Rogers 2014 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2014 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

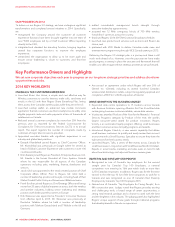

MANAGEMENT’S DISCUSSION AND ANALYSIS

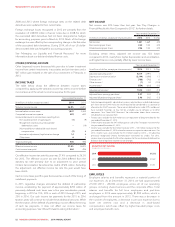

KEY CHANGES IN FINANCIAL RESULTS THIS

YEAR COMPARED TO 2013

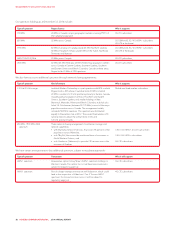

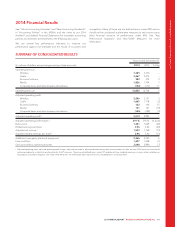

(In millions of dollars) Change See page

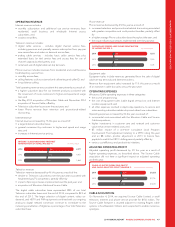

Operating revenue changes – higher (lower):

Network – Wireless (5) 44

Equipment – Wireless 40 44

Cable (8) 47

Business Solutions 8 48

Media 122 49

Corporate items and intercompany eliminations (13)

Higher operating revenue compared to 2013 144

Adjusted operating profit changes – higher (lower):

Wireless 89 45

Cable (53) 47

Business Solutions 16 48

Media (30) 49

Corporate items and intercompany eliminations 4

Higher adjusted operating profit 1compared to 2013 26

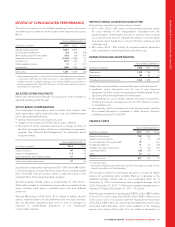

Lower stock-based compensation 47 51

Higher restructuring, acquisition and other (88) 51

Higher depreciation and amortization (246) 51

Higher finance costs (75) 51

Higher other expense (82) 52

Lowerincometaxes 90 52

Lower net income compared to 2013 (328)

Lower stock-based compensation (47) 51

Higher restructuring, acquisition and other 88 51

Loss on repayment of long-term debt 29 51

Gain on sale of interest in TVtropolis 47 52

Income tax impact of the above items (32)

Income tax adjustment, legislative tax change 6 52

Lower adjusted net income 1compared to 2013 (237)

1Adjusted operating profit and adjusted net income are non-GAAP measures and

should not be considered as a substitute or alternative for GAAP measure. These are

not defined terms under IFRS, and do not have standard meanings, so may not be a

reliable way to compare us to other companies. See “Non-GAAP Measures” for

information about these measures, including how we calculate them.

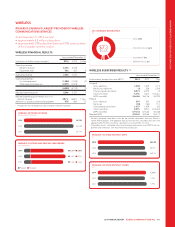

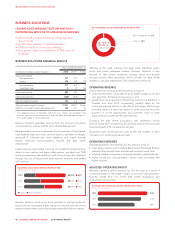

OPERATING REVENUE

Wireless network revenue remained fairly consistent this year primarily

because of the continued adoption of higher ARPU-generating Rogers

Share Everything Plans, offset by the introduction over the past year of

lower priced roaming plans.

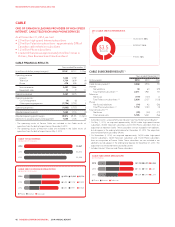

Cable operating revenue remained fairly consistent this year primarily

because the impact of a higher subscriber base for our Internet

products combined with the movement of customers to higher-end

speed and usage tiers was offset by TV subscriber losses over the past

year and a more competitive Phone pricing environment.

Business Solutions operating revenue increased this year primarily

because of continued growth in on-net and next generation services,

including our data centre businesses, partially offset by a reduction in

lower margin, off-net legacy revenue.

Media operating revenue increased this year primarily because of

revenue generated by our new NHL Agreement, growth at Sportsnet,

and higher revenues at the Toronto Blue Jays, The Shopping Channel,

and Radio, partially offset by continued softness in conventional TV and

print advertising.

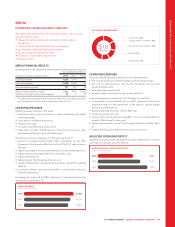

ADJUSTED OPERATING PROFIT

Wireless adjusted operating profit increased this year primarily

because of lower subsidy levels.

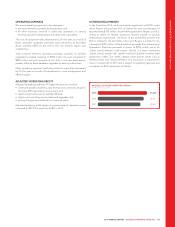

Cable adjusted operating profit decreased this year primarily because

of higher investments in customer care and network, customer value

enhancement-related costs and a one-time cumulative CRTC fee

adjustment.

Business Solutions adjusted operating profit increased this year as a

result of continued growth in the higher margin on-net and next

generation business mostly from our recent data centre acquisitions

and productivity improvements.

Media’s adjusted operating profit decreased this year primarily

because of investments in player salaries at the Toronto Blue Jays,

increased merchandise costs at The Shopping Channel, ramp-up costs

associated with the launch of Next Issue Canada and increased

programming costs, partially offset by lower publishing costs.

NET INCOME AND ADJUSTED NET INCOME

Net income and adjusted net income decreased this year primarily

because of the revenue and expense changes described above and

higher depreciation and amortization, and higher finance costs. Net

income was also lower as a result of higher restructuring, acquisition

and other costs.

42 ROGERS COMMUNICATIONS INC. 2014 ANNUAL REPORT