Rogers 2014 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2014 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

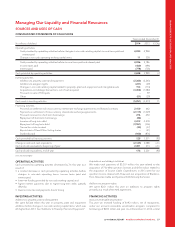

Managing Our Liquidity and Financial Resources

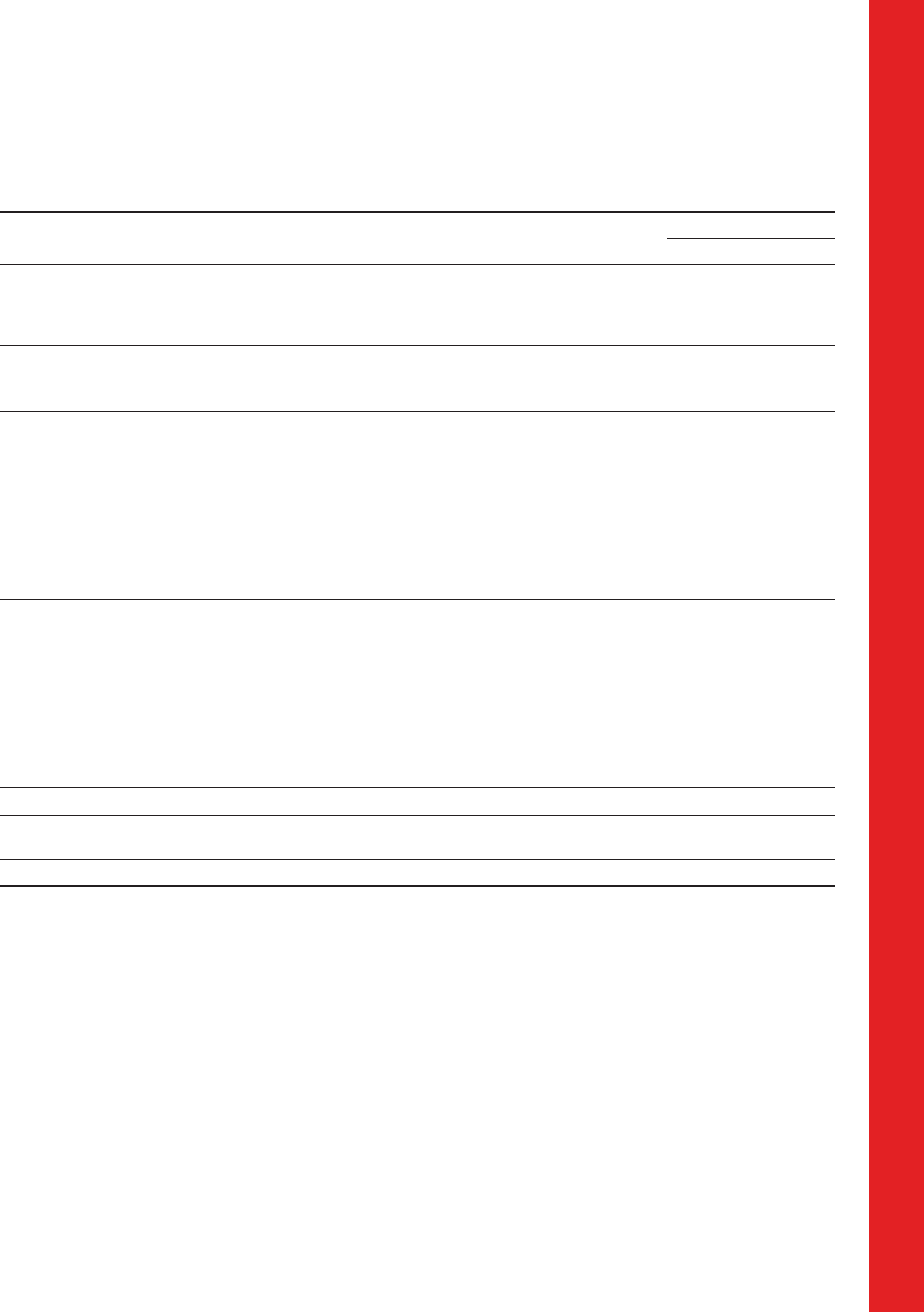

SOURCES AND USES OF CASH

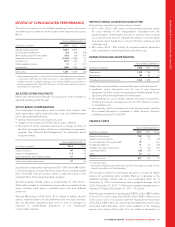

CONSOLIDATED STATEMENTS OF CASH FLOWS

Years ended December 31

(In millions of dollars) 2014 2013 % Chg

Operating activities:

