Rogers 2014 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2014 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

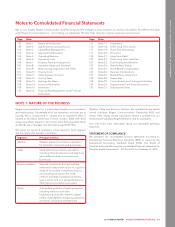

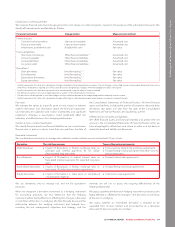

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

accordance with IAS 37, Provisions, Contingent Liabilities and

Contingent Assets and those where the timing and amount of the

levy is certain. The Interpretation identifies the obligating event for

the recognition of a liability as the activity that triggers the payment

of the levy in accordance with the relevant legislation. It provides the

following guidance on recognition of a liability to pay levies (i) the

liability is recognized progressively if the obligating event occurs

over a period of time, and (ii) if an obligation is triggered on

reaching a minimum threshold, the liability is recognized when that

minimum threshold is reached.

The accounting pronouncements we adopted in 2014 were made in

accordance with their transitional provisions, which were required to

be applied retrospectively and had no impact on our financial results.

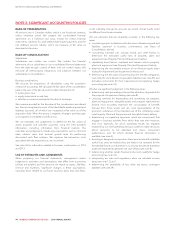

RECENT ACCOUNTING PRONOUNCEMENTS NOT YET

ADOPTED

The IASB has issued new standards and amendments to existing

standards. These changes are not yet adopted as at December 31,

2014, and could have an impact on future periods.

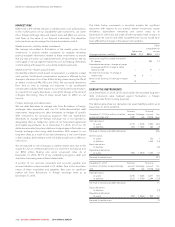

• IFRS 15, Revenue from Contracts with Customers (IFRS 15) – In May

2014, the IASB issued IFRS 15 which supersedes existing standards

and interpretations including IAS 18, Revenue and IFRIC 13,

Customer Loyalty Programmes.

IFRS 15 introduces a single model for recognizing revenue from

contracts with customers with the exception of certain contracts

under other IFRSs such as IAS 17, Leases. The standard requires

revenue to be recognized in a manner that depicts the transfer of

promised goods or services to a customer and at an amount that

reflects the expected consideration receivable in exchange for

transferring those goods or services. This is achieved by applying the

following five steps:

1. Identify the contract with a customer;

2. Identify the performance obligations in the contract;

3. Determine the transaction price;

4. Allocate the transaction price to the performance obligations in

the contract; and

5. Recognize revenue when (or as) the entity satisfies a

performance obligation.

IFRS 15 also provides guidance relating to the treatment of contract

acquisition and contract fulfillment costs.

We expect the application of this new standard will have significant

impacts on our reported results, specifically with regards to the

timing of recognition and classification of revenue, and

the treatment of costs incurred in obtaining customer contracts. The

standard is effective for annual periods beginning on or after

January 1, 2017. We are assessing the impact of this standard on our

consolidated financial statements.

• IFRS 9, Financial Instruments (IFRS 9) – In July 2014, the IASB issued

the final publication of the IFRS 9 standard, superseding the current

IAS 39, Financial Instruments: recognition and measurement

(IAS 39) standard. IFRS 9 includes revised guidance on the

classification and measurement of financial instruments, including a

new expected credit loss model for calculating impairment on

financial assets, and the new general hedge accounting

requirements. It also carries forward the guidance on recognition

and derecognition of financial instruments from IAS 39. The

standard is effective for annual periods beginning on or after

January 1, 2018 with early adoption permitted. We are assessing the

impact of this standard on our consolidated financial statements.

• Amendments to IAS 16, Property, Plant and Equipment and IAS 38,

Intangible Assets – In May 2014, the IASB issued amendments to

these standards to introduce a rebuttable presumption that the use

of revenue-based amortization methods for intangible assets is

inappropriate. The amendment is effective for annual periods

beginning on or after January 1, 2016 with early adoption

permitted. We are assessing the impact of this amendment on our

consolidated financial statements.

• Amendments to IFRS 11, Joint Arrangements – In May 2014, the

IASB issued an amendment to this standard requiring business

combination accounting to be applied to acquisitions of interests in

a joint operation that constitute a business. The amendment is

effective for annual periods beginning on or after January 1, 2016.

We are assessing the impact of these standards on our consolidated

financial statements.

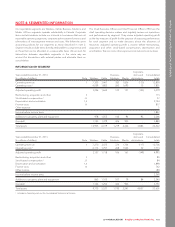

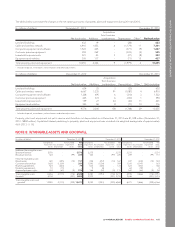

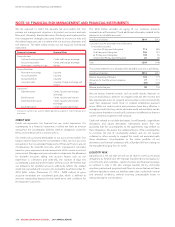

NOTE 3: CAPITAL RISK MANAGEMENT

Our objectives in managing capital are to ensure we have sufficient

liquidity to meet all of our commitments and to execute our business

plan. We define capital that we manage as shareholders’ equity

(including issued capital, share premium, retained earnings, hedging

reserve and available-for-sale financial assets reserve) and

indebtedness (including current portion of our long-term debt, long-

term debt and short-term borrowings).

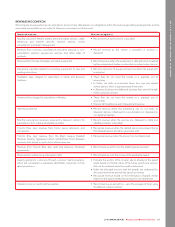

We manage our capital structure, commitments and maturities and

make adjustments based on general economic conditions, financial

markets and operating risks and our investment and working capital

requirements. To maintain or adjust our capital structure, we may, with

approval from our Board of Directors, issue or repay debt and/or short-

term borrowings, issue shares, repurchase shares, pay dividends or

undertake other activities as deemed appropriate under the

circumstances. The Board of Directors reviews and approves the

annual capital and operating budgets, and any material transactions

that are not part of the ordinary course of business, including

proposals for acquisitions or other major financing transactions,

investments or divestitures.

We monitor debt leverage ratios such as adjusted net debt to adjusted

operating profit as part of the management of liquidity and

shareholders’ return to sustain future development of the business,

conduct valuation-related analyses and make decisions about capital.

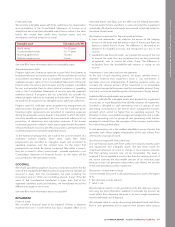

The Rogers First Rewards Credit Card program (operated through a

100% owned subsidiary of RCI) is regulated by the Office of the

Superintendent of Financial Institutions, which requires that a minimum

level of regulatory capital be maintained. Rogers was in compliance

with that requirement as at December 31, 2014 and 2013. This

program was launched in the fourth quarter of 2013 and the capital

requirements are not material as at December 31, 2014.

With the exception of Rogers First Rewards Credit Card program, we

are not subject to externally imposed capital requirements. Our overall

strategy for capital risk management has not changed since

December 31, 2013.

102 ROGERS COMMUNICATIONS INC. 2014 ANNUAL REPORT