Rogers 2014 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2014 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

INDUSTRY TRENDS

The telecommunications industry in Canada and our business segments are affected by several overarching trends.

CHANGING TECHNOLOGIES AND CONSUMER DEMANDS

Consumer demand for mobile devices, digital media and on-demand

content across platforms is pushing providers to build networks that

can provide more data, faster, cheaper and more easily. Increased

adoption of smartphones and double digit growth in our data revenue

continued this year, reflecting expanded use of applications, mobile

video, messaging and other wireless data.

ECONOMIC CONDITIONS

Our businesses are affected by general economic conditions and

consumer confidence and spending, especially in our Media segment,

where advertising revenue is directly affected by the strength of the

economy.

REGULATION

Most areas of our business are highly regulated, which affects who we

competewith,theprogrammingwecanoffer,whereandhowweuse

our networks, how we build our businesses and the spectrum we

purchase. The wireless and cable segments of the telecommunications

industry are both being affected by more regulation and more reviews

of the current regulations. See “Regulation in Our Industry”.

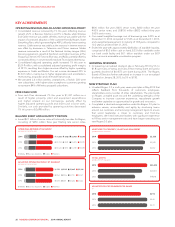

WIRELESS TRENDS CABLE TRENDS

More sophisticated wireless networks, devices and rise of

multimedia and Internet-based applications are making it easier and

faster to receive data, driving growth in wireless data services.

Wireless providers are investing in the next generation of

broadband wireless data networks, such as LTE, to support the

growing data demand.

Wireless market penetration in Canada is approximately 81.5% of

the population, and is expected to grow at an estimated 2%

annually.

The Canadian Radio-television and Telecommunications

Commission (CRTC) Wireless Code has limited wireless term

contractstotwoyearsfromthreeyears.

Subscribers are increasingly bringing their own devices and

therefore do not need to enter into term contracts for wireless

services.

The Internet and social media are increasingly being used as a

substitute for traditional wireline telephone services, and televised

content is increasingly available online, both on wireline and on

wireless devices. Cord-shaving and cord-cutting is on the rise with

the greater adoption of over-the-top (OTT) services, such as Apple

TV, Netflix and Android based TV boxes.

North American cable companies are improving their cable

networks and expanding their service offerings to include faster

broadband Internet. Our digital cable and VoIP telephony services

compete with continuing competitor IPTV deployments and non-

facilities based service providers, which continue to create pressures

that negatively impact growth.

RegulatoryrulingssuchastheCRTCLet’sTalkTVhearingcould

result in an increase in à la carte or “pick and pay” TV channel

options that may also impact industry growth.

BUSINESS SOLUTIONS TRENDS

MEDIA TRENDS

Companies are using fibre-based access and cloud computing to

capture and share information in more volume and detail. This,

combined with the rise of multimedia and Internet-based business

applications, is driving exponential growth in data demand.

Businesses are increasing usage and penetration of the Internet of

Things (IoT) to improve productivity and save costs.

Enterprises and all levels of government are dramatically

transforming data centre infrastructure and moving toward virtual

data storage and hosting. This is driving demand for more

advanced network functionality, robust, scalable services and

supportive dynamic network infrastructure.

In response, carriers are dismantling legacy networks and investing

in next generation platforms and data centres that converge voice,

data and video solutions onto a single distribution and access

platform.

Companies are increasing security for their data and information to

address cyber threats and other information security risks.

Consumer demand for digital media, mobile devices and on-

demand content is pushing advertisers to shift some of their

spending away from conventional TV to digital platforms.

Competition has changed as traditional media assets in Canada

become increasingly controlled by a small number of competitors

with significant scale and financial resources, while technology has

allowed new entrants and even individuals to become media

players in their own right. Across both traditional and emerging

platforms, many players have become more vertically integrated, as

both providers and purchasers of content creating more business

plan uncertainty as the relationship between these entities has

become more complex.

Finally, access to premium content has become even more

important for acquiring audiences that in turn attract advertisers and

subscribers. Ownership of content or long-term agreements with

content owners, therefore, have also become increasingly important

to media companies.

32 ROGERS COMMUNICATIONS INC. 2014 ANNUAL REPORT