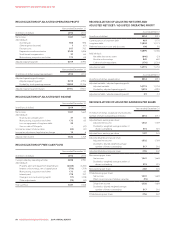

TRANSACTIONS WITH RELATED PARTIES

We have entered into certain transactions in the normal course of

business with related parties in which we have an equity interest. The

amountspaidtothesepartieswereasfollows:

Years ended December 31

(In millions of dollars) 2014 2013 % Chg

Revenues 15 3n/m

Purchases 88 83 6

n/m: not meaningful.

We have entered into certain transactions with companies, the partners

or senior officers of which are Directors of Rogers and/or our subsidiary

companies.Totalamountspaidtotheserelatedparties,directlyor

indirectly, were as follows:

Years ended December 31

(In millions of dollars) 2014 2013 % Chg

Printing, legal services and commission paid on

premiums for insurance coverage 38 43 (12)

We have entered into certain transactions with our controlling

shareholder and companies it controls. These transactions are subject

to formal agreements approved by the Audit Committee. Total

amounts paid to these related parties generally reflect the charges to

Rogers for occasional business use of aircraft, net of other

administrative services, and were less than $1 million for 2014 and

2013 combined.

These transactions are measured at the amount agreed to by the

related parties, which are also reviewed by the Audit Committee. The

amounts owing are unsecured, interest-free and due for payment in

cash within one month from the date of the transaction.

NEW ACCOUNTING STANDARDS

We adopted the following new accounting standards effective

January 1, 2014.

• Amendments to IAS 32, Financial Instruments: Presentation

(IAS 32) – In December 2011, the IASB amended IAS 32 to clarify the

meaning of when an entity has a current legally enforceable right of

set-off.

• Amendments to IAS 39, Financial Instruments: Recognition and

Measurement (IAS 39) – In June 2013, the IASB amended IAS 39 to

provide relief from discontinuing an existing hedging relationship

when a novation that was not contemplated in the original hedging

documentation meets specific criteria.

• IFRIC 21, Levies (IFRIC 21) – In May 2013, the IASB issued IFRIC 21,

which provides guidance on when to recognize a liability for a levy

imposed by a government, both for levies that are accounted for in

accordance with IAS 37, Provisions, Contingent Liabilities and

Contingent Assets and those where the timing and amount of the

levy is certain. The Interpretation identifies the obligating event for

the recognition of a liability as the activity that triggers the payment

of the levy in accordance with the relevant legislation. It provides the

following guidance on recognition of a liability to pay levies (i) the

liability is recognized progressively if the obligating event occurs

over a period of time, and (ii) if an obligation is triggered on

reaching a minimum threshold, the liability is recognized when that

minimum threshold is reached.

The accounting pronouncements we adopted in 2014 were made in

accordance with their transitional provisions, which were required to

be applied retrospectively and had no impact on our financial results.

RECENT ACCOUNTING PRONOUNCEMENTS

We are required to adopt the following revised accounting standards

on or after January 1, 2015. We are assessing the impact of adopting

these revised standards on our 2015 interim and consolidated financial

statements.

• IFRS 15, Revenue from Contracts with Customers (IFRS 15) - In May

2014, the IASB issued IFRS 15 which supersedes existing standards

and interpretations including IAS 18, Revenue and IFRIC 13,

Customer Loyalty Programmes. The standard is effective for annual

periods beginning on or after January 1, 2017.

IFRS 15 introduces a single model for recognizing revenue from

contracts with customers with the exception of certain contracts under

other IFRSs such as IAS 17, Leases. The standard requires revenue to

be recognized in a manner that depicts the transfer of promised goods

or services to a customer and at an amount that reflects the expected

consideration receivable in exchange for transferring those goods or

services. This is achieved by applying the following five steps:

1. Identify the contract with a customer;

2. Identify the performance obligations in the contract;

3. Determine the transaction price;

4. Allocate the transaction price to the performance obligations in

the contract; and

5. Recognize revenue when (or as) the entity satisfies a performance

obligation.

IFRS 15 also provides guidance relating to the treatment of contract

acquisition and contract fulfillment costs.

80 ROGERS COMMUNICATIONS INC. 2014 ANNUAL REPORT