Rogers 2014 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2014 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Unrecognized stock-based compensation expense as at December 31,

2014 related to stock-option plans was $7 million (2013 – $11 million),

and will be recorded in net income over the next four years as the

options vest.

RESTRICTED SHARE UNITS

The RSU plan allows employees, officers and directors to participate in

the growth and development of Rogers. Under the terms of the plan,

RSUs are issued to the participant and the units issued cliff vest over a

period of up to three years from the grant date.

On the vesting date, we will redeem all of the participants’ RSUs in cash

or by issuing one Class B Non-Voting share for each RSU. We have

reserved 4,000,000 Class B Non-Voting shares for issue under this

plan. We granted 1,088,951 RSUs in 2014 (2013 – 871,988).

Performance RSUs

We granted 313,291 performance-based RSUs in 2014

(2013 – 232,220) to certain key executives. The number of units that

vest and will be paid three years from the grant date will be within 50%

to 150% of the initial number granted based upon the achievement of

certain annual and cumulative three-year non-market targets.

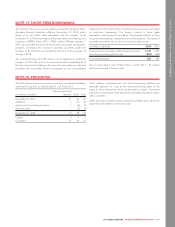

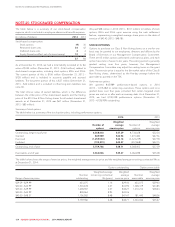

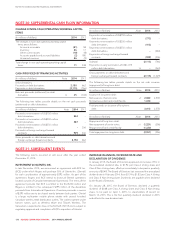

Summary of RSUs

The table below is a summary of the RSUs outstanding, including

performance RSUs.

(in number of units) 2014 2013

Outstanding, beginning of year 2,472,390 2,255,158

Granted and reinvested dividends 1,402,242 1,104,208

Exercised (828,645) (681,652)

Forfeited (280,732) (205,324)

Outstanding, end of year 2,765,255 2,472,390

Unrecognized stock-based compensation expense as at December 31,

2014 related to these RSUs was $48 million (2013 – $42 million) and

will be recorded in net income over the next three years as the RSUs

vest.

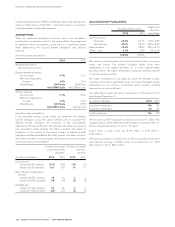

DEFERRED SHARE UNIT PLAN

The DSU plan allows directors, certain key executives and other senior

management to elect to receive certain types of compensation in

DSUs.

We granted 125,979 DSUs in 2014 (2013 – 103,990). As at

December 31, 2014, 826,891 DSUs (2013 – 700,912) were

outstanding. Unrecognized stock-based compensation expense as at

December 31, 2014, related to these DSUs was $2 million (2013 –

$2 million) and will be recorded in net income over the next three

years as the executive DSUs vest. All other DSUs are fully vested.

EMPLOYEE SHARE ACCUMULATION PLAN

Participation in the plan is voluntary. Employees can contribute up to

10% of their regular earnings through payroll deductions (up to an

annual maximum of $25,000). The plan administrator purchases our

Class B Non-Voting shares on a monthly basis on the open market on

behalf of the employee. At the end of each month, we make a

contribution of 25% to 50% of the employee’s contribution that month,

and the plan administrator uses this amount to purchase additional

shares on behalf of the employee. We record our contributions made

as a compensation expense.

Compensation expense related to the employee share accumulation

plan was $38 million in 2014 (2013 – $30 million).

EQUITY DERIVATIVES

We have entered into equity derivatives to hedge a portion of our

stock-based compensation expense (see note 16) and recognized a

$10 million loss (2013 – $8 million loss) in stock-based compensation

expense for these derivatives.

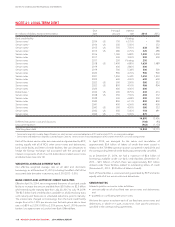

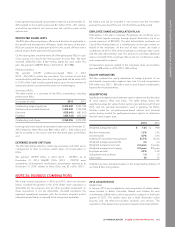

ASSUMPTIONS

Significant management estimates areusedtodeterminethefairvalue

of stock options, RSUs and DSUs. The table below shows the

weighted-average fair value of stock options granted during 2014 and

2013, and the principal assumptions used in applying the Black-

Scholes model for non-performance-based options and trinomial

option pricing models for performance-based options to determine

their fair value at grant date:

2014 2013

Weighted average fair value $ 7.35 $9.68

Risk-free interest rate 1.2% 1.2%

Dividend yield 4.0% 3.4%

Volatility of Class B Non-Voting shares 25.7% 26.2%

Weighted average expected life n/a n/a

Weighted average time to vest 2.4 years 2.4 years

Weighted average time to expiry 9.9 years 9.9 years

Employee exit rate 3.9% 3.3%

Suboptimal exercise factor 1.6 1.5

Lattice steps 50 50

Volatility has been estimated based on the actual trading statistics of

our Class B Non-Voting shares.

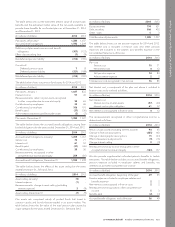

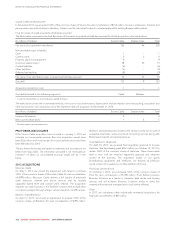

NOTE 26: BUSINESS COMBINATIONS

We made several acquisitions in 2014 and 2013, which we describe

below. Goodwill recognized in the 2014 dealer store acquisition is

deductible for tax purposes and all other goodwill recognized on

these acquisitions is not tax deductible. Goodwill represents the

expected operational synergies with the business acquired and/or

intangible assets that do not qualify to be recognized separately.

2014 ACQUISITIONS

Dealer stores

In January 2014, we completed an asset acquisition of certain dealer

stores located in British Columbia, Alberta and Ontario for cash

consideration of $46 million, which was paid as a deposit in the fourth

quarter of 2013. The dealer stores are a retail distribution outlet

business and sell telecommunication products and services. The

acquisition of the dealer stores provide increased product penetration.

2014 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 125