Rogers 2014 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2014 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

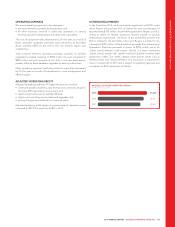

2015 OBJECTIVES

OVERHAUL THE CUSTOMER EXPERIENCE

We aim to create a seamless experience across all channels and further

reduce the number of customer complaints. Our objective is to

continue to improve the customer experience and track those

improvements through meaningful statistics.

DRIVE GROWTH IN THE BUSINESS MARKET

We aim to grow our business market share and roll out new, next

generation products that help our business customers succeed,

resulting in growth in our market share.

INVEST IN AND DEVELOP OUR PEOPLE

We aim to transform the employee experience by rolling out selected

onboarding and development programs, as well as evolve the physical

space in which we work to promote agility and collaboration.

DELIVER COMPELLING CONTENT EVERYWHERE

We aim to continue to invest to deliver compelling content and

enhance the value of and further leverage our Media assets across

Rogers to deliver more value to our customers.

FOCUS ON INNOVATION AND NETWORK LEADERSHIP

We aim to deliver a world-class mobile video experience, continue to

innovate and bring new products and services to market, and expand

the speed and coverage of our networks, including our continued LTE

expansion.

GO TO MARKET AS ONE ROGERS

We aim to re-position our key brands and bring new products to

market as One Rogers.

FINANCIAL AND OPERATING GUIDANCE

We provide consolidated annual guidance ranges for selected financial metrics on a consolidated basis consistent with the annual plans

approved by our Board of Directors.

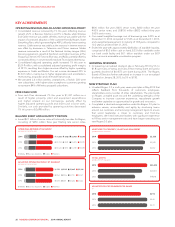

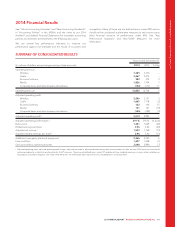

2014 ACHIEVEMENTS AGAINST GUIDANCE

The following table outlines guidance ranges that we had previously

provided and our actual results and achievements for the selected full

year 2014 financial metrics.

(In millions of dollars)

2014

Guidance

2014

Actual Achievement

Consolidated Guidance

Adjusted operating profit 15,000 to 5,150 5,019 ✓

Additions to property, plant

and equipment 22,275 to 2,375 2,366 ✓

Free cash flow 11,425 to 1,500 1,437 ✓

Missed x Achieved ✓Exceeded +

1Adjusted operating profit and free cash flow are non-GAAP measure and should not

be considered as a substitute or alternative for GAAP measures. These are not

defined terms under IFRS and do not have standard meanings, so may not be a

reliable way to compare us to other companies. See “Non-GAAP Measures” for

information about these measures, including how we calculate them.

2Includes additions to property, plant and equipment expenditures for Wireless,

Cable, Business Solutions, Media, and Corporate segments and excludes purchases

of spectrum licences.

2015 FULL YEAR CONSOLIDATED GUIDANCE

The following table outlines guidance ranges for selected full year

2015 consolidated financial metrics, which takes into consideration our

current outlook and our actual results for 2014 and are based on a

number of assumptions, including those noted after the table below.

Information about our guidance, including the various assumptions

underlying our guidance, is forward-looking and should be read in

conjunction with “About Forward-Looking Information” and “Risks and

Uncertainties Affecting Our Business” and the related disclosure and

information about various economic, competitive and regulatory

assumptions, factors and risks that may cause our actual future financial

and operating results to differ from what we currently expect.

We provide annual guidance ranges on a consolidated full year basis

and are consistent with annual full year board-approved plans. Any

updates to our full year financial guidance over the course of the year

would be made only to the consolidated level guidance ranges that

appear below.

Full Year 2015 Guidance

(In millions of dollars)

2014

Actual

2015

Guidance

Consolidated Guidance

Adjusted operating profit 15,019 5,020 to 5,175

Additions to property, plant and equipment 22,366 2,350 to 2,450

Free cash flow 11,437 1,350 to 1,500

1Adjusted operating profit and free cash flow are non-GAAP measures and should

not be considered as a substitute or alternative for GAAP measures. These are not

defined terms under IFRS and do not have standard meanings, so may not be a

reliable way to compare us to other companies. See “Non-GAAP Measures” for

information about these measures, including how we calculate them.

2Includes additions to property, plant and equipment expenditures for Wireless,

Cable, Business Solutions, Media, and Corporate segments and excludes purchases

of spectrum licences.

Key underlying assumptions

Our 2015 guidance ranges above are based on many assumptions,

including but not limited to the following material assumptions:

(1) Continued intense competition in all segments in which we

operate.

(2) A substantial portion of US dollar-denominated expenditures has

been hedged.

(3) No significant additional regulatory developments, shifts in

economic conditions or macro changes in the competitive

environment affecting our business activities. We note that

regulatory decisions expected during 2015 could potentially

materially alter underlying assumptions around our 2015 Wireless,

Cable, Business Solutions and/or Media results in the current and

future years, the impacts of which are currently unknown and not

factored into our guidance.

36 ROGERS COMMUNICATIONS INC. 2014 ANNUAL REPORT