Rogers 2014 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2014 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

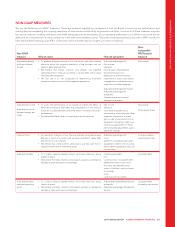

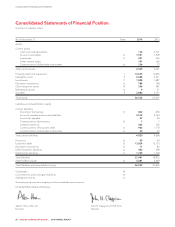

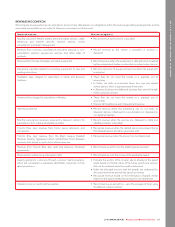

MANAGEMENT’S DISCUSSION AND ANALYSIS

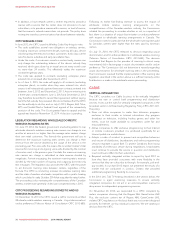

FIVE-YEAR SUMMARY OF CONSOLIDATED FINANCIAL RESULTS

(In millions of dollars, except per share amounts, subscriber count results, ARPU, churn,

percentages and ratios)

Years ended December 31

2014 2013 2012 2011 2010

Income and Cash Flow:

Revenue

Wireless 7,305 7,270 7,280 7,138 6,973

Cable 3,467 3,475 3,358 3,309 3,190

Business Solutions 382 374 351 405 452

Media 1,826 1,704 1,620 1,611 1,461

Corporate items and intercompany eliminations (130) (117) (123) (117) (77)

12,850 12,706 12,486 12,346 11,999

Adjusted operating profit 1

Wireless 3,246 3,157 3,063 3,036 3,173

Cable 1,665 1,718 1,605 1,549 1,419

Business Solutions 122 106898640

Media 131 161 190 180 131

Corporate items and intercompany eliminations (145) (149) (113) (112) (95)

5,019 4,993 4,834 4,739 4,668

Net income from continuing operations 1,341 1,669 1,725 1,590 1,532

Net income 1,341 1,669 1,693 1,563 1,502

Adjusted net income from continuing operations 11,532 1,769 1,781 1,736 1,704

Free cash flow 11,437 1,548 1,649 1,874 1,983

Property, plant and equipment expenditures 2,366 2,240 2,142 2,127 1,821

Earnings per share from continuing operations:

Basic 2.60 3.24 3.32 2.93 2.66

Diluted 2.56 3.22 3.30 2.91 2.64

Earnings per share

Basic 2.60 3.24 3.26 2.88 2.61

Diluted 2.56 3.22 3.24 2.86 2.59

Adjusted earnings per share 1

Basic 2.97 3.43 3.43 3.20 2.96

Diluted 2.96 3.42 3.41 3.17 2.94

Balance Sheet:

Assets

Property, plant and equipment, net 10,655 10,255 9,576 9,114 8,437

Goodwill 3,883 3,751 3,215 3,280 3,108

Intangible assets 6,588 3,211 2,951 2,721 2,591

Investments 1,898 1,487 1,484 1,107 933

Other assets 3,498 4,897 2,392 2,140 1,964

26,522 23,601 19,618 18,362 17,033

Liabilities and Shareholders’ Equity

Long-term liabilities 16,121 14,326 12,848 12,241 10,440

Current liabilities 4,920 4,606 3,002 2,549 2,833

Total liabilities 21,041 18,932 15,850 14,790 13,273

Shareholders’ equity 5,481 4,669 3,768 3,572 3,760

26,522 23,601 19,618 18,362 17,033

Subscriber count results (000s) 2

Wireless subscribers 9,450 9,503 9,437 9,335 8,977

Internet subscribers 2,011 1,961 1,864 1,793 1,686

Television subscribers 2,024 2,127 2,214 2,297 2,305

Phone subscribers 1,150 1,153 1,074 1,052 1,003

Additional wireless metrics 2

Wireless postpaid ARPU (monthly) 66.86 67.76 69.30 70.26 72.62

Wireless postpaid churn (monthly) 1.27% 1.24% 1.29% 1.32% 1.18%

Ratios:

Revenue growth 31% 2% 1% 3% 4%

Adjusted operating profit growth 1,3 1% 3% 2% 2% 6%

Dividends declared per share 1.83 1.74 1.58 1.42 1.28

Dividend payout ratio 270% 54% 48% 49% 49%

Dividend payout ratio of free cash flow 166% 58% 50% 41% 37%

Return on assets 25.1% 7.1% 8.6% 8.5% 8.8%

Adjusted net debt/adjusted operating profit 1,2 2.9 2.4 2.3 2.2 2.1

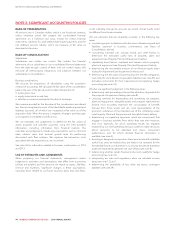

1Adjusted operating profit, adjusted net income, adjusted basic and diluted earnings per share, free cash flow and adjusted net debt are non-GAAP measures and should not

be considered as a substitute or alternative for GAAP measures. These are not defined terms under IFRS, and do not have standard meanings, so may not be a reliable way to

compare us to other companies. See “Non-GAAP Measures” for information about these measures, including how we calculate them.

2As defined. See “Key Performance Indicators”.

3Growth rates for 2010 are determined by comparing IFRS figures to figures prepared under Canadian GAAP in 2009.

86 ROGERS COMMUNICATIONS INC. 2014 ANNUAL REPORT