Rogers 2014 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2014 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOURTH QUARTER 2014 RESULTS

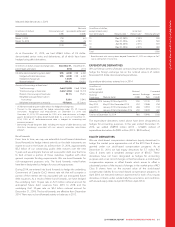

OPERATING REVENUE

Wireless network revenue increasedinthefourthquarterprimarily

because of the continued adoption of higher ARPU-generating Rogers

Share Everything Plans and greater smartphone sales.

Cable operating revenue was stable in the fourth quarter because the

impact of a higher subscriber base for our Internet products,

combined with the movement of customers to higher-end speed and

usage tiers. This was offset by Television subscriber losses over the

past year and lower Phone revenue from promotional discounting.

Business Solutions operating revenue decreased in the fourth quarter

because of the continued decline in the legacy off-net voice and data

business, partially offset by continued growth of on-net and next

generation IP-based services revenue and higher revenue from data

centre operations.

Media operating revenue increased in the fourth quarter primarily

because of the NHL Agreement, higher subscription revenue

generated by our Sportsnet properties, higher radio revenue, and

revenue growth in Next Issue Canada, partially offset by continued

softness in conventional television and print advertising.

ADJUSTED OPERATING PROFIT

Wireless adjusted operating profit increased in the fourth quarter

primarily because of the increased network revenue described above,

partially offset by higher costs for smartphones sold.

Cable adjusted operating profit decreased in the fourth quarter

primarily because of investments in programming and customer value

enhancement related costs.

Media’s adjusted operating profit increased in the fourth quarter

because of the revenue changes described above and cost efficiencies

in Television and Publishing.

NET INCOME AND ADJUSTED NET INCOME

Net income decreased in the fourth quarter primarily from the changes

reflected in the increase in adjusted operating profit discussed above,

and higher depreciation and amortization, higher restructuring,

acquisition and other, and higher income taxes.

Adjusted net income was $355 million in the fourth quarter of 2014,

with adjusted diluted earnings per share of $0.69. This was in-line with

adjusted net income of $357 million and adjusted diluted earnings per

share of $0.69 in the fourth quarter of 2013.

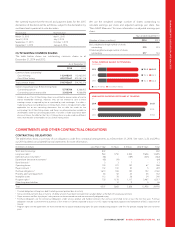

QUARTERLY TRENDS AND SEASONALITY

Our operating results generally vary from quarter to quarter because of

changes in general economic conditions and seasonal fluctuations,

among other things, in each of our business segments. This means our

results in one quarter are not a good indication of how we will perform

in a future quarter. Wireless, Cable and Media each have unique

seasonal aspects to, and certain other historical trends in, their

businesses.

Fluctuations in net income from quarter to quarter can also be

attributed to losses on the repayment of debt, foreign exchange gains

or losses, changes in the fair value of derivative instruments, other

income and expenses, impairment of assets and changes in income

taxes.

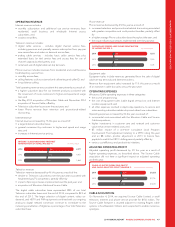

Wireless

The trends in Wireless revenue and adjusted operating profit reflect:

• the growing number of wireless voice and data subscribers;

• higher usage of wireless data;

• higher handset subsidies as more consumers shift to smartphones;

and

• a slight increase in churn reflecting our heightened focus towards

higher valued customers away from customers that generate lower

margins.

We continue to target higher value postpaid subscribers, which has

contributedtothesignificantlyheavier mix of postpaid versus prepaid

subscribers. Growth in our customer base over time has resulted in

higher costs for customer service, retention, credit and collection;

however, most of the cost increases have been offset by gains in

operating efficiencies.

Wireless operating results are influenced by the timing of our

marketing and promotional expenditures and higher levels of

subscriber additions and related subsidies, resulting in higher

subscriber acquisition and activation-related expenses in certain

periods. This increased activity generally occurs in the third and fourth

quarters, and can also occur or be accentuated by the launch of

popular new wireless handset models.

Cable

The trends in Cable services revenue and operating profit are primarily

due to:

• higher penetration and usage of Internet, digital and telephony

products and services; and

• pricing increases over the past year; offset by

• competitive losses of Television subscribers.

Cable’s operating results are affected by modest seasonal fluctuations

in subscriber additions and disconnections, typically caused by:

• university and college students moving;

• individuals temporarily suspending service for extended vacations

or seasonal relocations; and

• the concentrated marketing we generally conduct in our fourth

quarter.

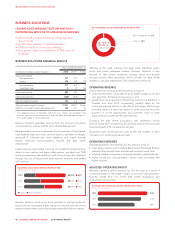

Business Solutions

The trends in Business Solutions operating profit margin primarily

reflect the ongoing shift from lower-margin, off-net legacy long

distance and data services to higher-margin, next generation services

and data centre businesses.

Business Solutions does not generally have any unique seasonal

aspects to its business.

Media

The trends in Media’s results are generally the result of continual

investment in prime-time and specialty programming, higher sports

rights costs, subscriber rate increases, and fluctuations in advertising

and consumer market conditions.

Seasonal fluctuations relate to periods of increased consumer activity

and their impact on advertising and related retail cycles, the MLB

season, where revenues and expenses are concentrated in the spring,

summer and fall months, and the NHL season, where advertising

revenues and programming expenses are concentrated in the fall and

winter months.

2014 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 55