Cash provided by operating activities before changes in non-cash working capital, income taxes paid and

interest paid

4,925 4,948

Change in non-cash operating working capital items 11 238

Cash provided by operating activities before income taxes paid and interest paid 4,936 5,186

Income taxes paid (460) (496)

Interest paid (778) (700)

Cash provided by operating activities 3,698 3,990 (7)

Investing activities:

Additions to property, plant and equipment (2,366) (2,240)

Additions to program rights (231) (69)

Changes in non-cash working capital related to property, plant and equipment and intangible assets 153 (114)

Acquisitions and strategic transactions, net of cash acquired (3,456) (1,080)

Proceeds on sale of TVtropolis –59

Other (51) (29)

Cash used in investing activities (5,951) (3,473) 71

Financing activities:

Proceeds on settlement of cross-currency interest rate exchange agreements and forward contracts 2,150 662

Payments on settlement of cross-currency interest rate exchange agreements (2,115) (1,029)

Proceeds received on short-term borrowings 276 650

Repayment of short-term borrowings (84) –

Issuance of long-term debt 3,412 2,578

Repayment of long-term debt (2,551) (356)

Transaction costs incurred (30) (37)

Repurchase of Class B Non-Voting shares –(21)

Dividends paid (930) (876)

Cash provided by financing activities 128 1,571 (92)

Change in cash and cash equivalents (2,125) 2,088 n/m

Cash and cash equivalents, beginning of year 2,301 213 n/m

Cash and cash equivalents, end of year 176 2,301 (92)

n/m: not meaningful.

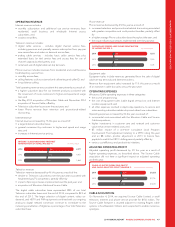

OPERATING ACTIVITIES

Cash provided by operating activities decreased by 7% this year as a

result of:

• a modest decrease in cash provided by operating activities before

changes in non-cash operating items, income taxes paid and

interest paid;

• lower net funding provided by non-cash working capital; and

• higher interest payments due to higher long-term debt; partially

offset by

• lower income tax cash payments due to timing.

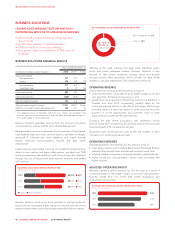

INVESTING ACTIVITIES

Additions to property, plant and equipment

We spent $2,366 million this year on property, plant and equipment

additions before changes in non-cash working capital items, which was

6% higher than 2013. See “Additions to Property, Plant and Equipment”.

Acquisitions and strategic initiatives

We made total payments of $3,301 million this year related to the

acquisition of 700 MHz spectrum licences and $156 million related to

the acquisition of Source Cable. Expenditures in 2013 were for our

spectrum licence deposit with Shaw and our acquisitions of Blackiron,

Pivot, Mountain Cable and Sportsnet 360 (formerly theScore).

Additions to program rights

We spent $231 million this year on additions to program rights

primarily as a result of the NHL Agreement.

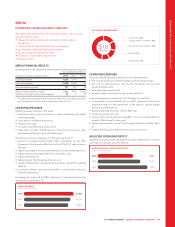

FINANCING ACTIVITIES

Accounts receivable securitization

This year we received funding of $192 million, net of repayments,

under our accounts receivable securitization program, compared to

borrowings of $650 million last year. As at December 31, 2014, a total

2014 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 57